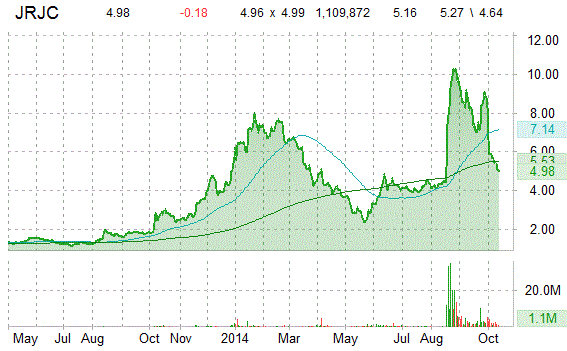

Recent short interest data for the 9/30/2014 settlement date shows an increase in short interest for shares of China Finance Online Co., Ltd. (JRJC). As of September 30, the short interest for the financial services provider totaled 1,730,443 shares, as compared to 1,163,542 shares since September 15, a jump of 48.72%. Average daily volume [AVM] for the same period rose by 388,870 to 3,306,604 shares from 2,917,734 shares.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.00 days. Days-to-cover for JRJC no change to 1.00 for the September 30 settlement date, as compared to 1.00 days at the September 15 report.

China Finance Online has a beta of 3.07 and a short float of 15.07%. In the past 52 weeks, shares of Beijing-based company have traded between a low of $2.33 and a high of $11.88 and are now at $4.92. Shares are up 99.23% year-over-year ; down 17.97% year-to-date.

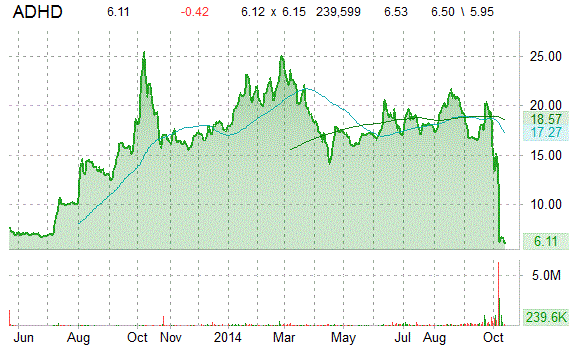

Recent short interest data for the 9/30/2014 settlement date shows an increase in short interest for shares of Alcobra Ltd. (ADHD). As of September 30, the short interest for the biopharmaceutical company totaled 1,433,917 shares, as compared to 1,002,396 shares since September 15, a jump of 43.05%. Average daily volume [AVM] for the same period rose by 242,222 to 460,048 shares from 217,826 shares. It is worth mentioning that ticker’s short interest has jumped 389%, from the 6/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 3.12 days. Days-to-cover for ADHD decreased to 3.12 for the September 30 settlement date, as compared to 4.60 days at the September 15 report.

Alcobra Ltd. has a beta of 1.94 and a short float of 21.56%. In the past 52 weeks, shares of Tel Aviv, Israel-based company have traded between a low of $5.88 and a high of $25.44 and are now at $6.17. Shares are down 68.42% year-over-year and 63.72% year-to-date.

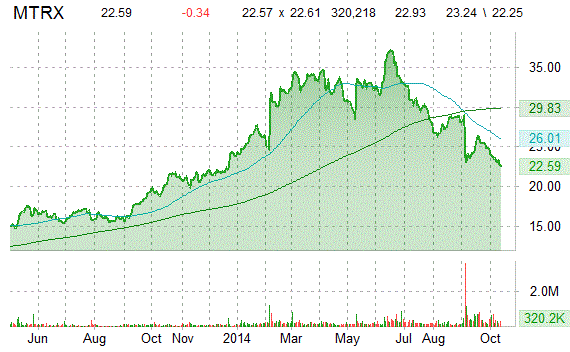

Recent short interest data for the 9/30/2014 settlement date shows a surge in short interest for shares of Matrix Service Company (MTRX). As of September 30, the short interest for the engineering, and construction services provider totaled 1,322,784 shares, as compared to 812,239 shares since September 15, a jump of 62.87%. Average daily volume [AVM] for the same period fell by 385,757 to 453,094 shares from 838,851 shares. It is worth mentioning that ticker’s short interest has jumped 186% from the 5/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 2.92 days. Days-to-cover for MTRX increased to 2.92 for the September 30 settlement date, as compared to 1.00 days at the September 15 report.

Matrix Service has a beta of 2.71 and a short float of 5.08%. In the past 52 weeks, shares of Tulsa, Oklahoma-based company have traded between a low of $19.05 and a high of $38.71 and are now at $22.61. Shares are up 22.23% year-over-year ; down 6.14% year-to-date.

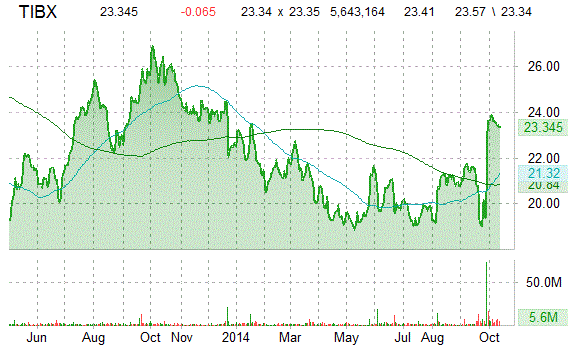

Recent short interest data for the 9/30/2014 settlement date shows an increase in short interest for shares of TIBCO Software Inc. (TIBX). As of September 30, the short interest for the business intelligence software provider totaled 9,238,533 shares, as compared to 6,331,017 shares since September 15, a jump of 45.92%. Average daily volume [AVM] for the same period rose by 10,336,447 to 13,048,267 shares from 2,711,820 shares. It is worth mentioning that ticker’s short interest has jumped by more than 7.41M shares, or 405.63%, from the 4/30/2014 settlement date.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 1.00 days. Days-to-cover for TIBX decreased to 1.00 for the September 30 settlement date, as compared to 2.33 days at the September 15 report.

TIBCO Software Inc. (TIBX) has a beta of 2.25 and a short float of 6.19%. In the past 52 weeks, shares of the New York-based company have traded between a low of $18.20 and a high of $26.58 and are now at $23.34. Shares are down -7.80% year-over-year ; up 4.14% year-to-date.

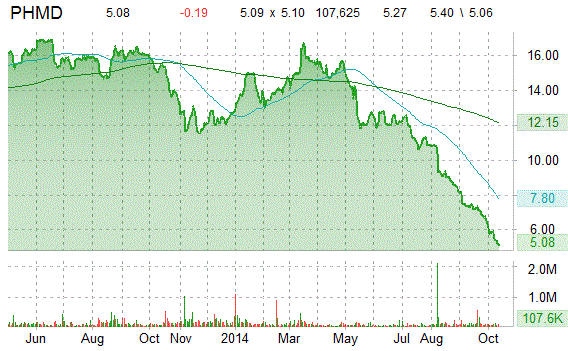

Recent short interest data for the 9/30/2014 settlement date shows an increase in short interest for shares of PhotoMedex, Inc. (PHMD). As of September 30, the short interest for the skin health company totaled 2,946,995 shares, as compared to 2,072,881 shares since September 15, a jump of 42.17%. Average daily volume [AVM] for the same period rose by 58,459 to 162,634 shares from 104,175 shares.

Based on the latest AVM, the days-to-cover ratio — a metric that includes both the total shares short and the average daily volume of shares traded — is currently 18.12 days. Days-to-cover for PHMD decreased to 18.12 for the September 30 settlement date, as compared to 19.90 days at the September 15 report.

PhotoMedex, Inc. has a beta of 0.35 and a short float of 26.36%. In the past 52 weeks, shares of Horsham, Pennsylvania-based company have traded between a low of $5.07 and a high of $16.82 and are now at $5.10. Shares are down 65.15% year-over-year and 59.31% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply