For some it is clear that the all-time record levels in the stock market are supported by loose monetary and the day policy starts changing, stock markets will suffer a sharp drop. While I also worry about the tendency of stock markets and investors to be overoptimistic, I am less concerned by the fact that we are hitting all-time record levels. First, we keep forgetting that we are talking about nominal variables and they will keep setting record levels as long as inflation remains positive. But I am also less worried because tightening of monetary policy normally happens when growth is picking up so the stock market will have to decide if they like more faster growth than higher interest rates. And the reaction might surprise some.

A historical example that I have mentioned earlier and that I find interesting is the period 1993-1996. In 1993 the recovery from the previous recession was slowly taking shape and the stock market was going up and, yes, setting all-time records. What did the newspaper headlines say at the time and also in anticipation of a future when monetary policy was about to get tighter? A quick search in Google reveals the following headlines:

Whatever else might be wrong with the U.S. economy, the stock and bond markets of Wall Street are thriving on the strength of falling interest rates. Sluggish job growth, subdued consumer spending and worries about how the nation will fare in an increasingly competitive world have not stopped the steady advance of stock prices to record highs. Fort Worth Star-Telegram. August 26, 1993.

Fed Fears a Market Bubble If It Lowers Interest Rates. New York Times, September 16, 1993.

Stocks climb to a record Surge in bonds, lower interest rates are behind it. It was the Dow’s fourth record close this month. The Associated Press, August 20, 1993.

Jump in interest rates sends shiver through bull market. The bull market that carried blue chip stocks to record highs last week may be running out of steam – and the next move could be nasty as small investors try to get out of the market, analysts say. Indeed, there is concern on Wall Street that the record flow of money into stock and bond mutual funds has created a potentially dangerous situation.

Signs of market fragility reappeared Friday when a jump in interest rates on the bond market triggered a selloff in stocks. The Washington Post, May 30, 1993.

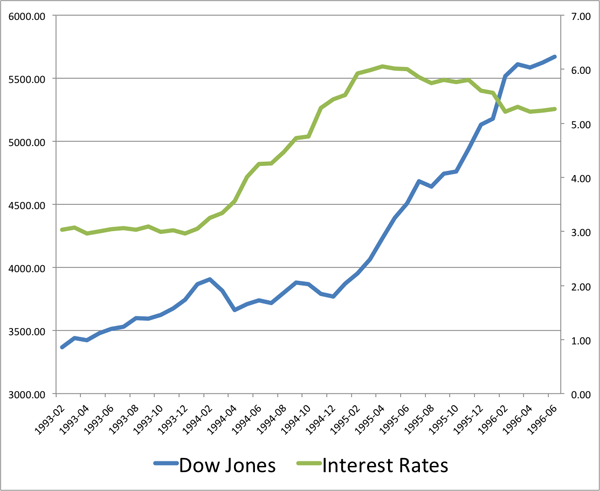

A lot of these headlines look identical to the ones we read today. What happened in that historical episode can be seen in the chart below where I compare the evolution of the interest rate (Fed Funds Rate) with the Dow Jones Index.

As interest rates started increasing towards the end of 1993 the stock market moved sideways (and it fell during some of the quarters). But as of the second quarter of 1994 the stock market recovered, paused towards the end of the year and then started a bull run that would continue for several years. What is interesting is that during 1995 monetary conditions continued to get tighter but the stock market kept booming. [I stopped my chart in 1996 but in the four years that followed the stock market doubled again]

I have no reason to expect the same behavior in the stock market this time (and given what happened after 2000, it might not be a desirable outcome), but these years serve as an illustration of how markets reacted positively to a significant reversal in monetary policy. Initially there was uncertainty and weakness in the stock market but it was later followed by strong optimism even if interest rates kept going up.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply