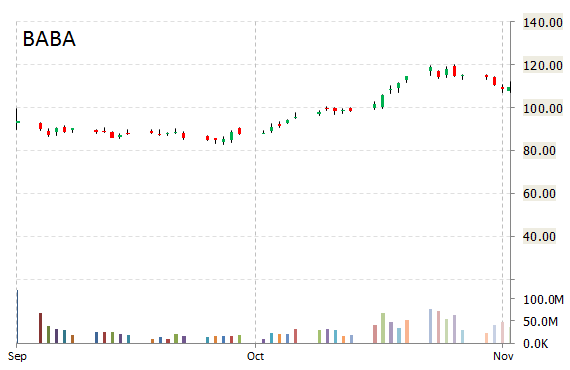

Shares of Alibaba Group Holding Ltd (BABA) are 2% higher at $112.00 in pre-market trade after the e-commerce giant tapped the U.S. debt markets for the first time Thursday, raising $8 billion. Demand for the bonds was strong, with investors reportedly placing more than $55 billion in orders.

Allibaba’s bond sale comes two months after its $25 billion initial public offering, the largest offering of all time.

On valuation measures, Alibaba Group Holding shares are currently priced at 54.56x this year’s forecasted earnings, compared to the industry’s 24.69x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.57 and 36.12, respectively. Price/sales for the same period is 26.13, while EPS is $2.01. Currently there are 30 analysts that rate BABA a ‘Buy’, and 4 that rate it a ‘Hold’. No analyst rates it a ‘Sell’. BABA has a median Wall Street price target of $120.00 with a high target of $148.00.

Shares of BABA gained $2.26 in recent trading.

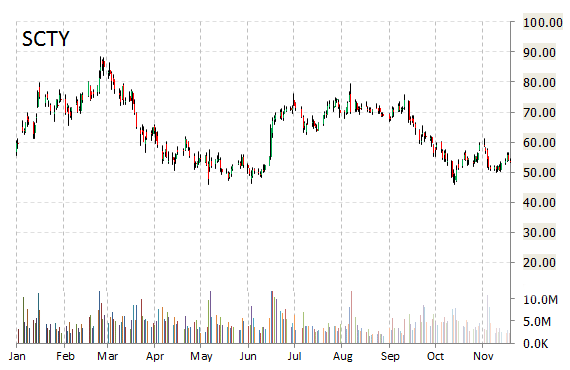

SolarCity Corporation (SCTY) is up more than 4 percent in pre-market trade Friday on news that the company has entered into contract with Walmart (WMT) for the installation of new solar projects at facilities in up to 36 states over the next four years. SolarCity has completed more than 200 solar projects at Walmart locations since 2010.

SCTY, currently valued at $5.15B, has a median Wall Street price target of $89.00 with a high target of $98.00. The name recently traded at $55.73, up more than 2 points.

Fundamentally, SCTY shows the following financial data:

· $733,46M cash, most recent Q

· $787,663 million total current assets

· $39.37 million t-12 gross profit

· $1.45 billion total debt

On valuation measures, SolarCity Corp. shares have a t-12 price/sales ratio of 22.48 and a price/book for recent quarter of 7.12. EPS is ($0.28).

Shares of San Mateo, Calif.-based solar energy systems designer are up 16.82% year-over-year ; down 5.61% year-to-date.

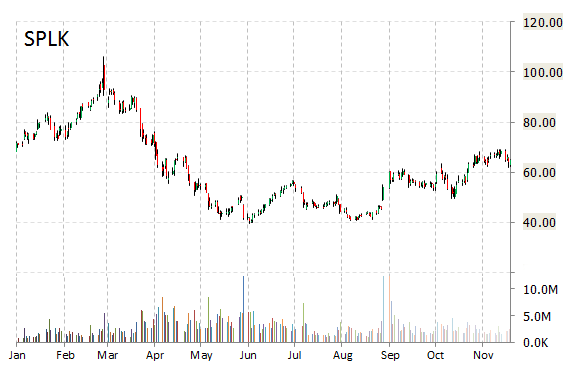

Splunk, Inc. (SPLK) shares rose more than 8% to $70.06 in pre-market hours following the release of the company’s fiscal third-quarter results. The data-intelligence software firm reported Q3 EPS of $0.02 per share, beating FactSet consensus estimates of $0.01. Revs came in at $116 million, $9+ million better than consensus and 47.6% higher year-over-year. Splunk also issued Q4 guidance saying it estimates revs to be in a range of $135 million to $137 million versus $133.37 million consensus estimates.

Following the release of the company’s results, FBR Capital raised its price target on the name to $83 from $78. The firm’s price target would suggest a potential upside of 18.46% from the stock’s current pps.

Splunk, Inc is a San Francisco, California-based intelligence software solutions provider. Its stock has a 52-week trading range of $39.35 to $106.15. The T-12 profit margin at SPLK is (43.91%). The name‘s revenue for the same period is $366 million. Splunk, Inc’s price/book is 9.63.

Shares in the $7.79 billion market cap company are up 3.85% year-over-year ; down 5.43% year-to-date.

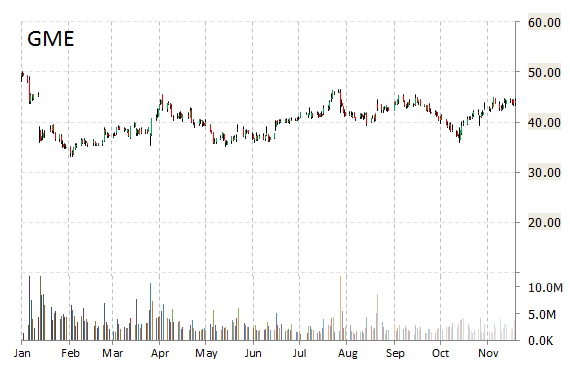

GameStop Corp. (GME) plunged more than 10% in pre-market trading, after the video game retailer reported a decline in Q3 EPS, revs, and guided Q4 EPS below consensus. GameStop said results were affected by the delayed release of ‘Assassin’s Creed Unity.’

Following the release of the results, the name was downgraded to ‘Market Perform’ from ‘Outperform’ at Telsey Advisory Group. The firm noted they are reducing their rating and price target to $45 from $51 given that “their prior thesis—the robust new gaming cycle would drive outsized sales and earnings gains this year—has not materialized.”

On valuation measures, GameStop Corp. shares are currently priced at 13.31x this year’s forecasted earnings compared to the industry’s 11.95x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.78 and 9.99, respectively. Price/sales for the same period is 0.52, while EPS is $3.27. Currently there are 12 analysts that rate GME a ‘Buy’, and 6 that rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. GME has a median Wall Street price target of $52.50 with a high target of $64.00.

In the past 52 weeks, shares of Grapevine, Texas-based company have traded between a low of $33.10 and a high of $51.55 and are now at $39.50. Shares are down 13.73% year-over-year, and 8.68% year-to-date.

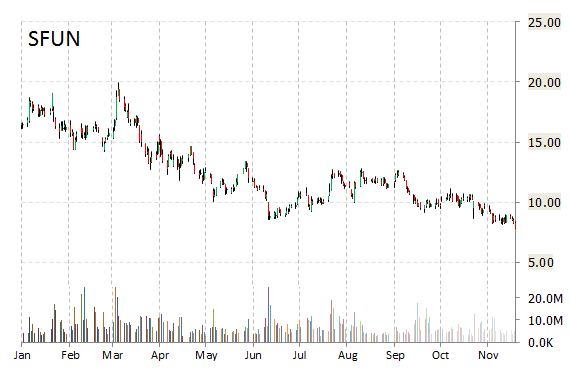

SouFun Holdings Ltd. (SFUN) shares are up close to 8% to about $8.50 in early trade. Not seeing any news to account for the move.

SouFun Holdings, currently valued at $3.66B, has a median Wall Street price target of $12.00 with a high target of $16.96. Approximately 1.17M shares have already changed hands, compared to the stock’s average daily volume of 6.10M.

In the past 12 months, shares of Beijing, China-based real estate Internet portal have traded between a low of $7.85 and a high of $19.94. Ticker is down 38.55% year-over-year and 51.33% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply