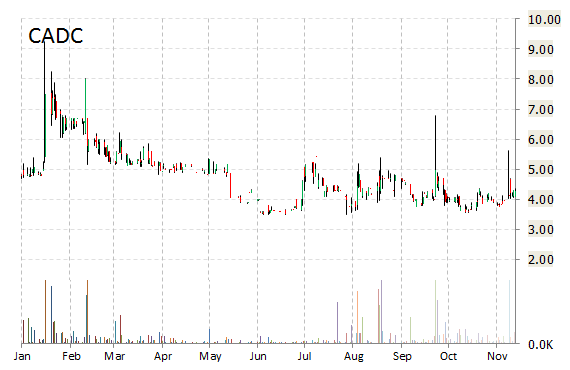

China Advanced Construction Materials Group (CADC) is seeing notable move off the open following earnings. For the three months ended Sept. 30, 2014, the company reported total revs of $21.2M compared to $10.2M during the three months ended Sept. 30, 2013, an increase of more than $11M or 109%. Q1’15 net income came in at $0.05 per diluted share vs a loss of ($3.92) per diluted share, in Q1’14. China Advanced also provided guidance for the second quarter ended on December 31, 2014, and raised full year guidance for fiscal year 2015.

For the second quarter the provider of ready-mix concrete and related technical services in China said it expects to earn revs of between $20M and $22M, net income of between $0M and $1M, and EPS of between $0 and $0.53 based on fully diluted shares of 1.9M as of Nov 15, 2014.

For the full fiscal year ended on June 30, 2015, CADC confirmed it expects to earn revenue of between $70M and $90M, and said it will raise its forecast to earn net income of between $1M and $9M, and EPS of between $0.53 and $4.72 based on fully diluted shares of 1.9M as of Nov 15, 2014.

“We are pleased with the results of the first quarter. This is a good start, not only for fiscal 2015, but also for the new era of China-ACM”, Xianfu Han, President and CEO of China ACM said in a statement.

CADC shares recently gained $1.31 to $5.57. The stock is down more than 14.80% year-over-year and has lost roughly 12.70% year-to-date. In the past 52 weeks, shares of Beijing-based company have traded between a low of $3.48 and a high of $9.24.

China Advanced Construction Materials Group, which closed Friday at $4.26, has a total market cap of $10.61M.

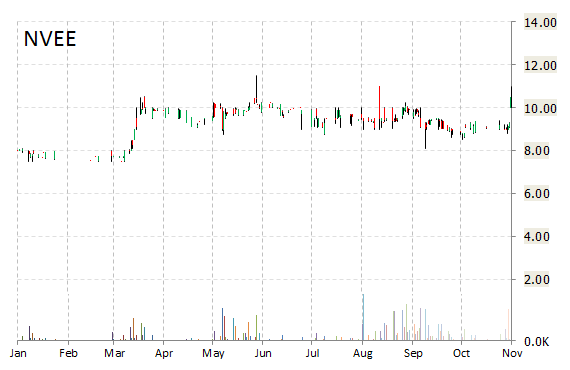

NV5 Holdings, Inc. (NVEE) ) shares are up nearly 14% to $11.90 in mid-day trading. The move comes on a big volume too with the issue currently trading more than 237K shares, which dwarfs the average volume of 12,992. Not seeing any news or rumors to account for the move.

NV5 Holdings is a Hollywood, Florida-based provider of professional and technical engineering to public and private sectors. Its stock has a price-to-sales ratio of of 0.72, and a 52-week trading range of $7.50 to $12.40.

The T-12 profit margin at NV5 Holdings is 3.86%. NVEE‘s revenue for the same period is $83.72 million.

NV5 Holdings, Inc. has a market cap of $68.108M.

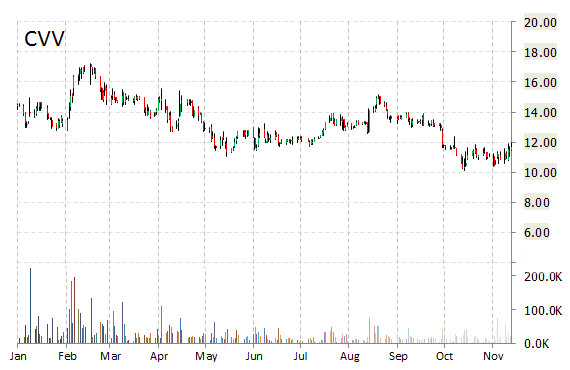

CVD Equipment Corporation (CVV) has been a solid gainer in mid-day trading, up more than 12.50% to $13.15 from Friday’s close of $11.67. The gains have been aided by a company report stating Q4 new orders received by CVD through Nov. 14, 2014 are in excess of $15.8M. These include orders for production equipment for our industrial aerospace and medical device manufacturing customers as well as research equipment for university and industrial research laboratories.

Leonard A. Rosenbaum, President and CEO said in a statement, “We are very pleased with the new and repeat orders we have received and anticipate the trend of new and repeat orders to continue during 2015. We expect 2015 to be a good year for our customers, shareholders, employees and suppliers.”

CVV is down 4.8% year-over-year, and 9.97% year-to-date. In the past 52 weeks, shares of Central Islip, New York-based company have traded between a low of $10.10 and a high of $17.20.

CVD Equipment Corporation has a total market cap of $80.54M.

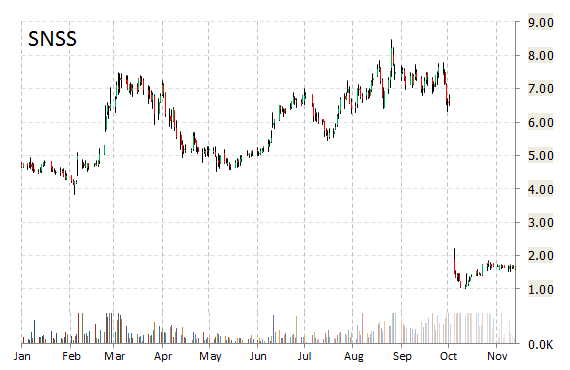

Sunesis Pharmaceuticals, Inc. (SNSS) soared nearly 35% in mid-day trading on Monday after the company said it would announce results from its Phase 3 VALOR trial of its acute myeloid leukemia treatment at the 56th American Society of Hematology Annual Meeting in early December.

In other Sunesis news, Biotechnology Value Fund II, L.P. has disclosed a 5.1% passive stake in a 13G filing.

Sunesis Pharmaceuticals, Inc shares have a price/book and t-12 price-to-sales ratio of 28.79 and 15.15, respectively. EPS for the same period is ($0.85). Currently there is only 1 analyst that rates SNSS a ‘Buy’, while 5 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’. SNSS has a median Wall Street price target of $2.00 with a high target of $3.00.

In the past 52 weeks, shares of San Francisco, California-based firm have traded between a low of $1.00 and a high of $8.46 and are now at $2.22. Shares are down 68.31% year-over-year, and 64.77% year-to-date.

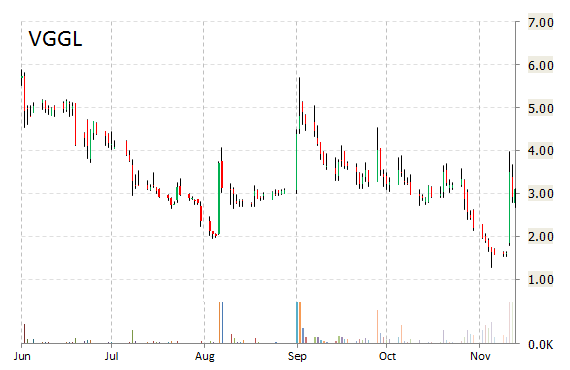

Shares of Viggle Inc. (VGGL) are spiking in mid-day trading today. The name is trading at unusually high volume with 8.76 million shares changing hands. It is currently at more than 12x its average daily volume and trading up nearly 45% at $4.50. Not seeing any news or rumors to account for the move.

VGGL shares recently gained $1.32 to $4.43. In the past 12 months, shares of the New York-based mobile and Web-based entertainment marketing platform operator have traded between a low of $1.27 and a high of $56.00. Shares in the $68M market cap company are up 603% year-over-year, and 797% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply