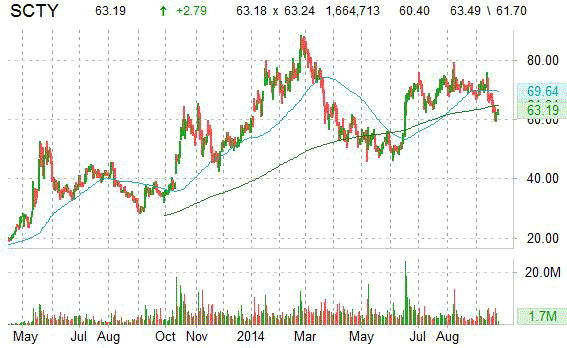

SolarCity Corporation (SCTY) – The firm’s stock was ‘Conviction Buy’ rated with a $96 price target at Goldman Sachs (GS) implying 58.94% expected returns from stock’s previous close. Goldman analysts said in a research note this morning they view ticker’s recent weakness as an attractive entry point and reiterate the name as a top pick in the sector. SolarCity’s shares have declined 11.55% in the last month and more than 17% in the last 2 weeks.

SCTY shares recently traded to $62.53. In the past 52 weeks, shares of San Mateo, California-based company have traded between a low of $32.10 and a high of $88.35. Shares are up 62.23% year-over-year and 6.30% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

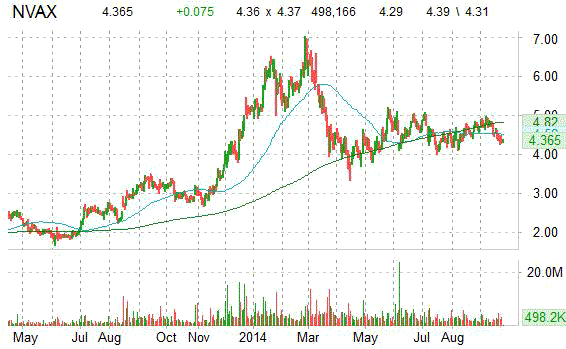

Novavax, Inc. (NVAX) had its price target raised to $10.50 from $9 at Piper Jaffray. The firm’s price objective suggests a potential upside of 142.49% from the stock’s current pps.

In the past 52 weeks, Gaithersburg, Maryland-based Novavax has traded between a low of $2.68 and a high of $6.95, which is almost 160% above that low price. Over the past 5 trading sessions however, the stock, which currently prints the tape at $4.33, has declined 8.82%. Ticker is up 35.20% year-over-year ; down 15.23% year-to-date.

On valuation-measures, shares of Novavax have a price-to-sales ratio of 34.90. EPS is ($0.30). Currently there are 3 analysts that rate NVAX a ‘Strong Buy’ and 2 that rate it a ‘Buy’. No analysts rate it a ‘Hold’ or a ‘Sell’. NVAX has a median Wall Street price target of $10.00 with a high target of $14.00.

The chart below shows where the stock has traded over the last year, with the 50-day and 200-day moving averages included.

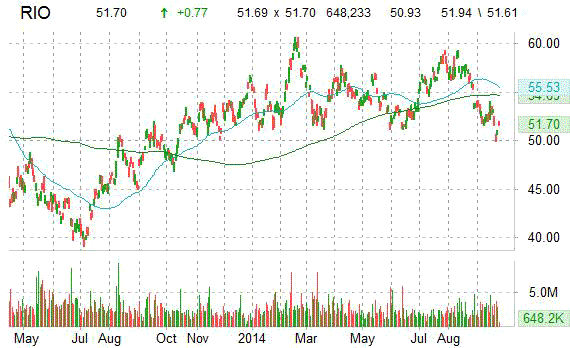

Rio Tinto plc (RIO) was upgraded by Morgan Stanley (MS) from an ‘Equal weight’ rating to an ‘Overweight’ rating in a research note issued on Wednesday.

Rio Tinto shares are currently priced at 26.22x this year’s forecasted earnings compared to the industry’s 11.28x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.54 and 8.82, respectively. Price/Sales for the same period is 1.85 while EPS is $1.97. Currently there are 3 analysts that rate RIO a ‘Strong Buy’ and 3 that rate it a ‘Buy’. No analysts rate it a ‘Hold’ or a ‘Sell’. RIO has a median Wall Street price target of $64.40 with a high target of $68.00.

In the past 52 weeks, shares of London-based company have traded between a low of $46.86 and a high of $60.61 and are now at $51.74. Shares are up 5.25% year-over-year ; down 8.33% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

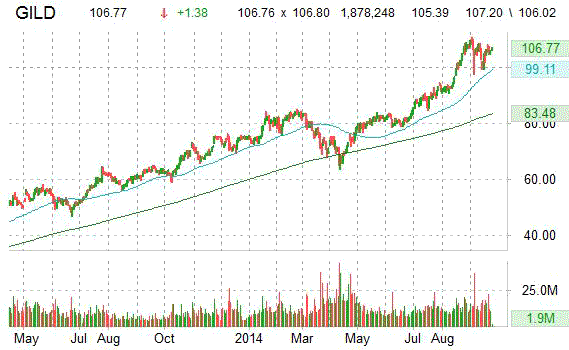

Gilead Sciences Inc. (GILD) had its price target raised to $118 from $111 at Piper Jaffray. The firm’s new PT represents expected upside of 10.38% from the stock’s current price-per-share.

On valuation-measures, shares of Gilead Sciences Inc. have a trailing-12 and forward P/E of 39.61 and 11.33, respectively. P/E to growth ratio is 0.53, while t-12 profit margin is 42.80%. EPS registers at $2.70. The company has a market cap of $161.65B and a median Wall Street price target of $110.00 with a high target of $165.00.

On trading-measure, GILD has a beta of 0.95 and a short float of 5.03%. In the past 52 weeks, shares of the biopharmaceutical company have traded between a low of $58.81 and a high of $110.64 with the 50-day MA and 200-day MA located at $102.43 and $85.73 levels, respectively.

GILD currently prints a one year return of about 70% and a year-to-date return of around 42%.

The chart below shows where the equity has traded over the last 52 weeks, with the 50-day and 200-day MAs included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply