The economic backdrop behind this week’s FOMC meeting is almost startlingly refreshing. The recession likely ended at some point during the summer, an occasion effectively confirmed this week by the highest authority in the land, Federal Reserve Chairman Ben Bernanke. For those still in denial, industrial production posted its second consecutive gain, and there is little doubt that GDP will post a significant positive reading for the third quarter. Finally, in a seemingly impossible development, the retail sales report suggested that consumers eagerly converged onto the nation’s shopping establishments in August. The economic summary paragraph in the upcoming FOMC statement will certainly identify the positive economic developments since their last gathering. But will improving conditions be sufficient to prod the FOMC to adopt language that points in the direction of tighter policy? Almost certainly not. The exit from the recession is clearly much too tenuous – and much too dependent on fiscal and monetary life support – to allow the risk of premature policy withdrawal. Moreover, even if economy activity were on a self-sustaining upward trend, the hole we are climbing out of is so deep that it could literally be years before resources are sufficiently utilized as to allow for significant policy reversal.

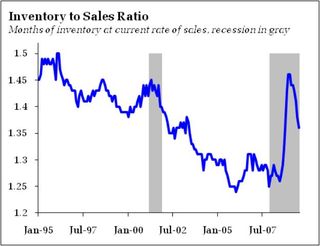

Let’s start off with the good news. The stabilization of consumer spending that we saw begin earlier this year is supporting an inventory correction story. Firms are no longer chasing spending plans down, which alone gives some boost to final output. Moreover, some restocking is likely occurring; anecdotally, I hear from firms that are surprised to learn that their suppliers are running low on inventories despite weak final sales. Restocking is also a consequence of the “Cash for Clunkers” program, as auto firms look to rebuild depleted inventories. And, the August retail sales report points to sales gains across a wide range of retail stores. All in all, the inventory cycle looks to be making a pretty clear turn, offering support to activity:

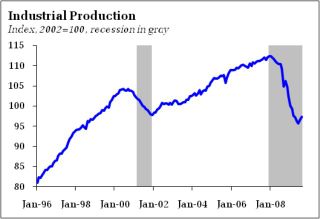

In addition, the strength of fiscal stimulus is coming to bear on the economy. And one cannot discount the additional boost delivered by the first time homebuyers credit, which helped support a bottom into the new housing market this summer. Adding everything together, it is not difficult to see why forecasters are looking for growth in the range of 3 to 4% this quarter. Not surprisingly, industrial production numbers are turning:

All of that is well and good. The FOMC, however, will look at this data flow and ask “what’s next?” An inventory correction in the wake of the 2001 recession provided little lasting support, leaving the economy struggling until the housing bubble gained force in 2003-04. The clunkers program and the homebuyers credit likely borrowed some spending from the future. And even if the homebuyers credit is extended, the marginal impact is likely to decline as it increasingly benefits those looking to buy anyway. Moreover, there is growing concern that this summer’s buying binge – such that it is was – can be partly attributed to a slowing in foreclosure activity earlier this week. Now that the pace of foreclosures looks to be picking up, and the threat of the option-ARM lending comes more clearly into the view, the sustainability of this summer’s housing gains comes into question. On top of all that housing concern, the possibility that the FHA might need a bailout indicates that the risk of loaning into an overpriced housing market has simply been shifted from the private sector to the taxpayer. Consequently, the FHA is poised – the current housing lender of last resort –is poised to tighten credit standards. And even the surprisingly strong retail sales numbers are somewhat suspect, as they don’t appear to comport with the anecdotal reports of retailers. A reasonable midpoint analysis, via the Wall Street Journal:

The July/August average for “core” retail sales is still not much stronger than the [second-quarter] average, but after a string of contractions, these data suggest that consumer demand is, at a minimum, stabilizing. Core retail sales may even be starting to firm slightly (up in 2 of the past 3 months), but we will need to see another month or two of positive data to have confidence in that view. –Stephen Stanley, RBS

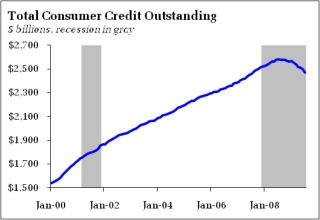

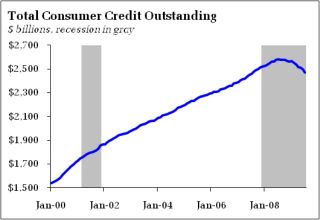

In addition, financial markets remain glued up by many metrics. Importantly, consumer credit growth is still significantly restrained, as is bank lending for commercial and industrial loans:

Given the steady anecdotal buzz surrounding the deterioration of the commercial real estate market, it is difficult to expect a rapid reversal of these trends. In short, if you think credit markets are still under stress, as the Fed certainly does, and are worried about the availability of credit to support future spending, also among Fed concerns, then shifting rhetorically to signal a tighter policy stance irrational. Moreover, it would seem inconsistent with plans to continue expanding the balance sheet via purchases of mortgage backed securities and TALF assets.

Now, the above are among the reasons many expect a relatively tepid recovery to emerge in the years ahead. Suppose instead that you, logically, believe that the economy is set to come roaring back on the straightforward hypothesis that deep recessions are always followed by strong recoveries. James Grant makes just such an argument in this past weekend’s Wall Street Journal:

“At the business trough in 1933,” Mr. Darda points out, “the unemployment rate stood at 25% (if there had been a ‘U6’ version of labor underutilization then, it likely would have been about 44% vs. 16.8% today. . . ). At the same time, the consumption share of GDP was above 80% in 1933 and the household savings rate was negative. Yet, in the four years that followed, the economy expanded at a 9.5% annual average rate while the unemployment rate dropped 10.6 percentage points.” Not even this mighty leap restored the 27% of 1929 GNP that the Depression had devoured. But the economy’s lurch to the upside in the politically inhospitable mid-1930s should serve to blunt the force of the line of argument that the 2009-10 recovery is doomed because private enterprise is no longer practiced in the 50 states.

One would have to wonder if Grant has ever seriously considered a different analysis of the path of the business cycle. After all, I have never heard it argued by the more pessimistic forecasters that the fundamentally reason for their concerns is that private enterprise is no longer practiced in the US. That this should be his line of argument seems silly. That aside, the post-1933 rebound is illustrated by the industrial production series:

What one could add to this story, however, is that despite the rapid growth of 1933-1937, unemployment remained unacceptably high and inflation remained sufficiently contained such that the price level never came close to regaining the ground lost during the depression:

And – critically for divining the path of policy – the growth in the 1933-1937 period was not sufficient to allow for policy tightening, as evidenced from the 1937 recession. One does not have to deny that the recession is over – and can even expect nontrivial growth – while still expecting a sufficiently weak outcome that prevents a significant reversal of the Fed’s monetary stance. Or further fiscal stimulus, for that matter. Which is to say that those who see rapid growth as a reason for an imminent Fed reversal are looking in the wrong direction. Even rapid growth could leave the Fed on the sidelines for much, much longer than many anticipate – and they know it. Bernanke has schooled policymakers well on the lasting damage that typically follows the collapse of a debt-driven bubble.

Bottom Line: Economic activity is clearly on the upswing – but the durability and sustainability of the recovery remains in doubt. The FOMC statement will certainly take notice of strengthening economic data. But a resumption of growth is not the only issue that factors into policymaking. At this juncture, the focus to resource utilization – how long will persistently weak labor marks sustain downward pressure on wages and thus make a wage-price inflation spiral simply unattainable? For now, a seemingly long period of time. Indeed, I find it virtually impossible that Fed officials will dare shift from “sure, we can withdraw stimulus when needed” to “it is not necessary to aggressively withdraw stimulus” until the unemployment rate begins a sustained march downward. And for now, we are still waiting for the upward march to end.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply