So what now?

Last night’s Fed statement was, to Macro Man’s eye (and, he suspects, those of most macro guys) about as dovish as it could have been. And for the first hour of trade, the asset market reaction was predictable…short end screams higher, equities rally, and the dollar takes it on the chin.

But at some point, some time around 7.30 pm London time, it all sort of ran out of steam. First EUR/USD ran into corporate offers in the mid 1.48’s, which then chased it lower, setting off stops. Then equities started trickling lower, which eventually morphed into a mini-torrent.

What happened? It’s hard to suggest that the market had taken the adjustment to the MBS purchase schedule as a sign of imminent tightening when the short end a) flattened on the day, and b) closed pretty much on its highs.

Could it be- and Macro Man is ashamed to admit that this never occurred to him- that equity guys actually thought that there was a chance that the Fed would announce more QE? The very suggestion seems ludicrous to a macro observer, which is why your author never contemplated it. But it would certainly serve as the simplest explanation for the generally disappointing performance of stocks in the wake of seemed to be a very benign, reflationary statement.

Regardless, the stars may be aligning towards a somewhat less favorable environment for risk assets. Oil was a notable laggard in the entire orgy of reflation that’s dominated the past few months, and in the wake of a huge composite inventory build crashed below the support level highlighted in this space the other day.

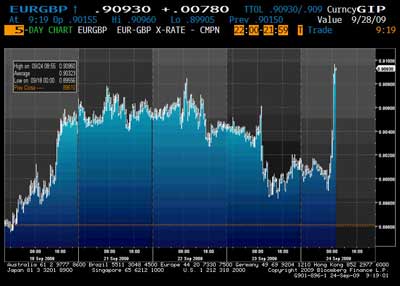

Sterling, meanwhile, has come under the cosh this morning after Merve the Swerve noted that a) it’s a bit silly to get excited about a little growth after a huge recession, b) a year ago, a couple of UK banks were within hours of going bust, and c) that sterling weakness is welcome, in that it helps rebalance the UK economy.

The last comment in particular helped propel EUR/GBP to new highs for the move, putting the kibosh on a recent high-profile “buy sterling” call from a well-connected institution. Perhaps they need to get Merve on the payroll….

In any event, the issue of rebelancing is of particular relevance, particularly with the Pittsburgh G20 meeting rapidly approaching. One would like to think that global imbalances would be up for discussion; as Macro Man has said on numerous occasions, if China et. al. want a seat at the big boys’ table, they need to bring something to the table, other than a set of demands. Y’know, like currency flexibility and/or convertibility, an issue which not only the US but also, increasingly, Europe are likely to highlight.

It’s a particularly relevant time to address the global imbalances issue, as the beanstalk-like proliferation of green shoots may be about to slow. Economic surprise indices in both the G10 and Asia have quit going up and, if anything, look like rolling over. It’s interesting to note that a number of leading indicator data points have disappointed consensus recently.

So if the second derivative/green shoot trend encounters a drought, ’twill be somewhat more challenging to avoid the siren song of protectionist, beggar-thy-neighbor policies that are already emerging in the dark corners of the global economy.

And if protectionism is allowed to flourish, green shoots-style, it won’t just be Macro Man and other punters asking “what now?”

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply