Straight to the chase – the U.S. stock market is overvalued, but not severely so. Prospective 10-year total returns for the S&P 500 are uninspiring, but they have been even more dismal for much of the past decade. Market action in the major indices has been clearly strong, as is breadth, but evidence of robust sponsorship is weak – particularly on the basis of trading volume. Several measures of risk aversion have abated, but have been replaced by exuberant investor sentiment, which has not been as bullish since the 2007 market peak. From the standpoint of typical post-war market cycles, there is little to get excited about, but there also does not seem to be a great deal to complain about either. That is, again, if we assume that this is a typical post-war market cycle.

As I frequently note, we try to align our investment positions based on the return to risk profile that we can expect, on average, given prevailing market conditions. Our dilemma here is this. There are two sets of data from which to draw those averages. One would include ordinary run-of-the-mill economic and market cycles using post-war data from the U.S. alone. The other is broader, and includes market behavior, both in the U.S. and in other countries, following major crashes. Extended economic dislocations were typically required before fundamentals durably improved.

Even giving the two possibilities equal weight is harsh, because as I’ve repeatedly noted, post-crash markets have included advances as large, and larger, than we’ve observed since March, but with devastating follow-through. In the current situation, our only choice is to consider the full data set, because we have no basis – whatsoever – to rule post-crash dynamics out in view of prevailing economic conditions. As a result, as things stand presently, we hold a substantial number of index call options (about 1-2% of Fund assets), but are otherwise hedged. The strike prices and expirations of our index calls currently result in a modest effective exposure to market fluctuations. Those call options are in place primarily to reduce the impact of our hedge in the event of further strength from here – to date, they have largely offset what would have been lagging performance due to our continued lack of holdings in financial stocks.

If we had a reasonable basis to believe that the recent economic downturn was an ordinary run-of-the-mill post-war recession having no lasting structural impact, and believed that the record profit margins observed in 2007 (about 50% above the historical norm) could be recovered and sustained, we would infer an average return/risk profile for the market that is still much less favorable than we have normally observed following bear market lows, but strong enough to warrant the removal of a good portion of our hedges outright, with a willingness to remove another portion of our hedges on market weakness.

On the other hand, using the same essential measures of valuation and market action, but including periods of major economic dislocation into the dataset, produces average return/risk inferences that are substantially less favorable. Indeed, the reason we were somewhat “burned” during the fourth quarter of 2008 is that we expected – too early, in hindsight – a powerful rebound from the extremely oversold conditions we observed, based on normal market behavior. The larger dataset also includes periods of similarly powerful rebounds – but the attempt to participate in them is less appealing due to their lack of predictability as well as their sometimes abrupt and costly endings.

We’ve seen several reasonable analyses of average market performance during, say, the 12-18 month period following the end of a recession, based on U.S. data. On average, post-recession market performance has been good, regardless of initial valuation. The difficulty with those analyses, however, is that they contain a premise that we are unable to take as given – specifically, that we presently have in hand an assurance that the recent downturn is behind us. So yes, if you examine the behavior of the stock market even following the end of the Great Depression, with the benefit of hindsight as to the date the Depression ended, you’ll find that stocks typically did well. But to assume the benefit of hindsight as a premise of one’s analysis strikes me as dangerous. There is no assurance, in my view, that the current economic stabilization we’ve observed is more than an artifact of enormous government spending, or that the underlying structure is invulnerable to a steep double-dip.

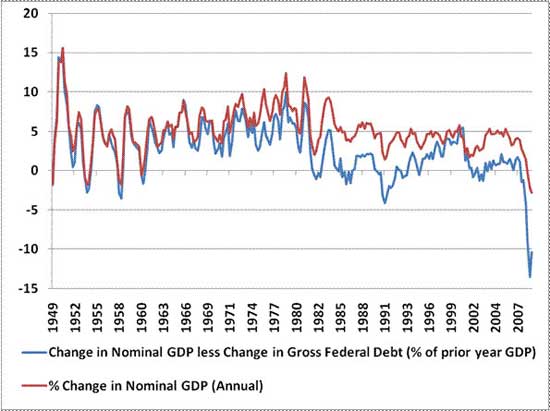

The chart below, for example, presents nominal GDP growth in recent decades, as well as the amount of nominal GDP growth that has occurred over-and-above the amount of new government debt that has been issued. This essentially measures the amount of dollar-GDP growth that has occurred independent of federal deficit spending. You can see that much of the economic performance during the 1980’s and during the period since 2002 has been accompanied by expansion in federal debt, though we did observe fairly strong intrinsic demand during much of the 1990’s.

The present situation is clearly and profoundly different from any post-war period, and was already preceded by weak intrinsic demand. The Treasury has run a deficit in excess of 7% of GDP year-to-date to maintain a still-negative growth in overall GDP. The economic expansion we’ve enjoyed since 2002 has been peculiar in its dependence on debt finance. The same basic story holds if one includes mortgage equity withdrawals and other forms of debt expansion. This will not be an easy situation to solve with an increasing number of homes now “underwater” relative to their outstanding mortgages, and with job losses continuing (above expectations at 570,000 last week).

As John Mauldin noted this week:

“We will be faced with a choice this fall and early next year. If you take away the government spending, the potential for falling back into a recession is quite high, given the underlying weakness in the economy. A few hundred billion for increased and extended unemployment benefits will not be enough to stem the tide.”

My impression is that if the recent downturn had been a standard post-war recession, many elements of market action – such as strong volume sponsorship – would have kicked in very early in the advance, as they historically have. That, coupled with less severe economic problems, might have allowed us to remove a much larger percentage of our hedge, as we did very quickly after the March 2003 low, when we removed 70% of our hedges. Market and economic conditions have not provided that evidence in this instance. So if, in hindsight, our economic difficulties are behind us by now, and we’re off to the races, then it’s clear that our measures missed an uncharacteristically large portion of the initial advance, and our concerns about economic fundamentals will have been misplaced.

On the other hand, if the broader structural problems with the economy – particularly the mortgage market – are still in place, as I believe they are, it is a dangerous leap of faith to assume that the market will be impervious to them and behave as it has during periods when we already know, with the benefit of hindsight, that the recession was over.

In the end, investment decisions here come down to the issue of how much data one wishes to consider. It’s fair to say that investors who take a sustained recovery as given may find themselves frustrated by our defensiveness, and might consider placing some portion of their portfolios in an index fund, which could be of benefit if faith in a recovery proves correct. As conditions stand, I don’t share that view, I don’t advise it, and I can’t do that for you, because I don’t believe that the evidence supports it.

That’s not to say that I will be correct in this instance, but our objective is to outperform our benchmarks (the S&P 500 in the case of the Strategic Growth Fund) over the complete market cycle, with a strong concern for defending capital. I believe that this objective is best served – at present – by continued skepticism that our economic difficulties have now been resolved. My view is not that the market will necessarily plunge or crash – only that the market returns that we presently expect are not substantial enough, relative to the risks involved, to accept more than call option-based exposure to market fluctuations. As always, we will continue to focus on disciplined stock selection underlying our hedged position. The difference in performance between our stocks and the indices we use to hedge has been the primary driver of overall returns in the Strategic Growth Fund since its inception.

Market Climate

As noted above, as of last week, the Market Climate in the stock market was characterized by moderately unfavorable valuations and mixed market action. On a very short-term basis, the market is strenuously overbought. We’re seeing the market sell off for a few days at a time, followed by powerful advances that recover the losses in a single day or two – which is viewed as a sign of resilience, but should also, by now, be familiar to shareholders as one of the signs of an “exhaustion” rally, particularly when it occurs on dull volume.

The Strategic Growth Fund continues to hold index call options representing between 1-2% of Fund value (which is the amount that could be lost in the event of a substantial decline), but with a larger “notional” value, so we would expect to gradually participate in market advances to an increasing degree in the event the market advance continues higher. Because the market is strenuously overbought, I believe that there is significant risk of losing much of the value we hold in these options, but they are in place as an “anti-hedge,” and would “soften” the impact of our existing hedges in the event that the recent advance is sustained.

In bonds, the Market Climate last week was characterized by relatively neutral yield levels and slightly unfavorable yield pressures. Inflation shows no near-term likelihood of resurgence. Any sustained upward pressure on that front is most likely 3-4 years away, despite the enormous increase in the outstanding stock of U.S. government liabilities. Weakness in the exchange value of the U.S. dollar, however, is a more pertinent risk, and the risk of substantial deterioration is increasing, particularly in light of the recent softening in bond yields. We’re not quite at the point where dollar weakness is an immediate concern, but from the perspective of fixed income, foreign currencies, and inflation risks, I would presently identify the dollar as our primary source of concern.

Hussman Funds Disclosure.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

This insurance bundling is the most obscene slap in the face in American history. I really do believe we’re out of options. Congress won’t help us, and the President won’t. We’re at the point now of peaceful civil disobedience. I’m talking forming lines, joining hands, and literally creating a physical barrier (a symbolic one, people could of course still get in)to firms like Goldman and also the Federal Reserve.

We can’t take it any more. The American people are going to have to step forward and dismantle these syndicates with their bare hands.