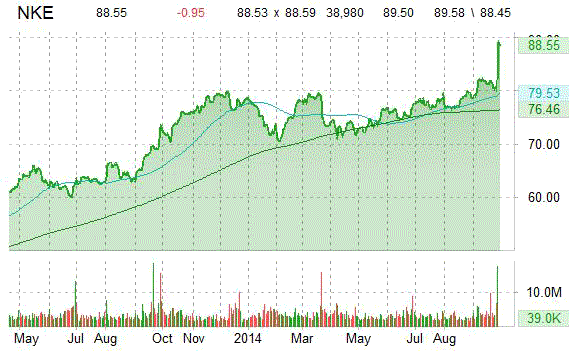

Nike Inc (NKE) had its rating upgraded to ‘Outperform’ from ‘Neutral’ by analysts at Credit Suisse (CS) on Monday. The bank also increased its price target on the stock to $100, from $80 a share citing the company’s ability to capture market share following its Q1 results. Credit’s price target would suggest a potential upside of 11.73% from the stock’s previous close.

Nike, Inc. shares are currently priced at 28.03x this year’s forecasted earnings compared to the industry’s 19.59x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.92 and 21.83, respectively. Price/Sales for the same period is 2.39 while EPS is $3.19. Currently there are 7 analysts that rate NKE a ‘Strong Buy’, 12 rate it a ‘Buy’ and 9 rate it a ‘Hold’. No analysts rate it a ‘Sell’. NKE has a median Wall Street price target of $93.00 with a high target of $110.00.

In the past 52 weeks, shares of Beaverton, Oregon-based multinational corporation have traded between a low of $69.85 and a high of $89.99 and are now at $88.70. Shares are up 28.81% year-over-year, and 14.86% year-to-date.

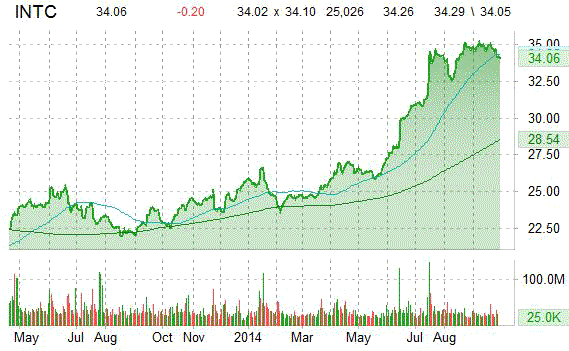

Intel Corporation (INTC) had its price target raised to $43 from $36 by analysts at Bank of America (BAC) on Monday. BofAs’ price objective suggests a potential upside of 26.28% from the stock’s current price.

Intel Corporation shares are currently priced at 16.97x this year’s forecasted earnings compared to the industry’s x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.77 and 14.83, respectively. Price/Sales for the same period is 3.14 while EPS is $2.02. Currently there are 6 analysts that rate INTC a ‘Strong Buy’, 13 rate it a ‘Buy’ and 21 rate it a ‘Hold’. 2 analysts rate it a ‘Sell’. INTC has a median Wall Street price target of $35.00 with a high target of $50.00.

In the past 52 weeks, shares of Santa Clara, California-based company have traded between a low of $22.48 and a high of $35.56 and are now at $34.08. Shares are up 50.40% year-over-year, and 34.35% year-to-date.

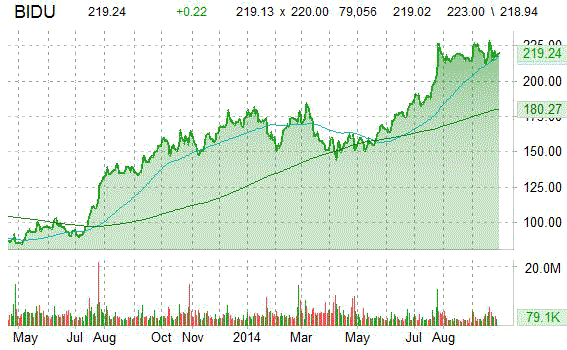

Shares of Baidu Inc (BIDU) are rising $1.18 to $220.20 this morning after the stock was upgraded to ‘Buy’ from ‘Neutral’ at UBS.

Baidu, Inc. shares are currently priced at 39.62x this year’s forecasted earnings compared to the industry’s 6.85x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.00 and 4.30, respectively. Price/Sales for the same period is 11.81 while EPS is $5.53. Currently there are 10 analysts that rate BIDU a ‘Strong Buy’, 15 rate it a ‘Buy’ and 4 rate it a ‘Hold’. No analysts rate it a ‘Sell’. BIDU has a median Wall Street price target of $1,596.01 with a high target of $1,737.20.

In the past 52 weeks, shares of Beijing-based company have traded between a low of $140.66 and a high of $231.41. Shares are up 41.96% year-over-year, and 23.13% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

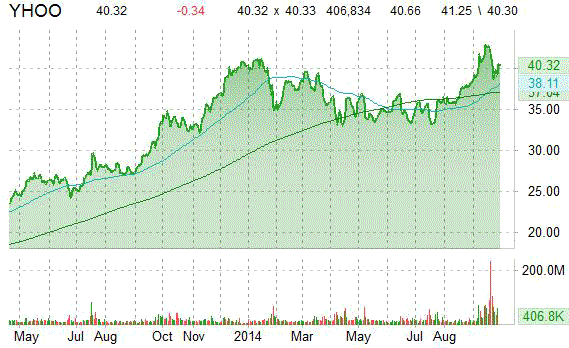

Yahoo (YHOO) was upgraded by Needham from an ‘Hold’ rating to a ‘Buy’ rating in a research note issued on Monday. The firm attributed the upgrade, among other things, to Starboard’s stake announcement which is expected to aid capital allocation of balance sheet cash and urgency to the turnaround. The firm currently has a $48 price objective on the stock, which suggests a potential upside of 18.92% from ticker’s current pps.

Yahoo! Inc., currently valued at $40.44B, has a median Wall Street price target of $42.00 with a high target of $48.00. In the past 52 weeks, shares of the web portal have traded between a low of $31.70 and a high of $44.01 with the 50-day MA and 200-day MA located at $38.99 and $36.28 levels, respectively. Additionally, shares of YHOO trade at a P/E ratio of 3.11 and have a Relative Strength Index (RSI) and MACD indicator of 54.34 and -1.18, respectively.

YHOO currently prints a one year return of about 24.15% and a year-to-date return of around 0.54%.

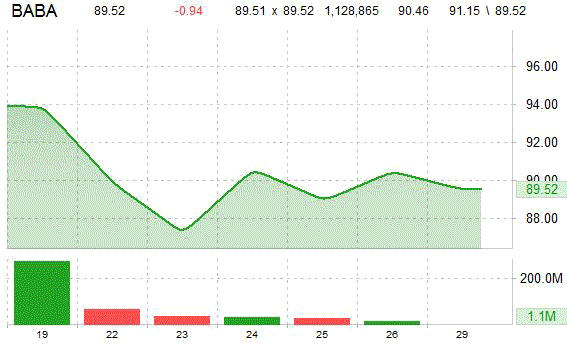

Investment analysts at Susquehanna initiated coverage on shares of Alibaba Group Holding (BABA) in a note issued to investors on Monday. The firm set a ‘Positive’ rating and a $110.00 price target on the stock. The firm’s price target would suggest a potential upside of 22.76% from the stock’s current price of $89.59.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply