Large flows of bank lending from core countries in the Eurozone to the periphery lead to large financial imbalances. This column explains what motivated such financial flows. With the advent of the Eurozone, banks in core countries gained relative advantage in lending to the periphery, making such lending very attractive. They also served as intermediaries for financial flows from outside the Eurozone to the periphery. Now – five years since the start of the euro crisis – Eurozone financial markets remain segmented.

Internal financial imbalances within the Eurozone were central to the development of the European debt crisis. They resulted in a concentration of European periphery risks on the balance sheets of banks located in core Eurozone countries (Lane 2012, Rey 2012, Shin 2012). They also promoted larger intra-Eurozone current-account deficits and a sharp fall in peripheral bond yields, accompanied by a loss of competitiveness of the peripheral economies, most strikingly relative to Germany (Chen et al. 2013, Shambaugh 2012). But these real imbalances could not have occurred without large flows of bank lending from the core to the periphery of the Eurozone (Hale 2013). What motivated these large financial flows?

Eurozone banks and financial flows

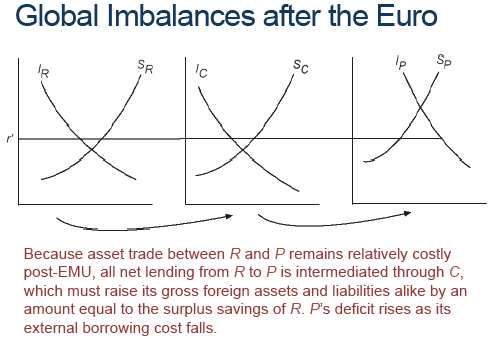

In a recent paper (Hale and Obstfeld 2014), we demonstrate that banks in core Eurozone countries served as intermediaries for channelling financial capital from outside the Eurozone to the Eurozone’s periphery. Throughout the pre-crisis period – 1999 to 2007 – these banks increasingly borrowed from financial centres such as the US and the UK, and invested in sovereign as well as private debt issued by the European periphery. The reason is that with the advent of the Eurozone, its core banks gained a relative advantage in lending to the periphery. An extreme form of the basic mechanism that arose is illustrated in Figure 1, where R denotes the rest of the world, C the core Eurozone countries, and P the European periphery. (The example ignores uncertainty and assumes that costs of lending to P are positive for R and zero for C.)

Figure 1. The mechanism: Global imbalances after the introduction of the euro

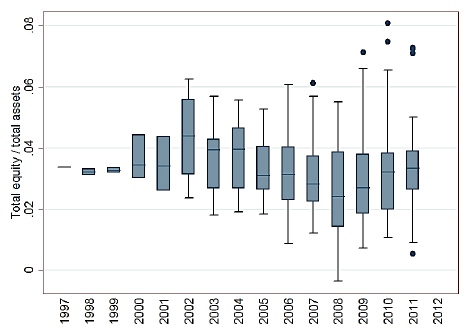

Thus, the Eurozone contributed not only to the big net current-account deficits of the peripheral countries, but to inflated gross foreign debt liability and asset positions for core Eurozone countries such as Belgium, France, Germany, and the Netherlands – countries that all experienced systemic banking crises after 2007. The tendency for systemically important banks to increase leverage in line with balance sheet size implied a substantial increase in financial fragility for these countries’ financial sectors. Figure 2 illustrates how the leverage of core Eurozone banks rose in the 2000s before the euro crisis.

Figure 2. Leverage of core Eurozone banks

Source: Bankscope. Notes: Boxed represents the 25th to 75th percentile range, with horizontal line indicating the median. Whiskers extend to adjacent values, dots are outside values. Very limited coverage of institutions prior to 2004.

Four main factors gave core Eurozone financial institutions a comparative advantage in terms of lending to the periphery, while also compressing peripheral bond yields relative to German bunds:

- The risk of investing in the Eurozone periphery declined with the advent of the euro due to investor assumptions (perhaps erroneous) about future political risks, including the possibility of official bailouts (Broner et al. 2014).

- Transaction costs declined and currency risk disappeared for Eurozone investors investing in the periphery countries (Hale and Spiegel 2012).

- The ECB’s policy of applying an identical collateral haircut to all Eurozone sovereigns, notwithstanding their varied credit ratings, encouraged additional demand for periphery sovereign debt by Eurozone financial institutions (Buiter and Sibert 2005), which, moreover, were able to apply zero risk weights to these assets for computing regulatory capital.

- Financial regulations in the EU were harmonized (Kalemli-Ozcan et al. 2010) and the euro infrastructure implied a more efficient payment system though its TARGET settlement mechanism.

Of course, some of these advantages were also enjoyed by financial institutions outside of the Eurozone. For example, European subsidiaries of US and UK banks also had access to ECB lending facilities. Moreover, perceptions of reduced risk in lending to the European periphery were likely not limited to core Eurozone investors. For these and other reasons, we also observed some increase in direct lending to the European periphery from countries outside the Eurozone. That is, capital flow diversion occurred, but was not as stark as suggested by Figure 1.

The dynamics of international debt flows

Can we observe these dynamics in the data? Ideally, we would like to see all debt flows between each country-pair for each year. Unfortunately, no such dataset exists. At the country-pair level, there are data on cross-border bond holdings (from the IMF Coordinated Portfolio Investment Survey, or CPIS) and on cross-border bank claims (from the BIS International Banking Statistics). There is also loan-level information on syndicated lending, which identifies both borrower and lender (from the Dealogic Loan Analytics database). For a number of reasons, none of these sources is ideal. We can, however, use all of these sources to proxy the true dynamics of international debt flows. Reassuringly, they all tell a similar story.

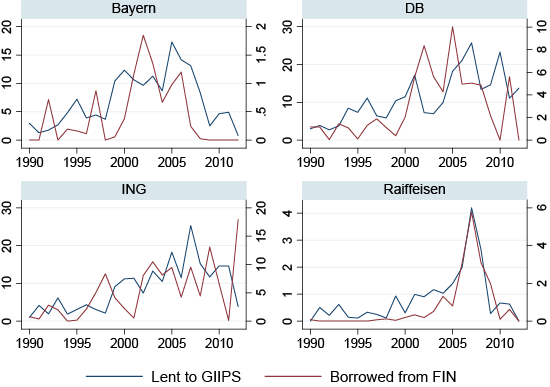

Using the Loan Analytics data, Figure 3 illustrates the correlation between syndicated borrowing from financial centres outside the Eurozone and syndicated lending to the European periphery for four large European banks. While the picture does not look the same for every core Eurozone bank, our statistical analysis shows a correlation, on average for the 27 largest core European banks, between the amount borrowed from outside the Eurozone and the amount lent to the European periphery on the syndicated loan market.

Figure 3. Syndicated borrowing from financial centres and lending to euro periphery of individual banks

Source: Dealogic Loan Analytics and authors’ calculations. Syndicated borrowing and lending only.

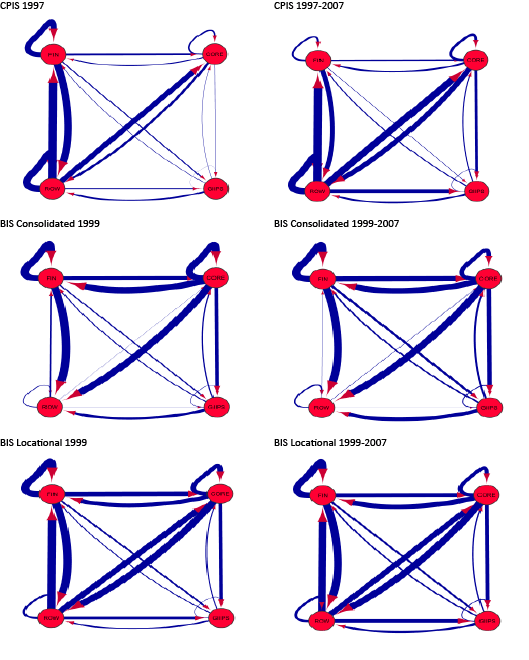

Using country-pair level data on consolidated bank claims from the BIS, Figure 4 shows that intermediation of financial flows to the European periphery by core Eurozone banks was a broad-based phenomenon. On the left-hand side of Figure 4, we show bank claims accumulated prior to Eurozone by four regions vis-à-vis each other: FIN (financial centres), CORE (Core Eurozone), GIIPS (Eurozone periphery), and ROW (rest of the world). On the right-hand side of Figure 4, we show how these claims evolved between 1999 and 2007. We can clearly observe an increase in bank lending from FIN to CORE and from CORE to GIIPS, as well as an increase in direct lending from FIN to GIIPS.

Figure 4. Bank claims by region at the beginning of Eurozone period and their change 1999-2007

Thus, the Eurozone created a situation in which lending to the European periphery became very attractive, especially for core Eurozone lenders, leading to unprecedented capital inflows into the peripheral Eurozone. This lending boom financed peripheral consumption and housing investment, and thereby growing current account deficits in the European periphery. Not only did peripheral countries borrow more after the Eurozone; in addition, financial institutions in the core expanded their balance sheets to facilitate peripheral deficits, thereby increasing their own fragility as they simultaneously invested heavily in US asset-backed products. This pattern set the stage for the diabolical feedback loop between banks and sovereigns that has been such a powerful driver of the Eurozone’s recent crisis (Brunnermeier et al. 2011, De Grauwe 2012, Obstfeld 2013).

By the end of 2008, the European periphery countries had accumulated large negative net international investment positions, of which more than two thirds were vis-à-vis the rest of the Eurozone, a total of $1.8 trillion. At the same time, core Eurozone countries accumulated positive net international investment positions vis-à-vis the rest of the Eurozone of $1.9 trillion (Waysand et al. 2010). The subsequent crisis has taken the form of a sudden stop of private capital inflows to the periphery, accompanied by accelerating deposit flight as the crisis deepened and spread. Peripheral current account deficits have had to adjust sharply in a context of low growth and higher unemployment. Five years after the start of the euro’s crisis, Eurozone financial markets remain segmented, and the crisis remains unresolved.

References

•Broner, Fernando, Aitor Erce, Alberto Martin, and Jaume Ventura (2014), “Sovereign Debt Markets in Turbulent Times: Creditor Discrimination and Crowding-Out Effects”, Journal of Monetary Economics, forthcoming.

•Brunnermeier, Markus, Luis Garicano, Philip R. Lane, Marco Pagano, Ricardo Reis, Tano Santos, Stijn Van Nieuwerburgh and Dimitri Vayanos (2011), “European Safe Bonds (ESBies)”, The Euro-nomics group, September.

•Buiter, Willem and Anne Sibert (2005), “How the Eurosystem’s Treatment of Collateral in Its Open Market Operations Weakens Fiscal Discipline in the Eurozone (and What to Do about It)”, CEPR Discussion Paper No. 5626.

•Chen, Ruo, Gian Maria Milesi-Ferretti, and Thierry Tressel (2013), “External Imbalances in the Euro Area”, Economic Policy.

•De Grauwe, Paul (2012), “The Governance of a Fragile Eurozone”, Australian Economic Review 45: 255-268.

•Hale, Galina (2013), “Balance of Payments in the European Periphery”, FRBSF Economic Letters

2013-01, January.

•Hale, Galina and Maurice Obstfeld (2014), “The Euro and the Geography of International Debt Flows”, CEPR Discussion Paper No. 9337.

•Hale, Galina B. and Mark M. Spiegel (2012), “Currency Composition of International Bonds: The EMU Effect”, Journal of International Economics 88: 134-149.

•Kalemli-Ozcan, Sebnem, Elias Papioannou, and Jose Luis Peydro (2010), “What Lies Beneath the Euro’s Effect on Financial Integration? Currency Risk, Legal Harmonization or Trade?”, Journal of International Economics 81: 75-88.

•Lane, Philip R. (2012), “The European Sovereign Debt Crisis”, Journal of Economic Perspectives 26 (Summer): 49-68.

•Obstfeld, Maurice (2013), “Finance at Center Stage: Some Lessons of the Euro Crisis.” European Commission Economic Papers 493, April.

•Rey, Hélène (2012), “Comment on ‘The Euro’s Three Crises’.” Brookings Papers on Economic Activity (1): 219-226.

•Shambaugh, Jay. C. (2012), “The Euro’s Three Crises.” Brookings Papers on Economic

Activity (1): 157-211.

•Shin, Hyun Song (2012), “Global Banking Glut and Loan Risk Premium,” IMF Economic Review 60: 155-192.

•Waysand, Claire, Kevin Ross, and John de Guzman (2010), “European Financial Linkages: A New Look at Imbalances.” IMF Working Paper WP/10/295.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply