Another first Friday, another employment report. Although the general expectation is that the Fed holds its currently policy in place, there is speculation that the monetary policymakers could pull the trigger on tapering this month if we see another employment report that could be deemed sufficient to declare the labor recovery “stronger and sustainable.” After all, it is not unreasonable to expect that, after tomorrow, three of the four most recent readings on the labor market revealed job growth in excess of 200k per month.

That said, caution would be warranted before taking an overly optimistic position based on these data. The gains may not be sustainable if US growth slows in the final quarter of the year as expected (indeed, the third quarter spurt is less than meets the eye). Moreover, Fed officials must be somewhat wary of reading too much into the data given the pattern of fall/winter strength seen in recent years. With these considerations in mind, it seems that sufficient certainty to justify tapering would not be evident until late in the first quarter of next year. This assumes, of course, the Fed doesn’t pull a different rabbit out of its hat – progress toward goals or cost/benefit analysis – to justify tapering sooner than anticipated.

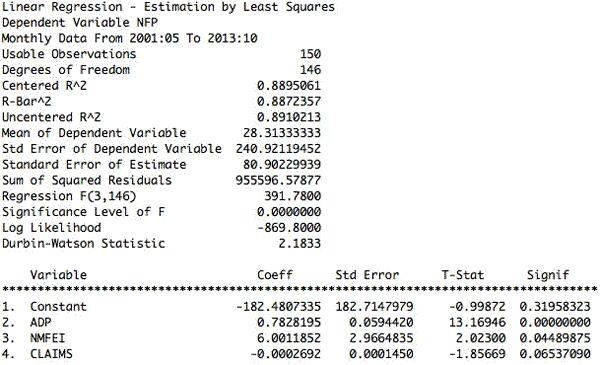

Forecasting the employment report is a notoriously hazardous activity. One quick and dirty method is a regression based on the ADP report, the ISM nonmanufacturing employment Index, and initial unemployment claims:

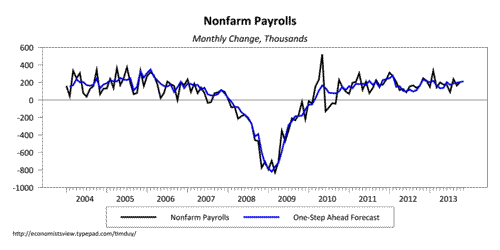

The one-step ahead forecasts since 2004 closely match the actual data:

The model predicts payroll growth of 211k for November, somewhat higher than concensus of 180k. But of course there are still occasions of particularly large errors. And this type of analysis is conditioned on the revised data. Tomorrow we get the preliminary report – the market moving report. It seems that no one cares much if you correctly anticipate the revised data; by the time that is released, the focus is on the next preliminary numbers. Overall, my takeaway is that is that this kind of model tells us that we should expect job growth consistent with that seen in past months. I don’t read much into the specific forecast.

The Fed might be sensitive to the most recent report, which is why fears of imminent tapering will arise if the number surprises strongly to the upside. Still, one number should not make a policy decision. Indeed San Francisco Federal Reserve President John WIlliams seemed to have a relatively high bar for tapering in an interview with Reuter’s Ann Saphir:

As for the Fed’s massive asset-purchase program, Williams said the Fed should only reduce it once it is “completely confident that the economy is on the right track.”

I have difficulty imagining that one number could leave the Federal Reserve “completely confident” about the pace of activity. The Beige Book, for example, gives no hints that the pace of activity has changed much at all. Like October, the economy was described as “modest to moderate” with no inflation to be seen despite continuing concerns about the supply of “qualified workers”:

Hiring showed a modest increase or was unchanged across Districts. Difficulty with finding qualified workers, especially for high-skilled positions, was frequently reported. Upward pressure on wages and overall price inflation were contained. Contacts in many Districts voiced concern about future cost increases attributable to the Affordable Care Act and other types of federal regulation.

I still find talk of tapering frustrating in the context of the FOMC forecast. Inflation is well below target and there is no imminent threat of it accelerating to the 2.5% threshold. Unemployment remains unacceptably high. And their forecasts are likely to show that a return to potential output remains years away. One reason they seem to be focused on tapering is the expectation that the fiscal drag will ease in 2014, thus eliminating the need for QE. But that would seem to be a missed opportunity to give the economy a turbo boost to more quickly meet the Fed’s policy objectives. What exactly is the pressing need to end the asset purchase program?

The need, I still suspect, could be found in the Fed’s double-secret analysis of the costs/efficacy of QE. I would appreciate an entire speech on this topic, complete with a list of specific, quantified costs and benefits so that we can track understand the calculus underlying the Fed decision making.

Until we see that calculus, we need to fall back on the data dependent nature of all the Fed’s programs. And if that data didn’t support tapering in September, I am hard-pressed to say that enough stronger data has arrived to change that decision. I really hope I don’t have to eat those words tomorrow!

In any event, the Fed would like us to shift our attention from tapering to interest rates. Indeed, it very well might be the case that the big tapering market move is behind us, and the Fed can now taper with little implication for financial markets. Thus would set the stage for the sort-of-normalization of policy. Williams was pushing in this direction:

“My view would be that we would not be raising the funds rate even if the unemployment rate was below 6.5 percent as long as inflation continued to be low, for some time,” Williams said. “We need to be communicating more about the post-6.5-percent world now, because it could be with us much sooner than we expect, and I don’t want market participants to be surprised.”

The interview does not indicate that Williams is pushing to change the unemployment threshold. This seems more consistent with my view that the FOMC is more interested in strengthening the “threshold not trigger” language in the statement. What happen’s after the unemployment rate hits 6.5% is going to be interesting; at that point, if they don’t want to change the thresholds, I expect they have to get rid of the thresholds altogether. The unemployment threshold itself would be nonsensical at a 6.4% unemployment rate.

If there are any substantive policy changes in the FOMC, I expect they will be in the nature of the forward guidance. I think they want to confirm they have a firm hold on the short end of the yield before they taper. There is the possibility that they drop the rate of interest on reserves. Williams again:

Williams said he also supported cutting the interest paid to banks on the excess reserves they keep at the central bank as a way to signal the Fed’s commitment to low rates. “I think it would make sense,” he said, although he acknowledged that policymakers have considered, and rejected, the idea several times over the years.

As Williams notes, this idea comes in and out of fashion at the Fed. Policymakers apparently don’t view it as having the potential for a huge boost, but they seem to be viewing it as less risky than previously thought.

Finally, one other thing of note from the William’s interview:

…once the Fed decides the economy is strong enough for the Fed to reduce its $85 billion in monthly bond purchases, it should announce an end date and a purchase total for the program, Williams said.

This follows in the thinking of hawk Philadelphia Fed President Charles Plosser, who argued that the Fed cap the size of the program to enhance it’s credibility (not sure how this works; ultimately credibility is built on meeting the Fed’s objectives, which are not currently in danger, and least in the direction Plosser seems to believe). If this kind of proposal does gain favor, note that it represents a shift from a data dependent policy to another time dependent policy. Once some threshold is reached, the program shifts into automatic. Didn’t the Fed just spend the summer convincing us that policy was not time dependent? Why change now? If they do change, why should we believe the same change will not occur with rate policy? Just food for thought.

Bottom Line: Another month, another employment report. With the fiscal shutdown in the rear-view mirror, Fed officials are turning their attention back to policy normalization. They want to taper, but remain wary of pulling the trigger on tapering too quickly. I tend to believe that, on balance, the FOMC needs to see a few more months of data given the uncertainty about the path of GDP before they were completely comfortable tapering. That said, one can make a reasonably solid argument for tapering if the November employment report adds to the recent string of 200k+ payroll gains. My expectation is that even a positive report will not trigger a taper with month; instead, the statement is most likely to evolve to reflect a new emphasis on forward guidance. But I can’t rule out a tapering surprise.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply