Yesterday I said:

Altogether, the desire to end asset purchases suggests to me that what we have seen so far is insufficient to prompt the Fed to change their plans. That is especially the case if the data does not soften further – if, for example, the next employment report shows a rebound in payroll growth and a further decline in the unemployment rate.

Today we learn via Bloomberg:

“The hurdle ought to remain pretty high for pausing in tapering,” Richmond Fed President Jeffrey Lacker said after a speech today in Winchester, Virginia. Chicago’s Charles Evans said in Detroit that policy makers probably face “a high hurdle to deviate” from $10 billion cuts in monthly bond buying at each of their next several meetings. Evans and Lacker don’t vote on policy this year.

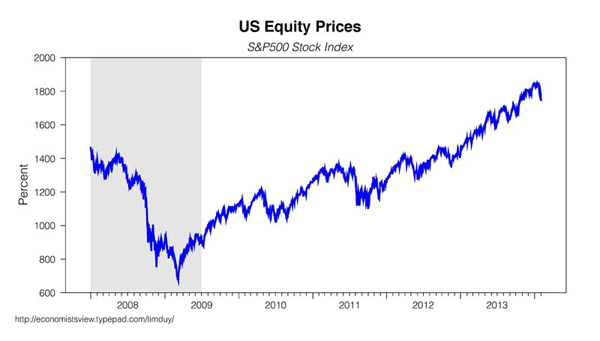

One hawk, one dove, both concluding that the bar to stopping the taper is quite high. Things need to get worse. This just won’t cut it:

Also take note of Jon Hilsenrath’s view via the Wall Street Journal:

Last summer, as U.S. stock prices and emerging markets wobbled, the Federal Reserve was at the center of the turmoil. This time, the Fed might be just a bystander in the stock market selloff and not the proximate cause…

…The market, in short, is now pricing in a much easier Fed, not a tighter Fed. Movements in 10-year Treasury notes are telling the same story. Last summer, 10-year yields were rising because investors saw a tighter Fed. Now they’re falling. Investors seem to be reading a string of soft economic data – weaker car sales, a manufacturing slowdown, disappointing job growth – and concluding the economic coast is not as clear as it appeared just a few weeks ago.

I would suggest that the decline in rates indicates the Fed is too tight, not too easy. Indeed, we would hope that they would only be tapering in the context of a rising interest rate environment as it would suggest that market participants were anticipating higher growth and inflation. But the Fed doesn’t see it that way. They see lower rates as a signal that policy is easier. And hence are not inclined to react to ease policy further by stopping the taper.

Moreover, I don’t think the Fed believes that the end of asset purchases is impacting global markets because they are convinced that tapering is not tightening. If it is tightening, then why should global markets react? And even if it was tightening, the Fed wouldn’t see it as their problem in the first place. (To be sure, you may or may not agree, and I suggest you read Izabella Kaminska, Frances Coppola, and Felix Salmon for further insight into the topic.)

Bottom Line: The Fed isn’t ready to change course. Recent turbulence is enough to peak their curiosity, not enough to suggest that tapering was premature.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply