Janet Yellen made her first public comments as Federal Reserve Chair in a grueling, nearly day-long, testimony to the House Financial Services Committee. Her testimony made clear that we should expect a high degree of policy continuity. Indeed, she said so explicitly. The taper is still on, but so too is the expectation of near-zero interest rates into 2015. Data will need to get a lot more interesting in one direction or the other for the Fed to alter from its current path.

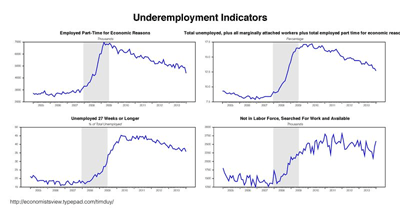

In here testimony, Yellen highlighted recent improvement in the economy, but then turned her attention to ongoing underemployment indicators:

Nevertheless, the recovery in the labor market is far from complete. The unemployment rate is still well above levels that Federal Open Market Committee (FOMC) participants estimate is consistent with maximum sustainable employment. Those out of a job for more than six months continue to make up an unusually large fraction of the unemployed, and the number of people who are working part time but would prefer a full-time job remains very high. These observations underscore the importance of considering more than the unemployment rate when evaluating the condition of the U.S. labor market.

A visual reminder of the issue:

(click to enlarge)

This is a straightforward reminder of the Fed’s view that the unemployment rate overstates improvement in labor markets and thus should be discounted when setting policy. Consequently, policymakers believe they have room to hold interest rates at rock bottom levels for an extended period. To be sure, there are challenges to this view, both internally and externally. For instance, Philadelphia Federal Reserve President Charles Plosser today reiterated his view that asset purchases should end soon and also fretted that the Fed will be behind the curve with respect to interest rates. Via Bloomberg:

“I’m worried that we’re going to be too late” to raise rates, Plosser told reporters after a speech at the University of Delaware in Newark. “I don’t want to chase the market, but we may have to end up having to do that” if investors act on anticipation of higher rates.

That remains a minority view at the Fed. Matthew Boesler at Business Insider points us at UBS economists Drew Matus and Kevin Cummins, who challenge Yellen’s belief that the long-term unemployed will keep a lid on inflation:

We do not view the long-term unemployed as necessarily “ready for work” and therefore believe that their ability to restrain wage pressures is limited. In other words, the unusually high number of long-term unemployed suggests that the natural rate of unemployment has increased. Indeed, when we have tested various unemployment rates’ ability to predict inflation we found that the standard unemployment rate outperforms all other broader measures reported by the Bureau of Labor Statistics. Although we disagree with Yellen regarding the long-term unemployed, our research does suggest that, perhaps unsurprisingly, the number of part-timers does have an impact on restraining inflation.

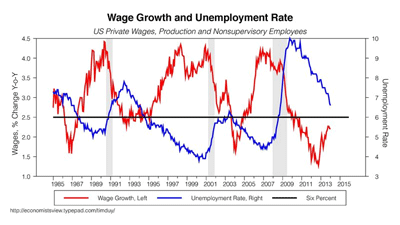

I tend to think that we will not see clarity on this issue until unemployment approaches even nearer to 6%. That level has traditionally been associated with rising wages pressures in the past:

(click to enlarge)

The Fed would likely see a faster pace of wage gains as lending credence to the story that the drop in labor force participation is mostly a structural story. At that point the Fed may begin rethinking the expected path of interest rates, depending on their interest in overshooting. But in the absence of such early signs of inflationary pressures, the Fed will be content to raise rates only gradually.

With regards to monetary policy, Yellen reminds everyone that she helped design the current policy:

Turning to monetary policy, let me emphasize that I expect a great deal of continuity in the FOMC’s approach to monetary policy. I served on the Committee as we formulated our current policy strategy and I strongly support that strategy, which is designed to fulfill the Federal Reserve’s statutory mandate of maximum employment and price stability.

Yellen makes clear that the current pace of tapering is likely to continue:

If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.

Later, during the question and answer period, Yellen does however, open the door for a pause in the taper. Via Pedro DaCosta and Victoria McGrane at the Wall Street Journal:

“I think what would cause the committee to consider a pause is a notable change in the outlook,” Ms. Yellen told lawmakers…

…“I was surprised that the jobs reports in December and January, the pace of job creation, was running under what I had anticipated. But we have to be very careful not to jump to conclusions in interpreting what those reports mean,” Ms. Yellen said. Recent bad weather may have been a drag on economic activity, she added, saying it would take some time to get a true sense of the underlying trend.

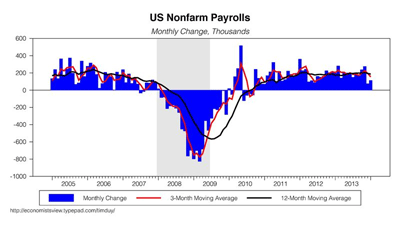

The January employment report was something of a mixed bag, with the unemployment rate edging down further to 6.6% while nonfarm payrolls disappointed again (!!!!) with a meager gain of 113k. That said, I still do not believe this should dramatically alter your perception of the underlying pace of activity. Variance in nonfarm payrolls is the norm, not the exception:

(click to enlarge)

Her disappointment in the numbers raises the possibility – albeit not my central case – that another weak number in the February report could prompt a pause. My baseline case, however, is that even if it was weak, it would not effect the March outcome but instead, if repeated again, the outcome of the subsequent meeting. Remember, the Fed wants to end asset purchases. As long as they believe forward guidance is working, they will hesitate to pause the taper.

Yellen was not deterred by the recent turmoil in emerging markets:

We have been watching closely the recent volatility in global financial markets. Our sense is that at this stage these developments do not pose a substantial risk to the U.S. economic outlook. We will, of course, continue to monitor the situation.

Yellen reiterates the current Evans rule framework for forward guidance, giving no indication that the thresholds are likely to be changed. Jon Hilsenrath at the Wall Street Journal interprets this to mean that when the 6.5% unemployment rate threshold is breached, the Fed will simply switch to qualitative forward guidance. I tend to agree.

Bottom Line: Circumstances have not change sufficiently to prompt the Federal Reserve deviate from the current path of policy.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply