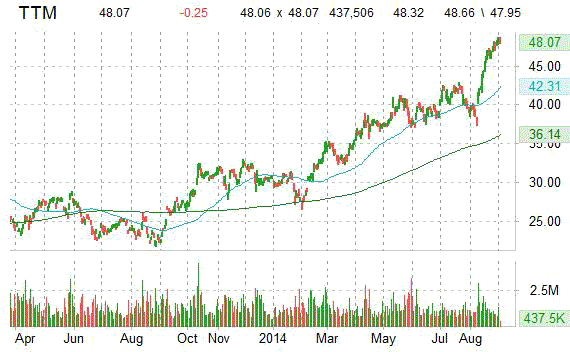

Tata Motors Limited (TTM), an automobile company engaged in engineering and automotive solutions, was downgraded by Bernstein analysts to ‘Market Perform’ from an ‘Outperform’ rating Wednesday. Tata Motors shares were down less than 1% at $48.12 in early trading hours, moving within a 52-week range of $22.20 to $48.66. The stock is up more than 115% year-over-year and 56.17% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

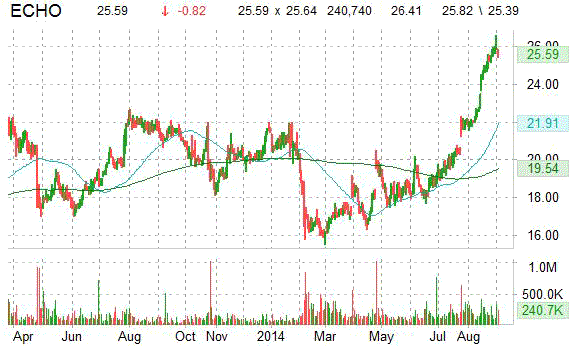

Echo Global Logistics, Inc (ECHO), a provider of tech enabled transportation and supply chain management services, was downgraded by Stifel analysts to ‘Sell’ from ‘Hold’ rating Wednesday.The firm sees ECHO as showing a 20+/percentage downside potential over the coming year. ECHO was down 3.15% at $25.59 in early trading hours, moving within a 52-week range of $15.54 to $26.57. Echo Global’s shares closed at $26.41 at the end of Tuesday’s Nas trading session. The stock is up 18.3% year-over-year and 19% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

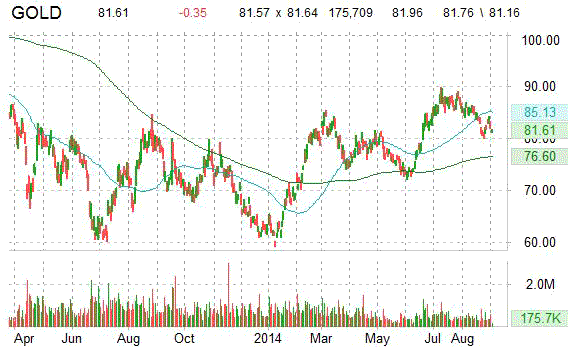

Randgold Resources Limited (GOLD) was downgraded by Deutsche Bank (DB) from a ‘Buy’ rating to an ‘Hold’ rating in a research report issued to clients and investors on Wednesday. Randgold Resources shares, which closed at $81.96 a share in Tuesday’s trading session, were down 0.52% at $81.53 in early trade, moving within a 52-week range of $59.19 to $89.89. GOLD is up more than 3% year-over-year and 30% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Nomura reported on Wednesday that they have lowered their rating for Bank of America (BAC). The firm has downgraded BAC to a ‘Neutral’ rating from a ‘Buy’ rating. Shares of Bank of America are currently flat at $16.17. The stock is up more than 13% year-over-year and about 4% year-to-date. BofA’s shares closed at $16.22 at the end of Tuesday’s trading session.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

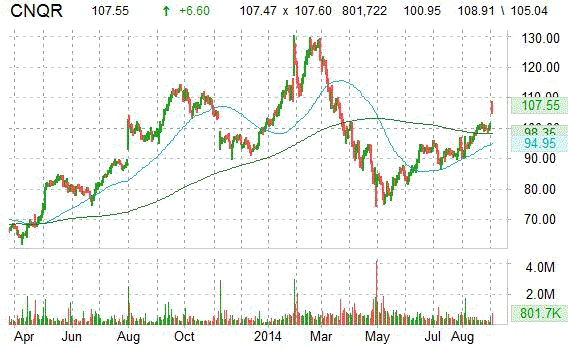

Concur Technologies, Inc. (CNQR), a provider of integrated travel and expense management solutions, was downgraded by Robert W. Baird analysts to ‘Neutral from ‘Outperform’ rating Wednesday. The downgrades follows a Bloomberg report last night that said Concur Tech has hired an investment bank to help explore sale of the firm. Concur Technologies shares were up 7.28% at $108.50 in midday trade, giving the company a market value of about $6.81 billion.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply