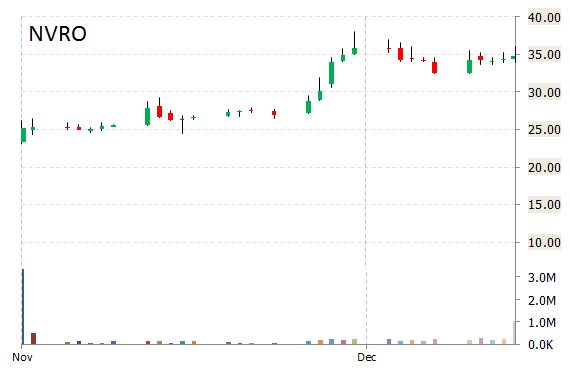

Analysts at JPMorgan lifted their price target on shares of Nevro Corp. (NVRO) to $42 from $34 in a report released on Monday. The firm currently has a ‘Overweight’ rating on the stock.

The Menlo Park-based company, which is currently valued at $891.90M, has a median Wall Street price target of $37.50 with a high target of $45.00. Shares of NVRO are up 38.03% this year.

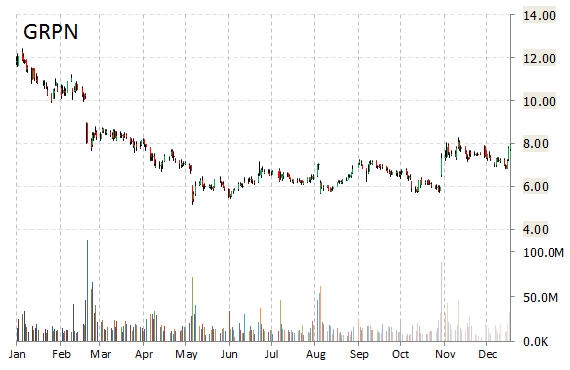

Brean Capital names Groupon, Inc. (GRPN) as ‘Top Pick’ for 2015. The analysts reiterated their ‘Buy’ rating and raised the price target to $11 from $10 on the stock.

GRPN’s shares have advanced 9.09% in the last 4 weeks and 16.47% in the past three months. Over the past 5 trading sessions the stock has gained 9.70%. Shares of Groupon are down 32.71% this year.

GRPN currently prints a one year loss of about 32.02% and a year-to-date loss of around 32.71%.

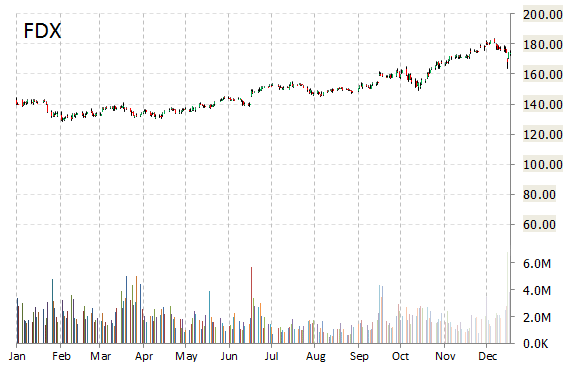

Shares of FedEx Corporation (FDX) are up 97c to $175.19 in morning trading, after the company had its price target raised to $195 from $175 at Argus. The firm currently has a ‘Buy’ rating on the stock.

On valuation-measures, shares of FedEx have a trailing-12 and forward P/E of 23.92 and 15.90, respectively. P/E to growth ratio is 1.19, while t-12 profit margin is 4.79%. EPS registers at 7.31. The company has a market cap of $49.52B and a median Wall Street price target of $185.00 with a high target of $211.00.

On trading-measure, FDX has a beta of 0.57 and a short float of 0.99%. In the past 52 weeks, shares of the transportation and e-commerce provider have traded between a low of $128.17 and a high of $183.51 with its 50-day MA and 200-day MA located at $174.15 and $157.62 levels, respectively.

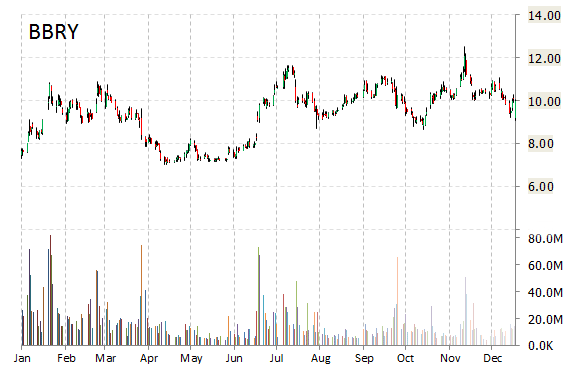

BlackBerry Limited (BBRY) was raised to ‘Buy’ from ‘Hold’ at TD Securities on Monday. BBRY was also reiterated as an ‘Underweight’ at Morgan Stanley.

BBRY, currently valued at $5.43B, has a median Wall Street price target of $10.00 with a high target of $18.00. Approximately 2.29M shares have already changed hands, compared to the stock’s average daily volume of 14.49M.

In the past 52 weeks, shares of BBRY have traded between a low of $6.98 and a high of $12.54 with the 50-day MA and 200-day MA located at $10.44 and $9.98 levels, respectively. Additionally, shares of BBRY trade at a P/E ratio of -0.54 and have a Relative Strength Index (RSI) and MACD indicator of 51.63 and -0.19, respectively.

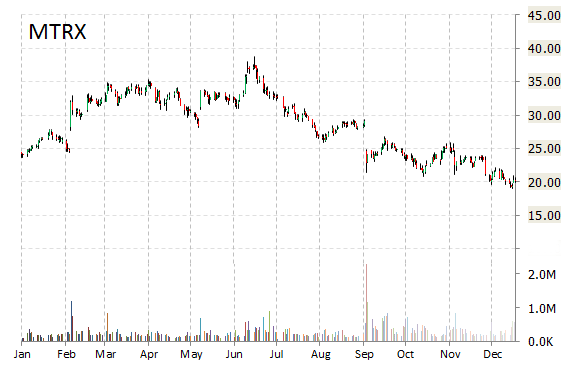

Investment analysts at Sidoti initiated coverage on shares of Matrix Service Company (MTRX) in a note issued to investors on Monday. The firm set a ‘Buy’ rating and a $33.00 price target on the stock.

MTRX shares are currently priced at 16.01x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 14.12x earnings multiple. The company’s current year and next year EPS growth estimates stand at 13.50% and 24.50% compared to the industry growth rates of 8.90% and -4.70%, respectively. MTRX has a t-12 price/sales ratio of 0.40. EPS for the same period registers at 1.30.

Shares of Matrix are down -16.95% this year.

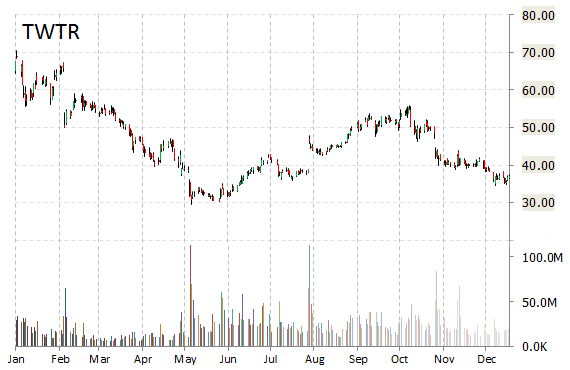

Shares of Twitter, Inc. (TWTR) are up 45c to $37.53 in morning trading, after the company was initiated with a ‘Buy’ at Argus. The firm also set its price target on the stock to $44 a share.

TWTR’s shares have declined 6.62% in the last 4 weeks and 28.61% in the past three months. Over the past 5 trading sessions the stock has lost 0.05%. Shares of Twitter are down 41.74% this year.

The San Francisco-based company, which is currently valued at $23.44B, has a median Wall Street price target of $50.00 with a high target of $64.00. TWTR is down 35.50% year-over-year as of the close of trading on Friday.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply