The resale-pricing aspect adopted by Apple’s agency model is highly controversial. Competition authorities fear that it raises retail prices. In the app market, resale pricing reduces prices to stimulate innovation and entrepreneurship. Prices of eBooks, though, increased when Apple entered the industry. This column analyses why this is the case.

Apple (AAPL), Amazon (AMZN) and Google (GOOG) are the major downstream firms in the markets for eBooks and apps. Apple uses the so-called ‘agency’ business model to regulate the vertical relationship in the value chain.

With this model:

- Apple does not pay any unit wholesale prices; instead there is a split, such that the upstream content providers receive 70% of the sales revenue and Apple 30%.

- This 70/30 revenue split is used no matter how large the upstream firms are – Macmillan does not obtain a better deal than a small, insignificant publisher.

- More importantly, the agency model delegates retail pricing to upstream firms.

This resale price maintenance aspect of the model is highly controversial, and competition authorities and others fear that it raises retail prices.

In the eBook market, US antitrust authorities further conjecture that the rapid industry-wide adoption of the agency model after Apple entered the industry was an outcome of tacit collusion among Apple and five major publishers (see e.g. Manne 2013 and Bobelian 2013). It has also been claimed that Amazon de facto was forced by major eBook publishers to change from the traditional wholesale model to the agency model.

While it is obvious that tacit collusion among upstream firms might increase retail prices, it is less clear whether resale pricing per se is anti-competitive in the industries where Apple operates. Indeed, Apple does not always prefer resale prices (though it always uses the 70/30 revenue split). One illustration of this is that when Apple entered the music industry with iTunes, Steve Jobs dictated a retail price of 99 cents per song, leaving no room for the music publishers to influence the price.

In Foros, Kind and Shaffer (2013) we raise the questions of:

- Why powerful firms like Apple cede control of retail pricing to content providers.

- What determines whether we will actually see an industry-wide adoption of the agency model (e.g., that both Apple and Amazon voluntarily will use the agency model for eBooks).

- What the role is for most-favoured nation clauses (MFN) in an industry where one or more downstream firms have adopted the agency model.

Why cede control of retail pricing to content providers?

Content providers are often better informed than retailers about the market potential for their products. In such cases, there might be efficiency gains from letting content providers determine retail prices (Foros, Kind and Hagen 2009). By the same token, more autonomy to content providers may stimulate entrepreneurship and innovation.

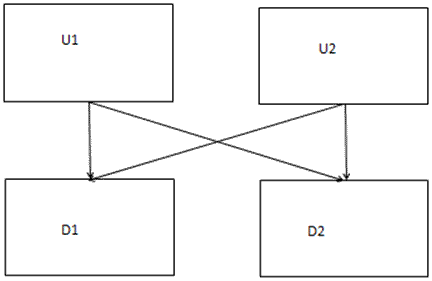

In Foros, Kind and Shaffer (2013) we intentionally abstract from asymmetric information, and fix the number and the quality of the products offered in the market. We set up a model with upstream and downstream competition, as illustrated in Figure 1. For given revenue shares (e.g. the 70/30 rule), we compare the outcome when the downstream firms (platforms like Apple, Amazon and Google) decide retail prices, to a setting where retail prices are decided by the upstream firms (content providers). The latter setting is the agency model.

Figure 1. Upstream firms are content providers like publishers for eBooks and developers of applications in app stores. The downstream firms are platforms like Apple, Google and Amazon

Public debate often gives the impression that resale pricing eliminates competition. This, of course, is incorrect. What resale pricing does do is to shift competition from the downstream level to the upstream level. A reasonable conjecture is, therefore, that the agency model tends to raise prices if and only if the competitive pressure is weaker upstream than downstream. This is formally proved in Foros, Kind and Shaffer (2013). Thus, other things equal, one would expect downstream firms to prefer the agency model when upstream competitive pressure is relatively weak.

In Apple’s App Store and Google’s Google Play there are evidently a large number of small and competing upstream firms (developers of apps). Resale pricing is, therefore, likely to reduce prices – a claim which is consistent with widespread complaints from app developers that low prices push down profits (Boudreau 2012). Consequently, it is hard to argue that ceding control of retail pricing to content providers by platforms like Apple and Google is an anti-competitive act. The motivation for imposing resale prices is presumably to stimulate entrepreneurship, rather than to increase prices.

So what about the eBook market, does the resale pricing mechanism raise prices there? Unlike the app market, in the eBook market we can, to some extent, compare prices with and without such resale pricing. Before Apple entered the market with the iBook store, downstream firms were responsible for determining retail prices, both for printed and digital books. After Apple’s entry, however, there was a rapid industry-wide transition to the agency model during the spring of 2010. And prices did increase!

The US Department of Justice (DOJ) claims that Apple’s motivation for using resale pricing was to stop the low prices set by Amazon for eBooks, described by publishers as “the $9.99 problem”. Compared to the apps market, the upstream eBook market consists of a relatively small number of publishers. Nonetheless, it is not obvious that the competitive pressure is weaker upstream than downstream in this market either, since there are only two major platforms selling eBooks on a global scale – Apple and Amazon (and you cannot readily read an “Apple book” on an Amazon tablet).

So why did prices rise? Presumably because the publishers wanted to protect the profit they earn on printed books. If printed books and eBooks are substitutes, a shift to the agency model might increase prices even if it should be true that eBook upstream competition is tougher than eBook downstream competition. It is thus not resale pricing which leads to price inflation, but rather the fact that the pricing decisions are transferred to firms which have incentives to compete more softly due to the existence of lucrative neighbouring markets with (imperfect) substitutes (see also Abhiskek et al 2013). In the same way, a key motivation behind Amazon’s low-price strategy for eBooks was to increase the sale of their complementary Kindle eBook reader (see Gaudin and White 2013). Jobs’ resistance to endorse Amazon’s low prices indicates that Apple’s analogue motivation (promote sales of iPads) was weaker.

What determines when platforms will adopt the agency model?

During the spring of 2010 there was a rapid industry-wide adoption of the agency model in the eBook market. The US antitrust authorities’ conjecture was that Apple and major publishers pressured Amazon into adopting the agency model. However, Foros, Kind and Shaffer (2013) show that industry-wide adoption of the agency model may arise in equilibrium if this raises industry profits, i.e. if the competitive pressure is lower at the upstream level than at the downstream level. There is one important caveat, though –the downstream firms have incentives to unilaterally deviate from the agency model if upstream competition is sufficiently weak. This might appear as a paradox, since it is precisely when upstream competition is weak that the industry gains from using resale pricing are particularly large. The problem is that the high resale prices give each downstream firm incentive to undercut the rival in order to steal business.

So is there anything Steve Jobs could have done to prevent such a prisoner’s dilemma situation? This is where the Most Favoured Nation (MFN) might enter the picture.

What is the role of Apple’s MFN clause?

When Apple entered the eBook market, it included a retail MFN in its contracts. This MFN clause means that the publishers cannot set higher retail prices at Apple than the retail prices at other downstream firms, regardless of whether the latters’ prices are controlled by the publishers (e.g., the publishers are not allowed to set Apple’s prices higher than Amazon’s prices even if Amazon controls its own prices).

Johnson (2013 a, b) shows that the MFN clause does not affect prices if the agency model is adopted industry-wide. The reason is that retail prices are then solely determined by the competitive pressure upstream. Interestingly, though, Johnson (op cit) shows that an MFN clause increases the bargaining power of the downstream firms, such that they can demand a higher revenue share. This might help to explain why Apple is able to capture 30% of the sales revenue also in the eBook market, even though the average upstream firm in this market is larger, and has a greater bargaining power over Apple than has the average app developer. But since Apple uses the 70/30 rule in all markets, the company’s reputation would possibly allow it to demand 30% in any case. In Foros, Kind and Shaffer (2013) we, thus, hold the downstream firms’ revenue shares fixed, and consider a case where upstream competition is so weak that the prisoner’s dilemma situation described above arises. We subsequently show how MFN might ensure that even if the rival firm (e.g., Amazon) does not adopt the agency model, equilibrium prices will be the same as they would be if both firms adopted the agency model. This has the interesting implication that it was unnecessary to ‘force’Amazon to delegate the pricing decisions to the publishers. With Apple’s MFN, there was simply no reason for Amazon not to adopt the agency model.

References

•Abhishek, V, K Jerath and Z J Zhang (2012), “To Platform Sell or Resell? Channel Structures in Electronic Retailing”, working paper.

•Bobelian, M (2013), “DOJ’s Victory Over Apple May Turn Out To Be A Pyrrhic One”, Forbes.

•Boudreau, K J (2012), “Let a Thousand Flowers Bloom? An Early Look at Large Numbers of Software App Developers and Patterns of Innovation”, Organization Science, forthcoming.

•Department of Justice (DOJ) (2012), “US v. Apple”, Inc. et al, April 11, 2012.

•Foros, Ø, H J Kind and G Shaffer (2013), “Turning the Page for Business Formats for Digital Platforms: Does Apple’s Agency Model Soften Competition?”, CESifo Working Paper Series No. 4362.

![]()

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply