Fiscal consolidation, and public concern that its pain be fairly spread, is putting tax systems under considerable pressure. This column takes stock of how they have been faring, and how they could do better.

Tax policy, like everything else, has been through tough times since the onset of the crisis. First, tax policy was to stimulate the economy (Heady 2011). Now it is to help consolidate the fiscal position – always with considerable urgency and all in the midst of public anger and disquiet.

What state has all this left our tax systems in? In the latest Fiscal Monitor (IMF 2013), my colleagues and I take a close look.

Advice offered…

Advice on how to go about the revenue side of consolidation (from the IMF 2010, for instance) was pretty straightforward (and predictable).

- Focus on broadening bases before raising rates.

- Rely more on taxing consumption rather than labour, and strengthen property taxes (based on the empirical results of Arnold et al. 2011).

- Exploit opportunities to raise revenue while correcting environmental and other distortions.

In the context of tackling climate change, this would mean carbon pricing. In the financial sector, it would mean bank levies (to address excess leverage by taxing, essentially, wholesale borrowing) and a Financial Activities Tax (on wages and profits) to offset the VAT exemption of financial services.

- For troubled Eurozone countries in particular (as a structural improvement, rather than consolidation), the advice was to consider a ‘fiscal devaluation’.

This meant cutting employers’ social contributions and paying for this by increasing consumption taxes – to gain a temporary improvement in employment and competitiveness (Keen and de Mooij 2012).

…but often ignored

How have the advanced countries done relative to this advice? Not especially well.

- By our count, 14 out of 29 advanced economies have increased their VAT rate since 2010.

- Only eight have undertaken significant base-broadening.

- Ten have increased social contribution rates.

- None has undertaken a significant fiscal devaluation.

- Effective carbon pricing in the major emitters is as remote as ever.

- Discussion of financial sector taxation has been dominated by the (continuing) debate on financial transactions taxation in the EU.

There are exceptions. Portugal, for instance, has managed significant VAT base-broadening. Also, with relatively little fanfare, 13 or so countries have adopted bank levies – with emerging evidence that these have had a notable impact on bank leverage (Devereux et al. 2013). Overall, however, the advice has been honoured largely in the breach.

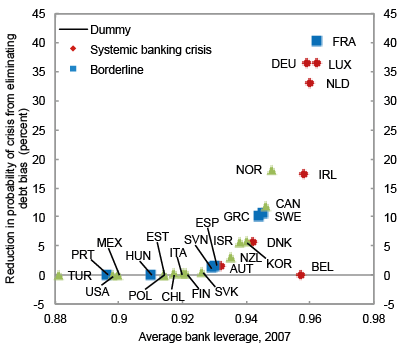

It could be that the advice was wrong. In several respects, however, the more recent evidence suggests it was right. One set of results in the Monitor, for instance, suggests that increasing reliance on the VAT by broadening its base rather than increasing its rate really is better for growth. Furthermore, de Mooij et al. (2013) find that the tax bias encouraging high leverage in the banking sector (by allowing interest paid, but not the costs of equity, as a deduction) have large effects on the probability of a banking crisis (Figure 1), with correspondingly large welfare gains from reducing it.

Figure 1. Eliminating debt bias makes banking crises less likely

Source: IMF (2013), using results in de Mooij et al. (2013). The identification of ‘systemic’ and ‘borderline’ banking crises is that of Laeven and Valencia (2010).

Note: Average bank leverage ratio defined as the ratio of total leverage to total assets.

Worrying about the rich

Concern that the better-off bear their fair share of the fiscal pain has been a pervasive feature of public debates on tax policies. Starting with the backlash against the financial sector, and now with anger at the tax avoidance of multinationals, this may not be as well articulated as public finance theorists would like. (It is not obvious, for example, precisely who benefits from low effective rates of corporate tax; shareholders, including through pension funds, are not necessarily rich and there is evidence that some of the benefit of low corporate taxes is passed to workers). But this backlash is a reality, and the fact of a substantial increase in inequality (especially in Anglo-Saxon countries, and especially for the top 1%) is well known.

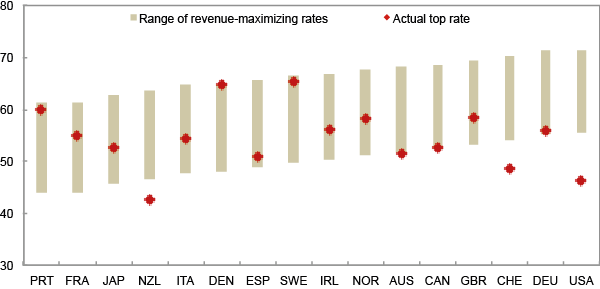

Tax systems, on the other hand, have become steadily less progressive over the last three decades or so, and whether the rich could pay more has become a centerpiece of academic and public debates. Saez (2001) provides an elegant methodology for answering this question, focused on whether or not the elasticity of taxable income – the responsiveness of the tax base to (one minus) the effective tax rate (whether through reduced earnings or increased avoidance and evasion) – is sufficiently low that raising the top marginal rate would increase revenue. Combining estimates of this elasticity with survey information on the distribution of income in a range of countries, analysis in the Monitor suggests that in most cases current rates are likely below revenue-maximising levels (Figure 2).

Whether this implies that top rates should be raised depends on the social marginal value one puts on the welfare of the better-off relative to that of everyone else. The Monitor provides a way of thinking about this by inferring what that relative weight must be if the current top marginal rate is appropriate – anyone who thinks that weight is too high would think the current rate too low.

Figure 2. Actual versus revenue-maximising top rates

Source: IMF (2013).

Note: The actual marginal rate here is the highest federal plus subnational statutory personal income tax rate, social contributions (taking account of any cap on the latter), and the value-added tax.

All this is, of course, contentious. Mertens (2013), for example, addressing the issue more in the macro tradition (of structural vector auto regressions), finds much higher elasticities of taxable income. Even more contentious is the possibility of making greater use of taxes on wealth and wealth transfers. These have been on the way out, but that too may be changing – both Ireland and Spain have introduced taxes of this kind (temporary, but temporary taxes have a way of becoming permanent). Their revenue potential looks significant, given the high wealth-income ratios in many countries (Piketty and Zucman 2013) – in the order of 1% of GDP for a tax on the wealth of the top 10%. Experience is not encouraging, as such taxes have usually been riddled with exemptions and undermined by the mobility of the rich and their assets. On the latter, however, movement towards strong exchange of information between national tax authorities may hold the prospect of, ultimately, real improvement in making such taxes effective.

Doing better

Of course there is much about tax policy that we do not know – not least, despite impressive recent analytical advances, on both the wisdom and practicality of markedly increasing progressivity. What is clear, however, is that there is scope to do better, and that the state of many countries’ tax systems needs close review if they are to effectively address the challenges that are still ahead.

References

•Arnold, Jens, Bert Brys, Christopher Heady, Åsa Johansson, Cyrille Schwellnus, and Laura Vartia (2011), “Tax Policy for Economic Recovery and Growth,” Economic Journal 121: 59–80.

•De Mooij, Ruud and Michael Keen (2012), “Fiscal devaluation as a cure for Eurozone ills – Could it work?”, VoxEU.org, 6 April.

•De Mooij, R, M Keen, and M Orihara (2013), “Taxation, Bank Leverage and Financial Crises,” in Taxation and Regulation of the Financial Sector, ed. R de Mooij and G Nicodeme (forthcoming, Cambridge, MA: MIT Press).

•Devereux, M, N Johannesen and J Vella (2013), “Can Taxes Tame the Banks? Capital Structure Responses to the Post-Crisis Bank Levies”, mimeo, Centre for Business Taxation, University of Oxford.

•Heady, C (2011), “Tax policy to aid recovery and growth”, VoxEU.org, 14 March.

•International Monetary Fund (2010), “From Stimulus to Consolidation: Revenue and Expenditure Policies in Advanced and Emerging Economies”.

•International Monetary Fund (2013), “Taxing Times,” Fiscal Monitor.

•Mertens, K (2013), “Marginal Tax Rates and Income: New Time Series Evidence,” NBER Working Paper No. 19171.

•Piketty, T and G Zucman (2013), “Rising wealth-to-income ratios, inequality, and growth”, VoxEU.org, 26 September.

•Saez, E (2001), “Using Elasticities to Derive Optimal Income Tax Rates”, Review of Economic Studies 68(1): 205–29.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply