Sometimes you can get a little too close to the market. If someone (say, a friendly punter/blogger with a tasteful double initial) had told you that there was a potentially significant event on Wednesday, but little news of consequence scheduled for release before then, what would be your a priori expectation of price action for the first half of the week?

Chances are, you’d say something like “well, there’ll probably be some profit-taking, and maybe the sharks will run some stops. I guess it’ll be pretty noisy.” Makes sense, right? And if you run a “directional medium-term macro strategy”, you’d think it would be nothing to get worked up over.

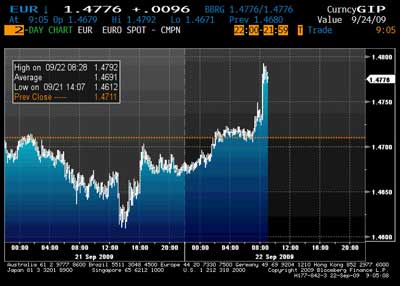

And yet, if you’re there watching the screens, it’s incredibly easy to get sucked into doing something stupid when you see stops being run and/or a price correction. Such as yesterday’s dip down to 1.4611 in EUR/USD….which you’re kicking yourself if you sold, given that we’ve soared to new highs…and that’s before Lauren Cooper Axel Weber said “I ain’t bovvered” about the level of the euro exchange rate.

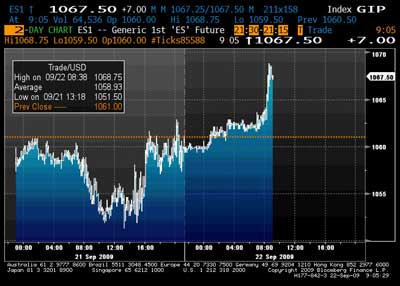

Not that FX is alone in its ability to suck in the unsuspecting punter, only to spit him out with a damaged P/L. Equities looked offered-only at this time yesterday…..and now they don’t.

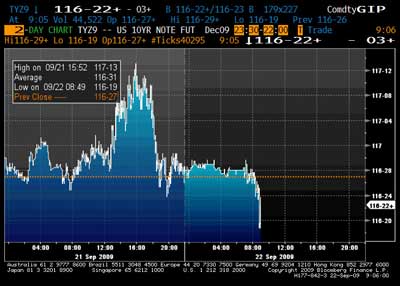

Treasuries caught a tasty bid…..until it went away.

Perhaps the most interesting price action was in the energy complex, where oil caught a proper bollocking…CLZ9 shed $3 at one point, and appeared on the verge of breaking a rather significant trendline. Needless to say, pre-emptive selling of the break was rewarded with a nice $1 bounce and a hole in one’s P/L.

Sometimes, it’s useful to take a step back and recognize that for the short-term, the noise to signal ratio is likely to be close to infinite. On yesterday’s evidence, you can save yourself money by not watching things too closely. So while Macro Man is ostensibly taking Mrs. Macro out to lunch for her birthday (and our wedding anniversary!) today, he may well find that it’s quite a profitable idea as well.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply