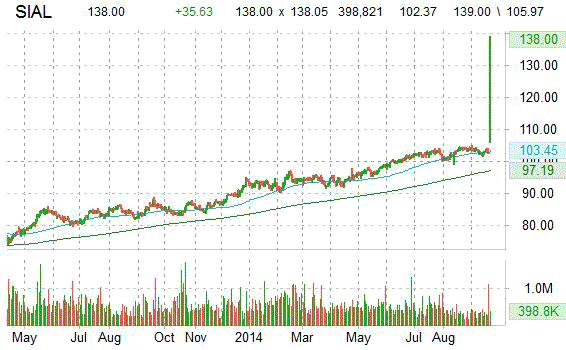

Shares of Sigma-Aldrich Corporation (SIAL) shot up more than 35% in premarket trading, nearing $138 a share after Merck KGaA of Darmstadt, Germany said on Monday that it had agreed to acquire the life sciences company for $17 billion, or $140 a share in cash. The transaction, which establishes one of the leading players in the $130 billion global life science industry, represents a 37% premium on Sigma’s closing pps from Friday, and a 36% premium to the one month average closing price.

“The combination of Merck and Sigma-Aldrich will secure stable growth and profitability in an industry that is driven by trends such as the globalization of research and manufacturing,” Karl-Ludwig Kley, Merck’s executive chairman, said in a statement.

The transaction is expected to close in mid-2015.

Sigma-Aldrich Corporation shares are currently priced at 24.97x this year’s forecasted earnings compared to the industry’s 17.73x earnings multiple. Ticker has a PEG and forward P/E ratio of 3.48 and 21.83, respectively. Price/Sales for the same period is 4.49 while EPS is $4.10. Currently, SIAL has a median Wall Street price target of $100.00 with a high target of $112.00.

In the past 52 weeks, shares of St. Louis, Missouri-based company have traded between a low of $82.90 and a high of $105.00. Shares are up 19.13% year-over-year and 8.89% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

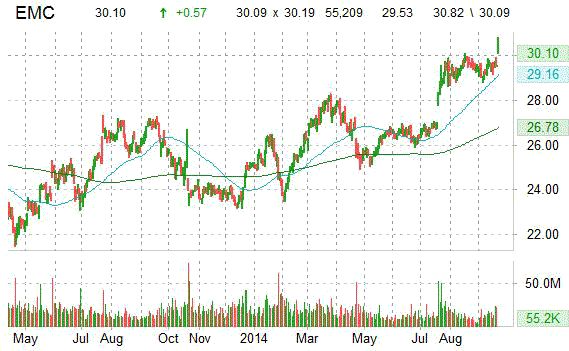

According to a Monday NY Times report that references a source “briefed on the matter”, the EMC Corporation (EMC), the developer of virtual infrastructure technologies now facing pressure from Paul Singer-run activist hedge fund Elliott Management Corp., had held discussions with Hewlett-Packard (HPQ) about a merger. The report notes that the negotiations ended several weeks ago over what the source described as “difficult issues, including financial terms.”

Separately, The Journal discusses that Dell Inc., Cisco Systems (CSCO), and Oracle (ORCL) may also be a suitor for EMC Corp (EMC).

EMC Corporation shares are currently priced at 23.38x this year’s forecasted earnings compared to the industry’s 12.57x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.53 and 13.67, respectively. Price/Sales for the same period is 2.56 while EPS is $1.26. Currently, EMC has a median Wall Street price target of $32.00 with a high target of $35.00.

In the past 52 weeks, shares of Hopkinton, Massachusetts-based company have traded between a low of $23.15 and a high of $30.13 and are now at $30.82. Shares are up 11.73% year-over-year and 17.42% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

The Wall Street Journal reports that the value of Yahoo‘s (YHOO) core business, which includes the entire empire of media sites, advertising, email, mobile apps and other Web properties like Tumblr and Flickr, was sliced in half to $6.8B from $13.85B after Alibaba’s (BABA) first day of trading Friday. Yahoo made $5.1B in cash, net of taxes, from the sale of shares in Alibaba’s IPO and its remaining stake is valued at about $23.4B.

In other Yahoo news, ticker was downgraded this morning to ‘Market Perform’ from ‘Outperform’, and to ‘Neutral’ from ‘Buy’ at Bernstein and Bank of America (BAC), respectively.

YHOO shares recently traded to $40.93. In the past 52 weeks, shares of Sunnyvale, California.-based web portal have traded between a low of $30.02 and a high of $44.01. Shares are up 32.35% year-over-year and 1.21% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

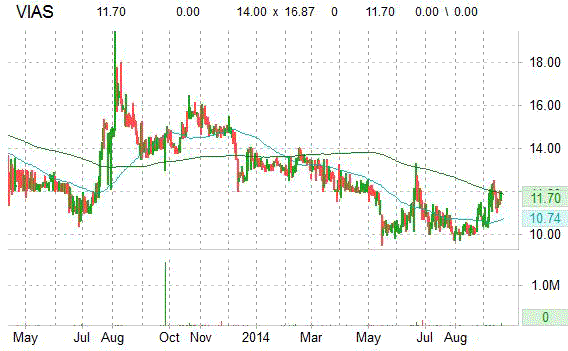

TTM Technologies (TTMI) announced today the acquisition of Viasystems Group (VIAS) for $16.46 per share, or approximately $368 million. The total enterprise value of the transaction, including the assumption of debt, is approximately $927 million.

“This is a compelling strategic combination that makes for an exciting new chapter for Viasystems,” David M. Sindelar, CEO of Viasystems said in a press release. “The combination of these two companies will create one of the best management teams in the industry. I believe this combination is an excellent opportunity to realize value for our shareholders and creates new opportunities for our customers and employees.”

VIAS shares recently traded to $11.70. In the past 52 weeks, shares of St. Louis, Missouri-based company have traded between a low of $9.52 and a high of $16.45. Shares are down 16.73% year-over-year and 16.47% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

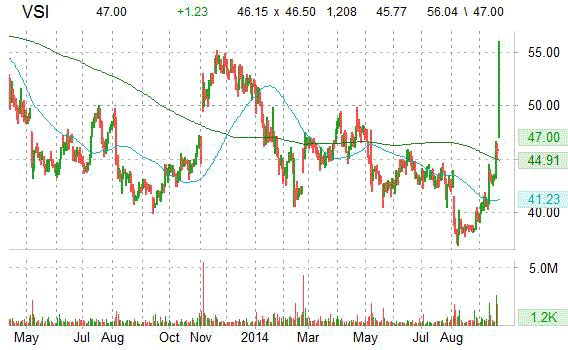

Barron’s profiles positive view on Vitamin Shoppe Inc (VSI) suggesting the name could rally 20% or more.

VSI shares recently traded to $45.77. In the past 52 weeks, shares of North Bergen, New Jersey-based company, which through its subsidiaries, operates as a specialty retailer of nutritional products in the United States, have traded between a low of $36.90 and a high of $55.20. Shares are up 11.15% year-over-year ; down 12% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply