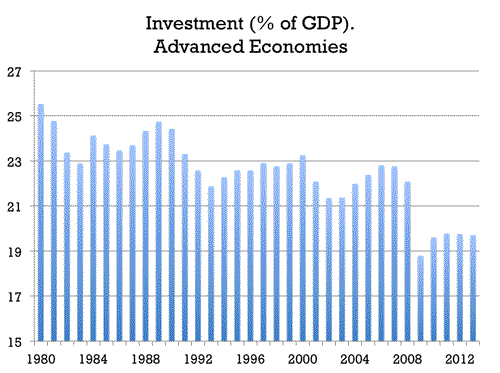

I have written before about the investment dearth that took place in advanced economies at the same time that we witnessed a global saving glut as illustrated in the chart below. In particular, the 2002-2007 expansion saw lower investment rates than any of the previous two expansions.

If one thinks about a simple demand/supply framework using the saving (supply) and investment (demand) curves, this means that the investment curve for these countries must have shifted inwards at the same time that world interest rates were coming down.

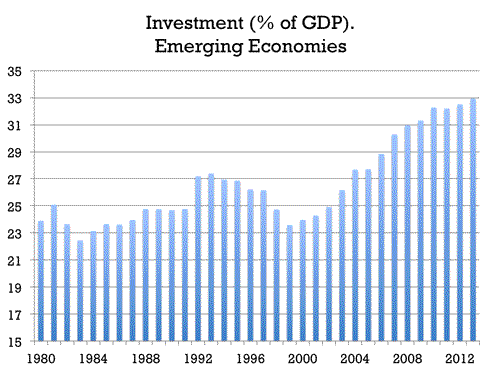

But what about emerging markets? Emerging markets’ investment did not fall during the last 10 years, to the contrary it accelerated very fast after 2000.

This is more what one would expect as a reaction to the global saving glut. The additional saving must be going somewhere (saving must equal investment in the world). As interest rates are coming down, emerging markets engage in more investment (whether this is simply a move along a downward-slopping investment curve or a shift of the investment opportunities for any given level of interest rates is impossible to tell from this simple analysis).

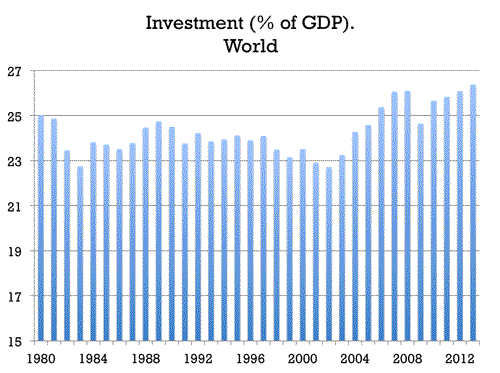

We can also look at the world as whole

Starting in the year 2000 we see a trend towards higher investment driven by emerging markets.

In equilibrium, both saving and investment have to move by the same amount (at the global level) so how do we know that this is a saving glut and not an increase in investment opportunities? The fact that interest rates were declining during these years means that these changes were dominated by an outward shift in the saving curve (if it had been investment shifting we would have seen interest rates increased). The resulting lower interest rates led to higher investment in emerging markets, as expected, but they did not foster any additional investment in advanced economies signaling that there has been a decline in investment opportunities in these countries. Whether this is a sign of a structural weakness that affects the inability of advanced economies to keep innovating at the same rate or purely a reflection of other, possibly cyclical, factors remains an open question.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply