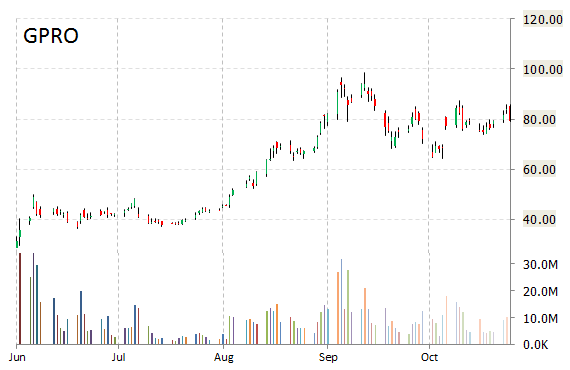

GoPro, Inc. (GPRO) shares tumbled more than 6% in pre-market trading on Thursday, after the company announced the pricing of its follow-on public offering of 10,360,500 shares of its Class A common stock at a price to the public of $75.00 per share.

GoPro is offering 1,287,533 shares and the selling stockholders are offering 9,072,967 shares.

Shares of the wearable camera company recently lost $4.86 to $74.23. Since its initial public offering GPRO has traded between a low of $28.65 and a high of $98.47. Ticker is up 152.36% year-to-date.

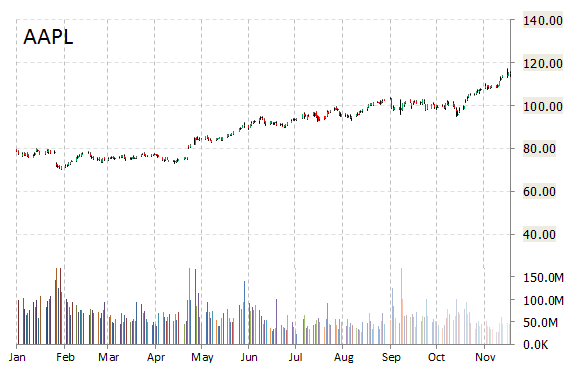

Apple Inc. (AAPL) had its price target raised by Piper Jaffray’s Gene Munster to $135 from $120 in a research note issued to clients on Thursday. Munster said he maintained his ‘overweight’ rating and raised the name’s PT after the firm’s channel checks indicated that supply of the iPhone 6 and 6 Plus is “gradually improving versus demand.” Munster’s new price target would suggest a potential upside of nearly 18% from the stock’s current pps.

AAPL shares recently lost $0.12 to $114.55. The name, currently valued at $672.52B, has a median Wall Street price target of $120.00 with a high target of $150.00.

In other Apple news, FT reports that the tech giant will bundle its newly acquired Beats Music streaming service into its iOS in FY2015, instantly making it available on hundreds of millions of iPhones and iPads.

On trading measures, in the past 52 weeks, shares of the Cupertino, Calif.-based iPhone maker have traded between a low of $70.51 and a high of $117.28 with the 50-day MA and 200-day MA located at $105.13 and $97.41 levels, respectively. Additionally, shares of Apple trade at a P/E ratio of 1.31, and have a Relative Strength Index (RSI) and MACD indicator of 74.89 and +3.75, respectively.

AAPL currently prints a year-to-date return of around 46.10%, compared with an 14.08% gain in the S&P 500.

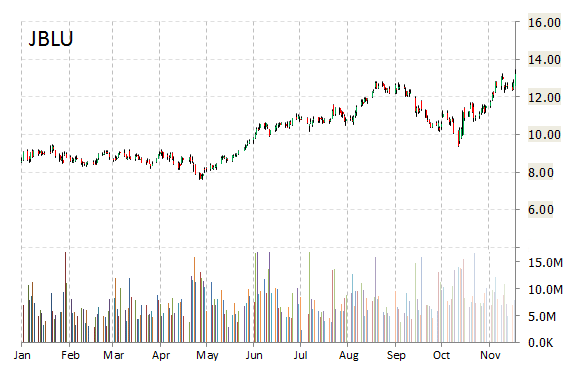

JetBlue Airways Corporation (JBLU) are up almost 3% to $13.64 in pre-market trading Thursday after Deutsche Bank (DB) raised its JBLU price target to $17 from $13 citing increased estimates and more confidence in management’s strategy following the company’s investor day. DB’s new PT represents expected upside of 25% from the stock’s current price-per-share.

JetBlue shares recently gained $0.39 to $13.63.

Currently there are 4 analysts that rate JetBlue shares a ‘Buy’, 6 an ‘Hold’, and 3 ‘Underperform’. No analysts rate it a ‘Sell’. The company has a median Wall Street price target of $14.00 with a high target of $20.00.

JetBlue Airways has a t-12 price/sales ratio of 0.65. EPS for the same period registers $1.06. The Long Island City, NY-based airliner has a market cap of $3.87 billion.

JBLU is up 50.80% year-over-year, and 55% year-to-date.

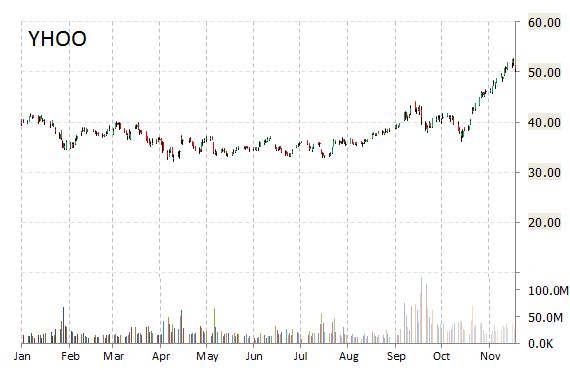

Shares of Yahoo! Inc. (YHOO) are slightly higher at $50.80 in pre-market trade after it was reported the company struck a five-year deal to replace Google (GOOG), (GOOGL) as the default search engine in Mozilla’s Firefox web browser.

The new alliance, announced in a blog post by Yahoo CEO Marissa Meyer, will end a long-standing agreement in the U.S. between search giant Google and the Mozilla Foundation, which oversees the Firefox browser.

On valuation measures, Yahoo shares are currently priced at 6.76x this year’s forecasted earnings compared to the industry’s 14.64x earnings multiple. Ticker has a PEG and t-12 forward P/E ratio of 5.18 and 45.57, respectively. Price/sales for the same period is 10.59, while EPS is $7.48. Currently there are 18 analysts that rate YHOO a ‘Buy’, and 16 that rate it a ‘Hold’. No analyst rates it a ‘Sell’. Yahoo has a median Wall Street price target of $50.00 with a high target of $63.00.

In the past 52 weeks, shares of the Sunnyvale, California-based company have traded between a low of $32.15 and a high of $52.62 and are now at $50.86. Shares are up 46.06% year-over-year, and 25.07% year-to-date.

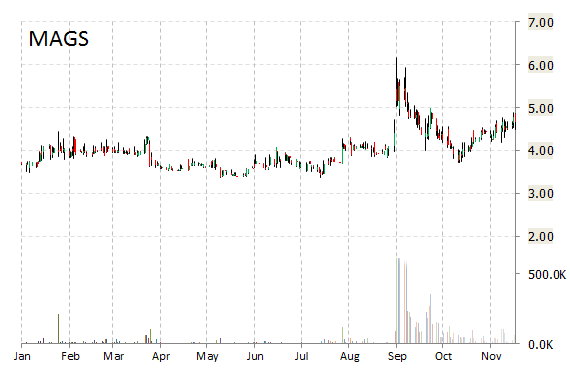

Shares of Magal Security Systems (MAGS) shot up more than 22% in pre-market trading after the company this morning reported Q3’14 EPS of $0.22 versus ($0.02) year ago. Revs increased 67% to $21.5 million from $12.8 million year-over-year. Gross profit in the quarter was $10.4 million, or 48.3% of revenues, an increase of 68% compared to gross profit of $6.2 million, or 47.9% of revenues year ago. Magal Security said the variance in the gross margin between the quarters reflects changes between products and projects in the revenue mix.

In the past 52 weeks, shares of Yehud, Israel-based company have traded between a low of $3.21 and a high of $6.16 and are now at $5.64. Shares are up 40.36% year-over-year, and 30.90% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply