This week, I was at the Tuck School of Business at Dartmouth, talking about the difference between price and value. I built the presentation around two points that I have made in my posts before. The first is that there are two different processes at work in markets. There is the pricing process, where the price of an asset (stock, bond or real estate) is set by demand and supply, with all the factors (rational, irrational or just behavioral) that go with this process. The other is the value process where we attempt to attach a value to an asset based upon its fundamentals: cash flows, growth and risk. For shorthand, I will call those who play the pricing game “traders” and those who play the value game “investors”, with no moral judgments attached to either. The second is that while there is absolutely nothing wrong or shameful about being either an investor (No, you are not a stodgy, boring, stuck-in-the-mud old fogey!!) or a trader (No, you are not a shallow, short term speculator!!), it can be dangerous to think that you can control or even explain how the other side works. When you are wearing your investor cape, you can be mystified by what traders do and react to, and if you are in your trader mode, you are just as likely to be bamboozled by the thought processes of investors. So, at the risk of ending up with a split personality, let me try looking at Facebook’s (FB) acquisition of Whatsapp for $19 billion, with $15 billion coming from Facebook stock and $4 billion from cash, using both perspectives.

The Investor/Value View

I will start wearing my value cap, mostly because I feel more comfortable in it and partly because I understand it better. Looking for fundamentals to justify the price paid but I realized very quickly that this would not only be futile but frustrating and here is why. To justify a $19 billion value for a company in equity markets today, you would need that company to generate about $1.5 billion in after-tax income in steady state.

Value of equity = $19 billion

Implied required return on equity, given how stocks were priced on 1/1/14 = 8.00% (a 5% equity risk premium on top of a 3% risk free rate)

Steady state earnings necessary to justify value = $ 19 billion *.08 = $1.52 billion

Steady state pre-tax earnings needed to justify value, using an effective tax rate of 30%= $1.52 billion/(1-.30) = $2.17 billion

That would translate into pre-tax income of about $2.2 billion and it is a lowball estimate of break even earnings, since the break even number will increase, the longer you have to wait for steady state and the more risk there is in the business model. Using a 10% required return (reflecting the higher risk) and building in a waiting period of 5 years before the income gets delivered increases the break-even income to $4.371 billion. You can try the spreadsheet with your inputs, if you so desire, to see what your break-even earnings estimate will be.

There are three pathways to delivering these break-even earnings:

- If the company continues its current business model of allowing people to try the app for free in the first year and charge them a dollar a year after that (99 cents) and has zero operating costs (completely unrealistic, I know), you would need about 2.5 billion people using the app on a continuing basis.

- It is possible that the app is so good that you could charge more per year and not lose customer. At their existing user base of 450 million, that would translate into about $5/year per user, if you have no costs, and more, if you have costs (which you clearly will).

- The value may be in the form of advertising revenues from Whatsapp’s users but that will be tricky. On the home page for the app, here is what the app’s developers say about advertising:

While they may not be legally bound by this statement, it will be awkward to walk it back and start sending text ads. However, there is a back door that Facebook may be able to user, if they can draw Whatsapp’s users (who tend to be younger) into the Facebook ecosystem and advertise to them there. Whatever the model, though, you would still have to generate at least $2.2 billion in after-tax income from advertising to Whatsapp users to break even.

As an investor, the fact that a significant portion of Whatsapp’s customer is teenagers is terrifying as a business proposition. While it is unfair to generalize based on anecdotal evidence, as the father of four children, two of whom used to be teenagers and two of whom are in the full throes of the disease (with symptoms ranging from extreme self-centeredness to volatile mood swings), it seems to me that the only group that is less dependable (and predictable) than teenagers is a group of teenagers who text a lot.

At this stage, if you are an investor, you have two choices. The first and less damaging one is to accept that social media investing is not your game and move on to other parts of the market, where you can find investments that you can justify with fundamentals. The second is to go from frustration (at being unable to explain the price) to righteous anger or indignation about bubbles, irrationality and short term traders to trading on that anger (selling short). I would strongly recommend that you not go down this path, since it will not only be damaging to your physical health (it is a sure fire way to ulcer and heart attacks) but it may be even more so for your financial health. While you may be right about the value in the long term, the pricing process rules in the near term.

The Trader (Pricing) View

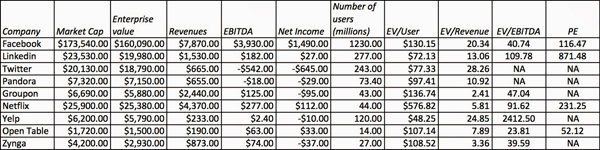

Wearing my trading hat, though, the Facebook acquisition for Whatsapp may not only make complete sense, but it may actually be viewed as a positive. To understand why, I had to change my mindset from thinking about fundamentals (earnings/cashflows, growth and risk) to focusing on what the market is basing its price on. To find that “pricing” variable, I looked at the market prices of social media company, multiple measures of their success/activity and tried to back out the drivers of both price differences and price movements.

(click to enlarge)

These companies have different business models and may even be in different businesses but remember that the pricing game may not be about what you and I (as investors) think makes sense but what traders care about. Though the two (what makes sense and what markets focus on) may sometimes converge, they don’t have to, at least for the moment. My simplistic attempt at making sense of market prices was to look at the correlation between the market’s assessment of corporate values and each of the measures for which I had data:

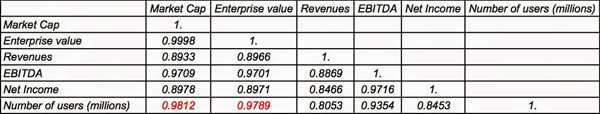

(click to enlarge)

Based on this correlation matrix, here are the conclusions I would draw:

- Number of users is the dominant driver: The key variable in explaining differences in value across companies is the number of users. While the value side of you may be telling you that you cannot pay dividends or buy back stock with users (you need cash flows), remember that the pricing game is not about what you or I think makes sense but what traders care about. This is reinforced by market reactions to earnings announcements, with Zillow seeing its stock price climb 12% when it reported earnings on February 14, 2014, primarily on the news that they added more users than expected and Twitter seeing its stock price drop 25% last week, again primarily on news that the user base grew less than expected.

- User engagement matters: The value per user increases with user engagement. Put different, social media companies that have users who stay on their sites longer are worth more than companies where users don’t spend as much time. While making comparisons across companies is difficult, since each company often has its own “measure” of engagement, there is evidence that markets care about this statistic. For instance, another reason Twitter was punished after its last report was that investors believed that the “timeline views per average user” and the “revenues per 1000 timeline views” reported the company were lower than they had anticipated.

- Predictable revenues are priced higher than more diffuse revenues: Some of the companies on this list derive revenues entirely from advertising, some from a mix of advertising and subscriptions and some from just subscriptions. In fact, some like Zynga make their revenues from retailing (in game purchases). While the sample is too small to draw strong conclusions, the value per user of $577 attached to Netflix’s users suggests that the market values predictable subscription revenues more than uncertain advertising or retail revenue.

- Making money is a secondary concern (at least for the moment): Markets (and investors) are not completely off kilter. There is a correlation between how much a company generates in revenues and its value, and even one between how much money it makes (EBITDA, net income) and value. However, they are less related to value than the number of users.

So, what’s next?

Following in the footsteps of my favorite baseball general manager, Billy Beane, its time to play some Moneyball, where we let the data drive our actions, rather than our intellects. Here is what I take out of these numbers:

- If you are an investor, stop trying to explain price movements on social media companies, using traditional metrics – revenues, operating margins and risk. You will only drive yourself into a frenzy. More important, don’t assume that your rational analysis will determine where the price is going next and act on it and trade on that assumption. In other words, don’t sell short, expecting market vindication for your valuation skills. It won’t come in the short term, may not come in the long term and you may be bankrupt before you are right.

- If you are a trader, play the pricing game and stop deluding yourself into believing that this is about fundamentals. Rather than tell me stories about future earnings at Facebook/Twitter/Linkedin, make your buy/sell recommendation based on the number of users and their intensity, since yhat it what investors are pricing in right now.

- If you are a company and you want to play the pricing game, I think that the key is to find that “pricing variable” that matters and try to deliver the best results you can on that variable.

Returning to the Facebook/Whatsapp deal, it seems to me that Facebook is playing the pricing game, and that recognizing that this is a market that rewards you for having a greater number of more involved users, they have gone after a company (Whatsapp) that delivers on both dimensions. Here is a very simplistic way to see how the deal can play out. Facebook is currently being valued at $170 billion, at about $130/user, given their existing user base of 1.25 billion. If the Whatsapp acquisition increases that user base by 160 million (I know that Whatsapp has 450 million users, but since its revenue options are limited as a standalone app, the value proposition here is in incremental Facebook users), and the market continues to price each user at $130, you will generate an increase in market value of $20.8 billion, higher than the price paid. Are there lots of “ifs” in this deal? Sure, but it does simplify the explanation.

Are there dangers in this deal? Of course! First, it is possible (and perhaps even probable) that the market is over estimating the value of users at social media companies across the board. However, Facebook has buffered the blowback from this problem by paying for the bulk of the deal with its own shares. Thus, if it turns out that a year or two from now that reality brings social media companies back down to earth, Facebook would have overpaid for Whatsapp but the shares it used on the overpayment were also over priced. Second, as social media companies move up the life cycle, the variable(s) that even traders user to price companies will change from number of users/user intensity to revenues, earnings and cash flows. When that happens, there will be a repricing of social media companies, with those that were most successful in turning users into revenues/earnings being priced higher. This, after all, is what happened in an earlier iteration with dot com companies that went from being priced based on website visitors (analogous to number of users) to being priced based on how long those visitors looked at your website (paralleling user intensity) to how much they generated in revenues before settling into earnings. The problem for companies (and investors) is that these transitions happen unpredictably and that markets can shift abruptly from focusing on one variable to another. For Facebook, the path to success with this deal is therefore simple, albeit not easy. Start by trying to attract Whatsapp users to the Facebook ecosystem, and hope and pray that the market’s focus stays on the number of users for the near term. Follow up by trying to monetize these users, with advertising revenue being the obvious front end but perhaps other sources as well.

Closing Thoughts

My experience with markets has been that no one has a monopoly on virtue and good sense and that the hubris that leads to absolute conviction is an invitation for a market take-down. To investors to view deals like the Whatsapp acquisition as evidence of irrational exuberance, remember that there are traders who are laughing their way to the bank, with the profits that they have collected from their social media investments. Similarly, for traders who view fundamentals and valuation as games played by eggheads and academics, recognize that mood and momentum may be the dominant factors driving social media companies right now, but markets are fickle and fundamentals will matter (sooner or later).

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply