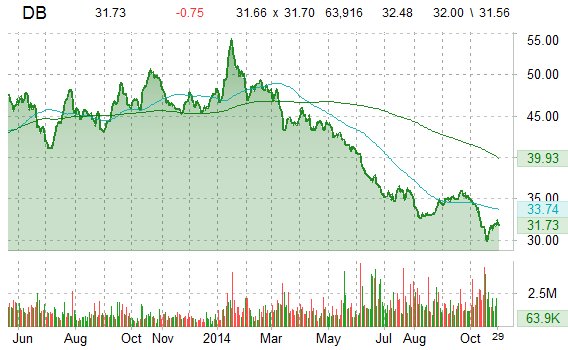

Shares of Deutsche Bank AG (DB) are lower by nearly 3% in pre-market trading Wednesday, after the company reported a net loss of €94M ($120M) in 3Q, compared with net income of €41M ($52M) a year earlier. The banking giant said it swung to a loss in the three months through September after setting aside a provision of €894M ($1.13B) against possible fines and litigation. The bank also announced Tuesday evening it named Goldman Sachs (GS)’ Marcus Schenck to succeed Stefan Krause as CFO in May.

On valuation measures, DB shares have a PEG and forward P/E ratio of 1.28 and 9.99, respectively. Price/Sales for the same period is 1.18 while quarterly earnings growth on y/y basis is (29.00%). Currently there are 14 analysts that rate Deutsche Bank a ‘Buy’, while 14 rate it a ‘Hold’. 3 analysts rate it a ‘Sell’. DB has a median Wall Street price target of $40.82 with a high target of $48.34.

In the past 52 weeks, shares of the Frankfurt-based company have traded between a low of $29.24 and a high of $51.99 and are now at $31.75. Shares are down 29.56% year-over-year, and 27.66% year-to-date.

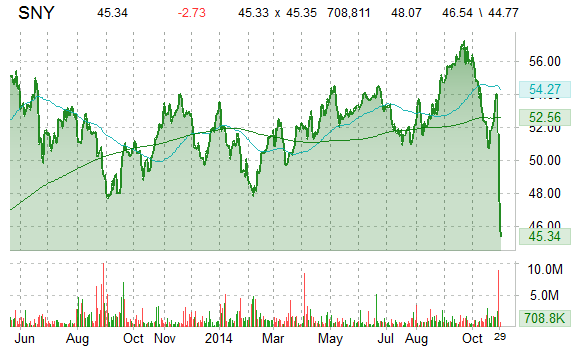

Shares of Sanofi (SNY) are trading down more than 5% in pre-market trading after the French drugmaker’s board removed Christopher Viebacher as CEO, and appointed chairman Serve Weinberg as interim CEO. According to Reuters, the move comes 48 hours after it emerged Viebacher, the firm’s first non-French boss, had fallen out with the company’s chairman. The management turmoil comes at a particularly awkward time for France’s second-biggest listed company, after it warned on Tuesday that growth in its key diabetes segment would likely stall in FY 2015.

Sanofi shares recently lost $2.67 to $45.40. In the past 52 weeks, shares of Paris, France-based company have traded between a low of $47.06 and a high of $57.42. SNY currently prints a one year loss of about 4.36%, and a year-to-date loss of around 7%.

Garmin Ltd. (GRMN) is currently changing hands at $54.81, down 3%. The stock is in the red after the maker of GPS devices reported a net loss of $0.76 per share, in the quarter ended Sept. 27, compared with a profit of $0.96 per share, a year earlier.

Garmin Ltd., currently valued at $11.02B, has a median Wall Street price target of $60.00 with a high target of $70.00. In the past 52 weeks, shares of Schaffhausen, Switzerland-based company have traded between a low of $43.03 and a high of $62.05 with the 50-day MA and 200-day MA located at $52.26 and $55.86 levels, respectively. Additionally, shares of GRMN trade at a P/E ratio of 2.74 and have a Relative Strength Index (RSI) and MACD indicator of 70.99 and +3.51, respectively.

GRMN currently prints a one year return of about 23.89%, and a year-to-date return of around 27.03%.

Shares of SodaStream International Ltd. (SODA) fell 3.20% in recent trading after the company said third quarter revenue fell below consensus forecasts.

On valuation-measures, shares of SodaStream have a trailing-12 and forward P/E of 16.68 and 13.87, respectively. P/E to growth ratio is 0.74, while t-12 profit margin is 4.91%. EPS registers at $1.31. The company has a market cap of $459.40M and a median Wall Street price target of $25.00 with a high target of $46.00.

On trading-measure, SODA has a beta of 1.13 and a short float of 25.34%. In the past 52 weeks, shares of the Airport City, Israel-based company have traded between a low of $20.13 and a high of $61.41 with the 50-day MA and 200-day MA located at $41.38 and $47.61 levels, respectively.

SODA currently prints a 12-month loss of about 64.86%, and a year-to-date loss of around 55.84%.

Shares of Facebook, Inc. (FB) fell around 7% in early trade after the company reported stonger-than-expected fiscal third-quarter results but warned that revenue growth would slow this quarter and that spending would increase significantly in fiscal 2015.

FB’s revs and costs rose 59% to $3.2 billion, and 41% in Q3, respectively. On a conference call with analysts Tuesday, the company’s finance chief David Wehner said he expects costs to rise as much as 75% for the year.

FB shares are currently priced at 80.54x this year’s forecasted earnings, which makes them expensive compared to the industry’s 4.51x earnings multiple. The company’s current year and next year EPS growth estimates are 85.20% and 25.20% compared to the industry growth rates of 11.30% and 23.60%, respectively. FB has a t-12 price/sales ratio of 20.97. EPS for the same period registers at $0.94.

FB’s shares have advanced 2.24% in the last 4 weeks and 8.15% in the past three months. Over the past 5 trading sessions the stock has gained 2.64%. The social networking giant, which is currently valued at $197.06B, has a median Wall Street price target of $90.00 with a high target of $106.00. FB is up 60.80% year-over-year and 47.80% year to date.

Leave a Reply