The bull market has warped your brain.

For the better part of the past year, stocks have offered nothing but backslaps and high-fives. Your favorite names streaked higher. Your losing trades were few and far between. And most importantly, every single setback miraculously ended in furious buying and another round of new highs for stocks…

That’s why you’re convinced we are now in the midst of a major market correction.

But I have news for you…

That’s why you’re convinced we are now in the midst of a major market correction.

Not yet, at least. No, the action you’ve seen over the past couple of weeks is a minor pullback at best. That’s it.

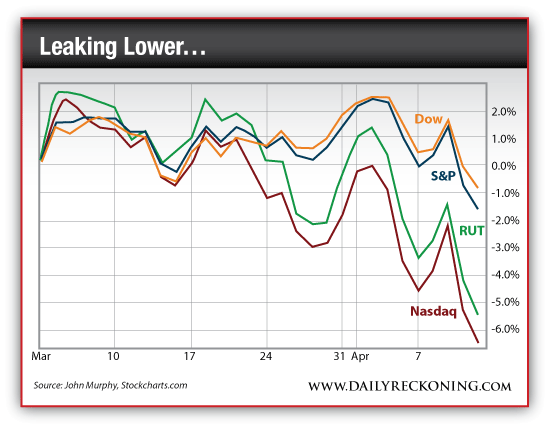

After the market mercifully closed Friday afternoon, investors had the chance to stew over its downright awful performance over the weekend. The Nasdaq dropped more than 3% on the week. The growth stock rout continued. But a correction? Not even close…

The NASDAQ hasn’t breached its February lows yet. That’s right. Even after last week’s gut-punch, the tech-heavy index isn’t even trading at 2014 lows.

Keep this in mind as a new trading week begins. Now’s not the time to try and pick out comeback plays. I’m very skeptical of any market rally. Every move higher is a dead-cat bounce until proven otherwise. Simply put, I do not think the market can just ignore the breakdown we’re seeing in the Nasdaq…

“The lost decade for stocks began with a 2000 collapse in the Nasdaq market as the dot.com bubble burst,” writes technician John Murphy over at Stockcharts.com. “Since market bottoms were formed at the end of 2002 and the spring of 2009, however, the Nasdaq has been a market leader.”

Remember, the Nasdaq has been a critical component of the current bull market. Murphy points out that the Nasdaq Composite has gained 245% since the October 2002 bottom – compared to a gain of 124% for the S&P 500. The Nasdaq has also almost doubled-up the S&P since the March 2009 bottom.

Now, we’re seeing the overheated market leader begin to lag in a big way. That’s a big warning sign you shouldn’t ignore…

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply