I have always believed that government policies are a precursor to change, and witnessing the drama with Putin in the Russian corner of the globe, I think now is a perfect time to shuffle our investment deck and underweight our portfolio to the country. We noticed economic growth in Russia beginning to slow in 2013, with few identifiable, positive catalysts, but the recent geopolitical tension with Ukraine was the final indication of an undesirable shift.

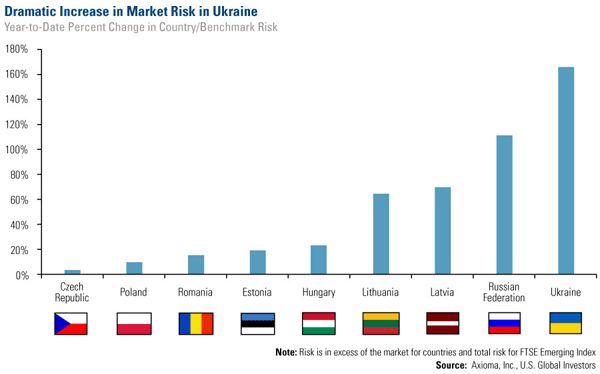

Since the breakout of conflict between Russia and Ukraine, investor confidence has dwindled in the area, and as you can see in the chart below, the two countries directly involved in the clash are the ones showing the highest market-risk impact.

Towards the end of 2013 I wrote that European equities had seen the longest streak of inflows in over 11 years, as investors began noticing this area of the globe as a spectacular investment opportunity. In addition to many strong areas in developed and emerging Europe, several of these equities were in Russia, and continue to be in Russia. Despite the disorder and our decreased exposure to Russia, we still see resilient stocks with growth opportunities. Two examples of strong Russian names include Norilsk Nickel, a nickel and palladium mining company, along with an Internet company, Mail.Ru.

When it comes to actively managing a portfolio, it’s all about playing your cards right, and at U.S. Global Investors we seek to manage risk while pursuing opportunity for our shareholders.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply