Government interventions to control capital flows and reduce exchange-rate volatility have long been controversial. The Global Financial Crisis has made the debate more urgent. This column discusses recent research that evaluates such policies against the counterfactual of no intervention. Depreciations and reserve sales can boost GDP growth during crises, but may also substantially increase inflation. Large increases in interest rates and new capital controls are associated with reductions in GDP growth, with no significant effect on inflation. When faced with sudden shifts in capital flows, policymakers must ‘pick their poison’.

In 2010, the Brazilian finance minister Guido Mantenga declared a ‘currency war’ because of the harmful effects of the strengthening of the real. He blamed the currency’s appreciation on easy money in advanced countries, and to a lesser extent on reserve accumulation in some emerging markets. More recently, concerns were raised by slides in the values of the Indian rupee – which lost 18% of its value against the dollar between February and August – and by the fall in the value of the Indonesian rupiah – which has lost almost a quarter of its value against the US dollar in 2013.

The merits of government intervention aimed at mitigating large swings in capital flows and exchange rates have long been debated. Over the past few years, they have again taken on an increased urgency (Blanchard 2013). They will continue to foster debate as major developed economies discuss how and when to normalise monetary policy.

Some worry that countries open to international capital flows are defenceless against appreciations – as in the case of Brazil – or depreciations – as in the case of Indonesia and India (Rey 2013). However, governments have a number of options to respond to large swings in currency values, such as capital controls, adjusting interest rates, managing reserves, or just letting the currency adjust to where markets send it.

For example, Mantega oversaw the imposition of capital controls in 2009 and 2010 in an attempt to limit capital flows into Brazil and raise the value of the real. Raghuram Rajan, the new leader of the Reserve Bank of India, increased the benchmark interest rate two times, coinciding with the 10% strengthening of the rupee since the end of the summer. Indonesia’s central bank, Bank Indonesia, sold almost a fifth of its foreign reserves, although this does not seem to have forestalled the fall in the rupiah.

The counterfactual problem

Of course, we do not know whether the rupiah would have fallen by more had Bank Indonesia not sold reserves, nor whether the recovery of the rupee would have occurred without the increase in interest rates. There is also debate about whether Brazil’s capital controls played a role in the reversal of the real’s appreciation (Klein 2013, Garcia 2013, Forbes et al. 2012). Counterfactuals are notoriously hard to come by in macroeconomic settings.

Even if we knew the effectiveness of these policies, we would also need to consider their other consequences, whether intended or not. For example, even if purchasing reserves accomplished its goal of slowing exchange-rate appreciation and spurring exports, it could also have adverse balance-sheet effects (such as inflating liabilities relative to assets and harming domestic consumers and firms by raising the price of imports). Or, as another example, even if an increase in the interest rate stemmed a depreciation, it could reduce interest-sensitive spending and raise debt burdens.

One could turn to country experiences to understand the efficacy of these policies and their relative costs and benefits. But this approach is fraught with difficulties. One cannot simply compare countries that undertake policies with countries that do not, because country characteristics and underlying conditions are likely to be fundamentally different across these two groups. For example, countries are more likely to have large currency depreciations if they have flexible exchange rates or after a slowdown in GDP growth. Therefore, it would be inappropriate to just compare all countries that had large depreciations with those that did not without accounting for the link between the likelihood of a depreciation and variables such as their exchange-rate regimes and recent GDP growth. In other words, in order to assess the consequences of different policy choices, we need to find appropriate ‘control groups’ to create the counterfactuals for these economies.

One way forward for research

One means to address this issue is through propensity-score matching.1 This statistical technique matches countries and episodes in which a certain policy is undertaken with comparable countries and episodes in which that path is not taken. For example, the technique identifies specific episodes in which there was not a large depreciation, but underlying conditions were similar to those found in countries that did have a large depreciation. We can then compare key outcome variables of interest – such as GDP growth, unemployment, and inflation – in countries that had a large depreciation to the respective outcomes for the matched countries that had a similar profile at a particular moment but did not depreciate.

We used this method to analyse the effect of four different policies that are the primary rapid responses to sudden capital outflows and currency depreciations: large reserve sales, allowing sharp depreciations, major increases in interest rates, and implementing new controls on capital outflows (Forbes and Klein 2013). We looked at the experiences of 85 countries over two crisis periods: 1997 to 2001 (when there were crises in Asia, Russia, and Turkey, amongst others) and 2007 to 2011 (the Global Financial Crisis).

We find that:

- Large currency depreciations and major reserve sales can support GDP growth during crisis periods relative to the counterfactual.

- This growth benefit is lagged by about one year, may come after an initial reduction in GDP growth, and is weaker outside of the set of advanced economies.

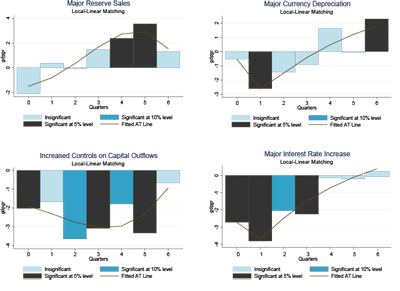

These effects are shown in Figure 1 below. Each bar shows the estimated effect on a country’s GDP growth (relative to the counterfactual) over each quarter from one of the four policy responses (listed at the top). The horizontal axis is reported in event time, with zero denoting the quarter in which the policy was adopted, one denoting the next quarter, and so on up to six quarters after the initial policy response. Most important, the colour of the bar indicates whether any effect is significant: black is significant at the 5% level, medium shading is significant at the 10% level, and the lightest shading is insignificant. The thin line is the fitted ‘average treatment effect’ – basically the effect of the policy smoothed over time.

Figure 1 Effect of Policy Responses on GDP Growth

(click to enlarge)

Source: Selected parts of Figure 2 in Forbes and Klein (2013).

Concluding remarks

Although depreciations and reserve sales can boost GDP growth during crises, these policies (especially depreciations) may also generate a substantial increase in inflation. The other two policies we study – large increases in interest rates and new capital controls – seem to offer even less benefit since they are associated with reductions in GDP growth with no significant effect on inflation.

These estimates suggest that, when faced with challenging crisis periods and sudden shifts in capital flows, policymakers must ‘pick their poison’. No single policy delivers unalloyed benefits, and even for policies that do accomplish certain goals, this is associated with substantial costs and tradeoffs.

References

•Blanchard, O (2013), “Monetary Policy will Never be the Same”, VoxEU.org, 27 November.

•Forbes, K, M Fratzscher, T Kostka, and R Straub (2012), “Bubble Thy Neighbor: Direct and Spillover Effects of Capital Controls”, NBER Working Paper 18052.

•Forbes, K, M Fratzscher, and R Straub (2013), “Capital Controls and Macroprudential Measures: What are They Good For?”, MIT-Sloan Research Paper 5061-13.

•Forbes, K and M Klein (2013), “Pick Your Poison: The Choices and Consequences of Policy Responses to Crises”, MIT-Sloan Research Paper 5062-13.

•Garcia, M (2013), “Brazil: Did inward Capital Controls Work?”, VoxEU.org, 1 March.

•Klein, M W (2013), “Capital Controls: Gates versus Walls”, VoxEU.org, 17 January. http://www.voxeu.org/article/capital-controls-gates-versus-walls

•Rey, H (2013), “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, VoxEU.org, 31 August.

______

1 For a detailed explanation of propensity-score matching, see the Appendix in Forbes et al. (2013).

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply