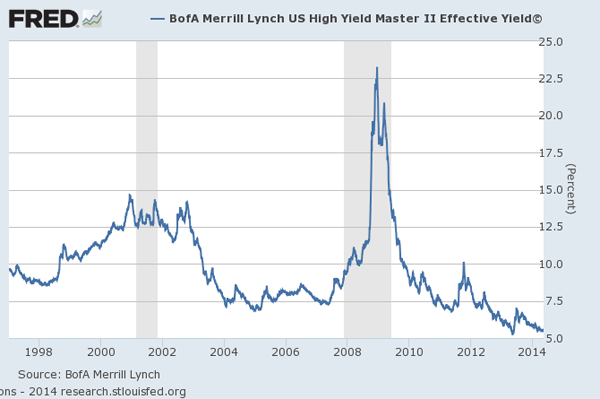

I try to avoid investments where the upside is limited, but the downside is unlimited. That’s the way I feel about junk bonds now. Have junk yields been lower before? No, we have eclipsed the time in 2003 when the junk market was in a yield frenzy, until Bernanke uttered the word “taper.”

There are a lot of desperate retirees seeking income, assuming it is free, and not merely a return of capital. There are a lot of desperate people seeking certainty in investing and do not realize that dividends are a handmaiden of value, and not value itself.

There are a lot of desperate pension plans looking to make up for lost time, and hoping against hope, buying dividend paying and growth stocks, high-yield bonds, alternatives like hedge funds, private equity, etc., at the wrong time.

Those are the things you should buy when stocks are cheap and people are scared to death. You sell them when people are confident, and valuations are high.

Valuations are high; not nosebleed high as in 2000, but high as in comparable to the peak in 2007. Could things go higher? Yes, but you are playing for pennies and risking dollars in the process. Those with a value and quality discipline will likely fare better in the process, but markets are messy, and what actually happens will be a surprise.

Thus I would encourage you to consider the credit quality of your stocks and bonds. What kind of shock could they withstand? When yields are low, like they are now, the system is less resilient to credit crises. Be aware, and be on your guard.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply