Most accounts of inflation focus on national statistics. While the national series is still low, in some select locations, it’s even lower.

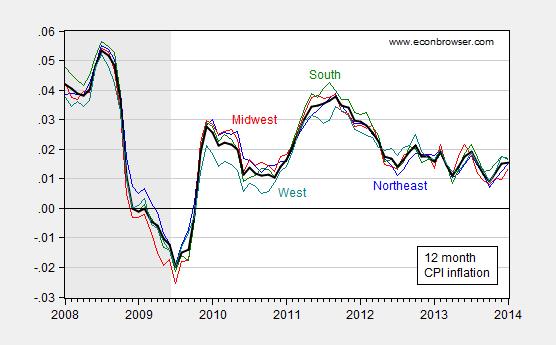

Figure 1 depicts 12 month inflation for the four BLS regions, and for the US as a whole.

Figure 1: Twelve month CPI-all inflation for Northeast urban (blue), Midwest urban (red), South urban (green), West urban (teal) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

Midwest inflation is the lowest, while all series are trending downward.

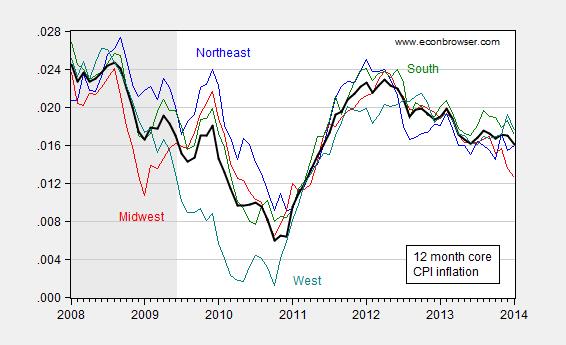

Core inflation is declining as well, with the Midwest once again leading the descent. As of January, core inflation in the region was 1.26%, less than the 1.6% recorded for the nation overall.

Figure 2: Twelve month core CPI-all inflation for Northeast urban (blue), Midwest urban (red), South urban (green), West urban (teal) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

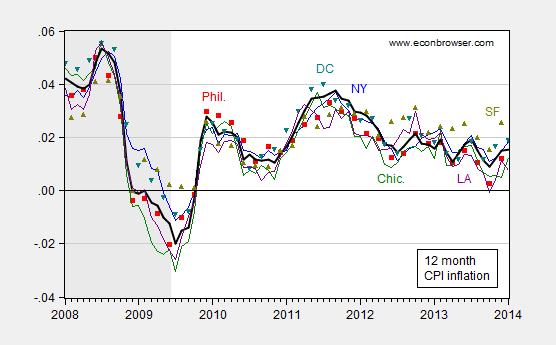

The BLS regions are pretty large, so one would not expect a lot of dispersion. Hence, I also examine the evolution in prices in several cities.

Figure 3: Twelve month CPI-all inflation for NY (blue), Philadelphia (red), Chicago (green), Washington DC (teal), LA (purple), SF (olive) and US (bold black). Inflation rates calculated as log-differences. NBER recession dates shaded gray. Source: BLS via FRED, and author’s calculations.

LA and Philadelphia hit zero inflation earlier, in 2013, and inflation in those urban areas remains low. In assessing all these region- and city-specific indices, it’s important to realize that there’s considerably more sampling uncertainty, manifested in part by the greater volatility in these series. Hence, a positive reading could be obtained even when actual inflation is negative.

Does the geographical dispersion of inflation matter? In Europe, dispersion matters for interpreting the overall low rate of inflation (see IMF via Krugman). That’s partly because the lower degree of labor and credit market integration (think banking systems). In the United States, assets and liabilities are likely to be held more widely; nonetheless, for a given household, the relevant deflator for a given nominal debt is going to be at least somewhat region-specific, so actual deflation in a region is a matter for some worry.

My more central concern is that as the general inflation rate declines, it’s more and more likely that some regions are going to be facing actual deflation.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply