Infosys Ltd. (INFY) is one of Monday’s notable stocks in decline, down 52% to $32.29. The plunge follows a Reuters report stating that several founders of India’s second-largest IT outsourcing firm are seeking to raise $1.1 billion by selling shares. Four founders and their families are said to be offering a total of 32.6 million shares at about $32 each, a 4% discount to Friday’s trading close. The sale of shares, which reduces the combined stake of all the founders to 5.1% from nearly 8%, comes five months after Infosys picked Vishal Sikka, the first non-founder, as the company CEO.

Infosys Ltd., currently valued at $38.47B, has a median Wall Street price target of $70.75 with a high target of $86.57. In the past 52 weeks, shares of Bengaluru, India-based firm have traded between a low of $50.06 and a high of $70.36 with the 50-day MA and 200-day MA located at $66.49 and $59.18 levels, respectively. Additionally, shares of INFY trade at a P/E ratio of 1.38 and have a Relative Strength Index (RSI) and MACD indicator of 50.46 and -0.03, respectively.

INFY currently prints a one year return of about 24.94% and a year-to-date return of around 18.94%.

—

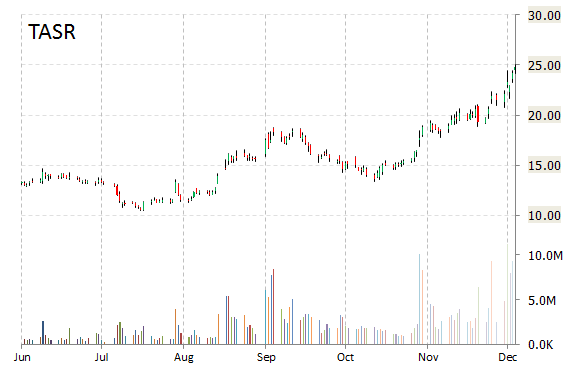

Taser International Inc. (TASR) was downgraded by Ladenburg Thalmann from an ‘Buy’ rating to a ‘Neutral’ rating in a research note issued on Monday.

TASR recently lost 2.38% to $24.23. Taser Int’l shares are currently priced at 67.08x this year’s forecasted earnings compared to the industry’s -5.64x earnings multiple. Ticker has a PEG and forward P/E ratio of 2.12 and 52.81, respectively. Price/Sales for the same period is 8.04, while EPS is $0.37. Currently there are 3 analysts that rate TASR a ‘Buy’, 1 rates it a ‘Hold’. 1 analysts rates it a ‘Sell’. TASR has a median Wall Street price target of $22.00 with a high target of $24.00.

In the past 12 months, shares of Scottsdale, Arizona-based company have traded between a low of $10.46 and a high of $25.02. Shares are up 50.33% year-over-year and 56.30% year-to-date.

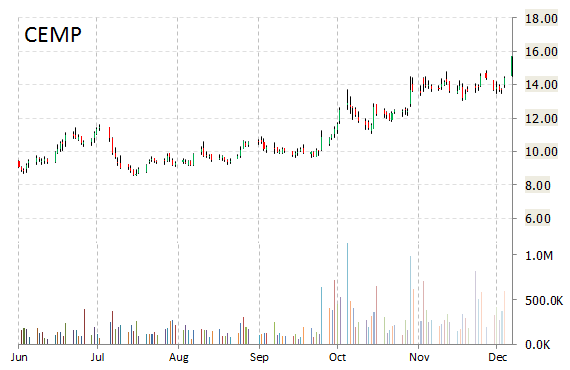

Shares of Cempra, Inc. (CEMP) gained more than 6 percent in pre-market following Cubist Pharmaceuticals (CBST) acquisition at large premium. CEMP, which has been named as a potential acquisition candidate in the past, is among the other antibiotics names that may be of interest today following’s Merck’s (MRK) buyout of Cubist for about $8.4 billion in cash, or $102 p/sh, representing a 35% premium over Cubist’s closing pps on Dec. 5.

Cempra, Inc is a clinical-stage pharmaceutical firm based in Chapel Hill, North Carolina. Its stock has a 52-week trading range of $8.10 to $15.39. The T-12 operating margin at Cempra is (400.06%). The name‘s revenue for the same period is $14.82 million. Cempra, Inc.’s price/sales is 34.87.

Shares in the $516.41 million market cap company are up 11.52% year-over-year, and 16.38% year-to-date.

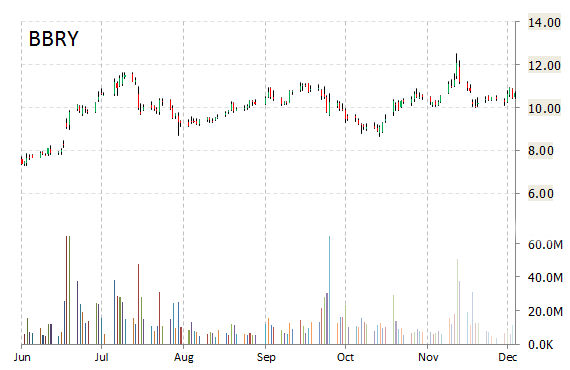

Shares of BlackBerry Limited (BBRY) are higher by nearly 2% to $10.89 in early trade Monday, after the smartphone maker together with NantHealth, a cloud-based information technology provider combining science and big data to transform healthcare, announced the first secure clinical genome browser that gives doctors access to patients’ genetic data on the BlackBerry Passport smartphone – the NantOmics Cancer Genome Browser.

On valuation-measures, shares of BlackBerry Limited have a P/E to growth ratio is -0.58. T-12 profit margin is (123.62%), while EPS registers at -9.66. The company has a market cap of $5.55B and a median Wall Street price target of $10.00 with a high target of $17.00.

On trading-measure, BBRY has a beta of 0.14 and a short float of 20.63%. In the past 52 weeks, shares of Waterloo, Canada-based company have traded between a low of $5.44 and a high of $12.54 with the 50-day MA and 200-day MA located at $10.51 and $9.81 levels, respectively.

BBRY currently prints a one year return of about 81.02% and a year-to-date return of around 43.55%.

BlackBerry Limited is currently valued at $5.55B.

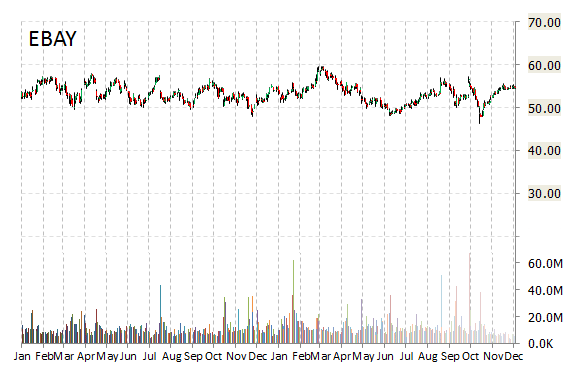

Shares of eBay (EBAY) are up 1.40% to $55.40 in early trade on Monday, after analysts at Stifel Nicolaus upgraded the name to ‘Buy” from ‘Hold’ with a $65 price target, referring to the company as the “real deal” in the e-commerce sector while most people are focused on Amazon.com (AMZN).

Stifel said it believes spinning off online payment service PayPal as a separate company will allow both eBay and PayPal to invest while operating profits grow faster than revs.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply