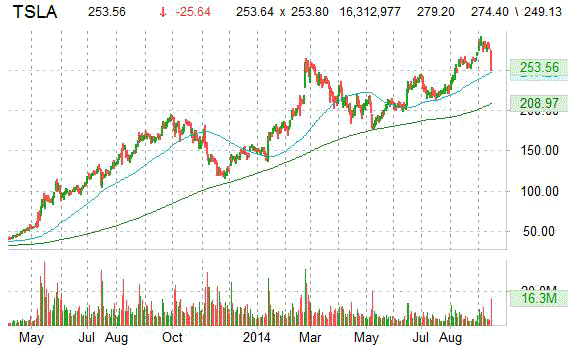

Tesla Motors (TSLA) is trading at a very high volume Monday with 14 million shares changing hands compared to the average volume of 5,747,730. The stock began trading this morning at $274.37 and is currently down about 25 points, or 9%, from the prior days close of $279.20. On an intraday basis it got as low as $249.13 and as high as $274.40. The weakness is being attributed to Morgan Stanley (MS) analyst Adam Jonas who suggested the stock may be a bit ahead of itself.

“We believe the shares are worth $320, but perhaps not so quickly and not for some of the reasons we believe are driving the market,” Jonas wrote [via WSJ] in a note to clients this morning, adding that he doesn’t foresee the stock appreciating “so consistently and one-directionally from here.”

Tesla shares are currently priced at 75.88x next year’s forecasted earnings. Ticker has a current year and next year EPS growth estimates of 37.20% and 213.10% compared to the industry growth rates of 11.20% and (8.70%), respectively. TSLA has a PEG of 5.26 and a T-12 price-to-sales ratio of 14.28. EPS for the same period is ($1.11). Currently there are 3 analysts that rate TSLA a ‘Strong Buy’, 6 rate it a ‘Buy’ and 6 rate it a ‘Hold’. No analysts rate it a sell. TSLA has a median Wall Street price target of $275.00 with a high target of $400.00.

In the past 52 weeks, shares of Palo Alto, California-based company have traded between a low of $116.10 and a high of $291.42 and are now at 253.93. Shares are up 53.44% year-over-year and 68.85% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

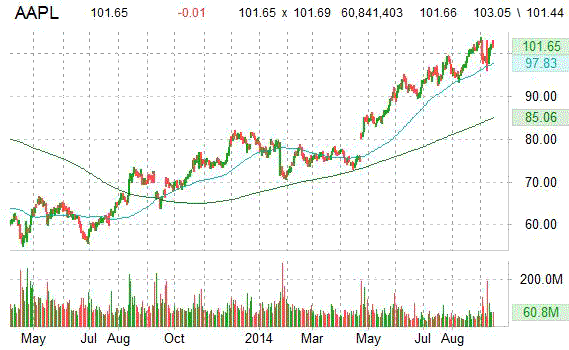

On Monday morning, Apple (AAPL) announced that it received a record 4 million orders for the iPhone 6 and iPhone 6 Plus configurations during the first 24 hours of pre-orders.

That figure sounds miniscule when compared to the number of iPhones Cupertino could sell during Q2’14, according to UBS analyst Steven Milunovich.

[via BI]”The iPhone 6, quickly on back order, should satisfy near-term revenue growth needs with a chance for 100 [million] in total iPhones shipped in the second half,” said Milunovich.On Monday, Apple printed a higher than average trading volume with the issue trading over 60M shares compared to the average volume of 51,766,900. The stock is currently priced at 17.03x this year’s forecasted earnings, making it relatively inexpensive compared to the industry’s 23.40x earnings multiple. Ticker has a forward P/E of 14.30 and T-12 price-to-sales ratio of 3.42. EPS for the same period is $5.96.

In the past 52 weeks, shares of Cupertino, California-based tech giant have traded between a low of $63.89 and a high of $103.74 and are now at 101.52. Shares are up 52.85% year-over-year and 26.65% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

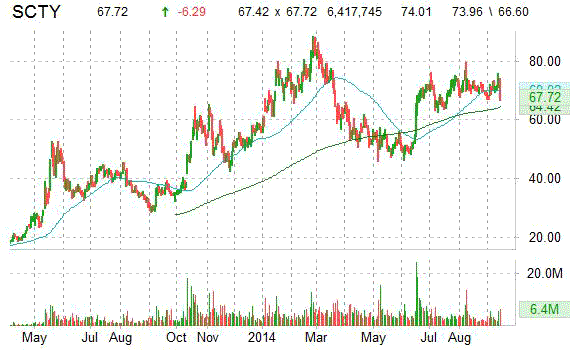

SolarCity Corporation (SCTY) is one of Monday’s notable stocks in decline (in sympathy with Tesla), down $6.65, or 9%, to $67.36.

SolarCity shares have a PEG ratio of 0.45. Price/Sales for the same period is 31.07 while EPS is -0.47. Currently there are 3 analysts that rate SCTY a ‘Strong Buy’, 6 rate it a ‘Buy’ and 1 rates it a ‘Hold’. No analysts rate it a sell. SCTY has a median Wall Street price target of $92.00 with a high target of $98.00.

In the past 52 weeks, shares of San Mateo, California-based company have traded between a low of $32.10 and a high of $88.35 and are now at 67.36. Shares are up 96.79% year-over-year and 18.55% year-to-date.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply