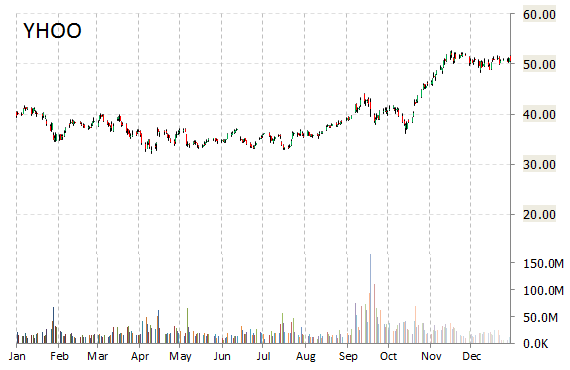

Yahoo! Inc. (YHOO) — Yahoo CEO Marissa Mayer and her top execs are considering buying a cable channel or a network, according to a report in Business Insider. The publication notes the internet giant considered acquiring Scripps Networks Interactive (SNI), and may have started M&A talks regarding two potential deals, including talks to buy the Food Network. Additionally, a media source says Yahoo reportedly wanted to buy CNN from Time Warner (TWX) last summer.

YHOO shares recently gained $0.17 to $50.68. In the past 52 weeks, shares of Sunnyvale, California-based web portal have traded between a low of $32.15 and a high of $52.62. Shares are up 24.90% year-over-year.

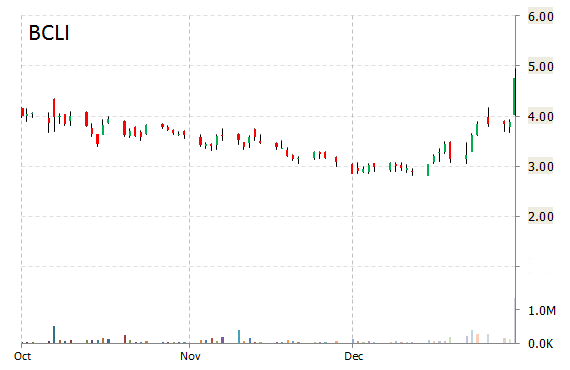

Shares of Brainstorm Cell Therapeutics Inc. (BCLI) are up 47% to $7.00 in pre-market trading Friday after jumping 22.68% Wednesday. The stock continues to show strength ahead of the biotech company’s release of final results from its phase 2a clinical trial of NurOwn in Lou Gehrig’s Disease [ALS] on Monday, Jan. 5. Brainstorm describes NurOwn as an “autologous, adult stem cell therapy technology” designed to treat ALS.

The New York-based firm will host a conference call and webcast presentation at 8:30am Eastern Time on Monday to discuss the results.

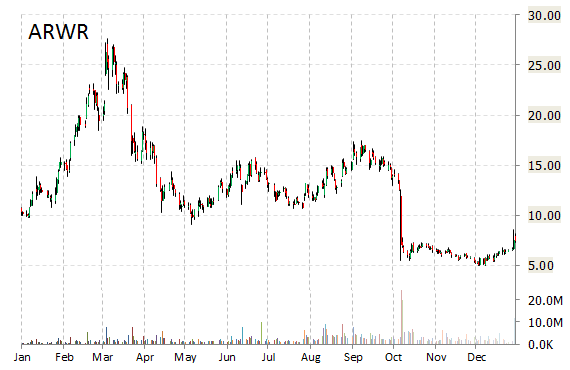

Arrowhead Research Corp. (ARWR) shares are trading higher by more than 4% pre-market. It’s hard to pinpoint just what exactly is driving the surge in stock price but the name is frequently the target of M&A speculation.

Arrowhead Research Corp. shares currently have a a PEG and P/B ratio of -0.57 and 2.48, respectively. Price/Sales for the same period is 2,365.40 while EPS is ($1.25). Currently there are 3 analysts that rate ARWR a ‘Buy’, 1 rates it a ‘Hold’. No analysts rates it a ‘Sell’. ARWR has a median Wall Street price target of $16.00 with a high target of $30.00.

In the past 52 weeks, shares of the Pasadena, California-based company have traded between a low of $4.95 and a high of $27.63 and are now at $7.70. Shares are down 31.98% year-to-date.

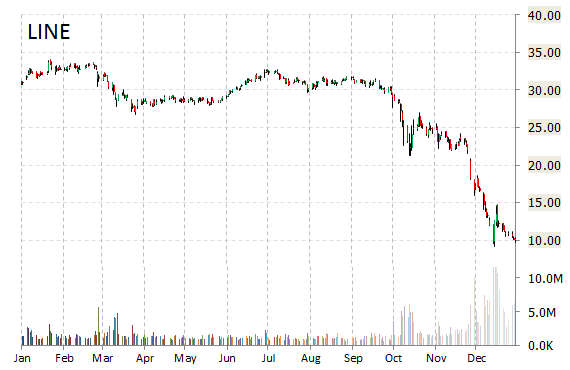

Linn Energy, LLC (LINE) shares are down 6.50% in early trade to $9.47 after the independent oil and natural gas company announced that it will invest $730 million in capital spending in 2015, a drop of 53% from the 2014 total of about $1.55 billion. The company, which is the latest energy-related firm to announce a cut in capital spending plans, due to the drop in oil prices, also announced a reduction of its annual payout per common unit from $2.90 to $1.25, from the previous level of $2.90 per unit or share, on an annualized basis.

Linn said it expects to fund its total 2015 capital spending and its shareholder payouts from “internally generated cash flow.”

On valuation measures, Linn Energy shares have a PEG and forward P/E ratio of -0.52 and 11.38, respectively. Price/Sales for the same period is 0.94 while EPS is ($3.53). Currently there are 4 analysts that rate LINE a ‘Buy’, 9 rate it a ‘Hold’. No analyst rates it a ‘Sell’. LINE has a median Wall Street price target of $17.50 with a high target of $29.00.

Shares are down 63.43% year-over-year.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply