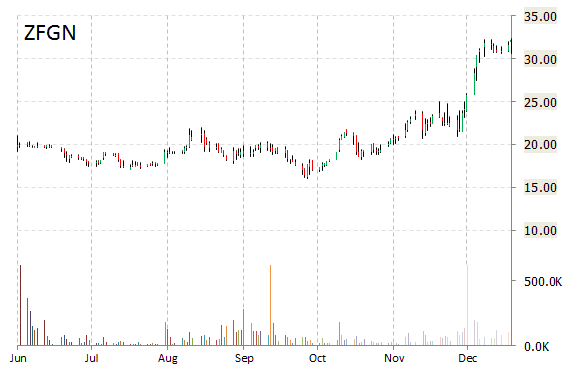

Zafgen, Inc. (ZFGN) is a big mover this session, as its shares up nearly 20% to $38.50 following news that ZAF-221, a Phase 2 clinical trial of beloranib for the treatment of hypothalamic injury associated obesity, met the primary efficacy endpoint of weight reduction.

“We are extremely pleased with these results, which differentiate beloranib from other weight loss agents. Beloranib’s impact to restore balance to production and utilization of fat is further validated with these findings,” said Dennis Kim, M.D., Chief Medical Officer of Zafgen.

Zafgen, Inc., currently valued at $874.22M, has a median Wall Street price target of $35.50 with a high target of $45.00. Approximately 584K shares of the thinly traded issue have already changed hands, compared to the stock’s average daily volume of 66.5K shares.

In the past 52 weeks, shares of the biopharmaceutical company have traded between a low of $16.01 and a high of $38.50 with the 50-day MA and 200-day MA located at $25.04 and $20.41 levels, respectively. Additionally, shares of ZFGN have a Relative Strength Index (RSI) and MACD indicator of 88.41 and +3.71, respectively.

ZFGN currently prints a one year return of around 92%.

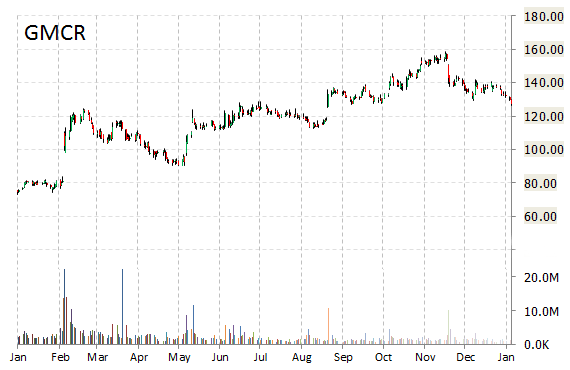

Shares of Keurig Green Mountain, Inc. (GMCR) rose nearly 7 points to $133.79 in recent trade Wednesday after the company announced that its has signed an agreement with Dr Pepper Snapple (DPS) to sell soda pods in its planned cold-drink machine.

On valuation measures, Keurig Green Mountain, Inc. shares are currently priced at 35.78x this year’s forecasted earnings compared to the industry’s 6.45x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.04 and 28.02, respectively. Price/Sales for the same period is 4.38 while EPS is $3.74. Currently there are 6 analysts that rate GMCR a ‘Buy’, 9 rate it a ‘Hold’. No analyst rates it a ‘Sell’. GMCR has a median Wall Street price target of $155.50.

In the past 52 weeks, shares of Waterbury, Vermont-based company have traded between a low of $74.44 and a high of $158.87. Shares are up 66.83% year-over-year.

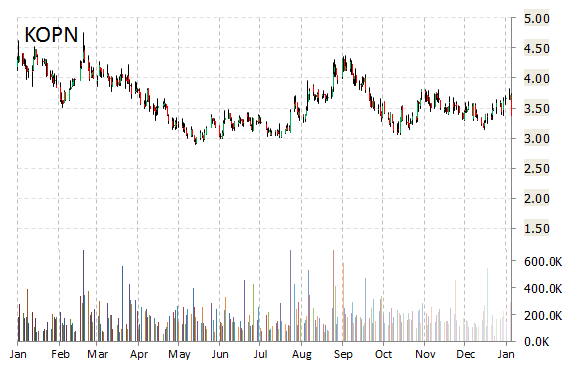

Shares of Kopin Corporation (KOPN) are higher by 14.84% in midday trading on Wednesday, as the stock continues to see gains following a preliminary update from the company on its business initiatives and revenues for the fiscal year ended December 27, 2014.

Kopin said it expects revenue for FY14 to be at least $30 million, significantly above the company’s previously stated guidance of $24.0 million to $28.0 million.

KOPN shares recently gained $0.50 to $3.87. In the past 52 weeks, shares of Westboro, Massachusetts-based developer of wearable technologies and display products have traded between a low of $2.90 and a high of $4.75.

Shares are down 20.33% year-over-year and 6.91% year-to-date.

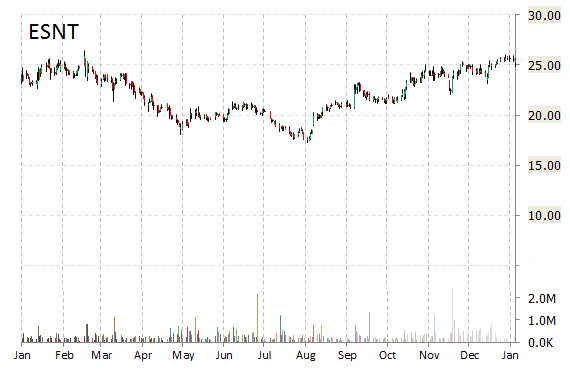

Shares of Essent Group Ltd. (ESNT) are lower by 9.58% to $22.85 on heavy volume in midday trading on Wednesday following reports that President Obama tomorrow will announce a cut in Federal Housing Administration [FHA] mortgage-insurance premiums. The annual fees the FHA charges to guarantee mortgages will be cut by 0.5 percentage point, to 0.85% of the loan balance, Julian Castro, secretary of the Department of Housing and Urban Development, said today during a conference call with reporters.

Other private mortgage insurers names getting negatively affected, include Radian Group (RDN) and MGIC Investment (MTG).

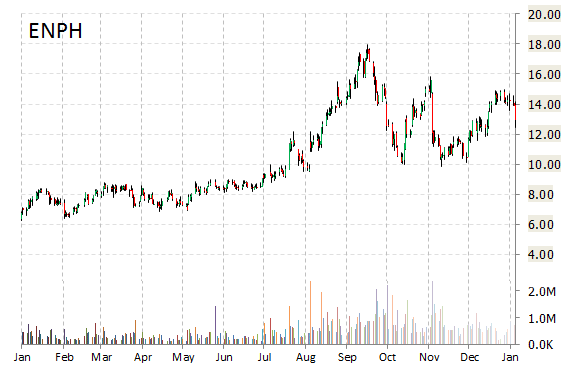

Enphase Energy (ENPH) stock is getting crushed, down 12.48%, after Goldman Sachs (GS) analysts started coverage of the name with a ‘Sell’ rating and $11.00 12-month base case estimate, saying the company’s market share headwinds are picking up and not factored into consensus expectations.

Enphase Energy, Inc. lost $1.63 to $11.31 in mid-day trading today. Approximately 1.37M shares have already changed hands, compared to the stock’s average daily volume of 749.41K shares.

On valuation-measures, shares of Enphase Energy, Inc. have a forward P/E of 41.91. P/S ratio is 1.85, while t-12 profit margin is (3.68%). EPS registers at ($0.27). The company has a market cap of $493.17M and a median Wall Street price target of $18.00.

On trading-measure, ENPH has a beta of 0.00 and a short float of 17.69%. In the past 52 weeks, shares of the seller of microinverter systems have traded between a low of $6.35 and a high of $17.97 with its 50-day MA and 200-day MA located at $12.71 and $12.41 levels, respectively.

ENPH currently prints a one year return of about 83.81% and a year-to-date loss of around 9.45%.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply