Are you a highly educated “economist” like Congressman Pete Stark?

[video1]UjbPZAMked0[/video1]If you’ve been “highly trained” then the odds are that your mind has been simply programmed full of misconceptions, half truths, bad math, lies, and marketing manipulations.

Perusing the latest reports at the St. Louis Fed I came up with this just released and very fine tax payer funded work titled, “What Happened to the U.S. Stock Market? Accounting for the Last 50 Years.” Please take the time to read and fully comprehend the revolutionary understanding of the markets the authors have created:

– – –

– – –

I unofficially title this paper, “Huh?” or perhaps it should simply be titled, “Send in the Clowns?”

Let’s look at their hypothesis:

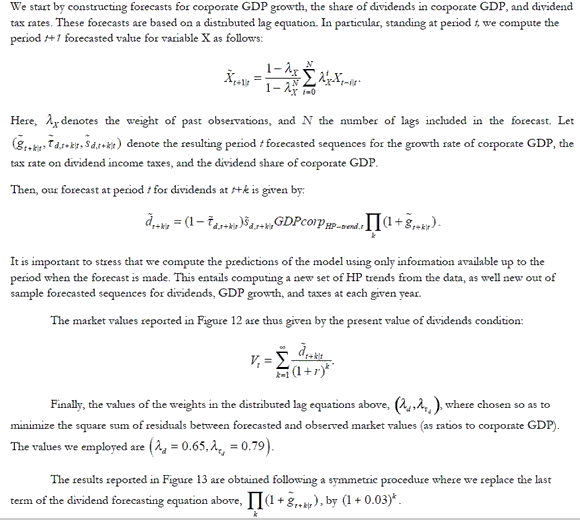

They go on to talk about market valuation in comparison to GDP and dividends, searching in vein to try to find some reason why, oh why, they cannot find any indicator that fits what they call “PERFECT FORESIGHT.” LOL, you could not make this stuff up if you were paid $85,000 or more per year of taxpayer dollars to make economic forecasts for the government! Ooops.

Poor Michele Boldrin and Adrian Peralta-Alva. They have been led astray by their “high” education, why just look at what their minds are forced to comprehend:

You did catch all that, right? Work of pure genius. I find that their very last run-on sentence of their last summary paragraph pretty much sums up their sterling paper (it’s safe to assume their work is pretty typical of the “economist’s” forecasts that have been so “accurate” in the past):

“Apart from the obvious question of what, other than wisdom after the fact, may justify or explain the particular choice of forecasting rule made by market participants, our analysis leaves open an important puzzle: the value of corporations should equal the value of their tangible and intangible assets, while in the data the two series seem to be negatively correlated and persistently apart from each other.

Ah, ha! “…our analysis leaves open an important puzzle,” is, I think, really all you can get out this government sponsored work.

Not once did their thesis mention the word “DEBT.” Not once did they try to correlate the expansion of credit with the expansion of stock prices. Not once did they mention that of the original DOW Industrials, only one stock is still listed today and that had you bought those stocks and held “for the long term” that you would not only NOT be a millionaire, but you would actually be flat broke and busted because businesses have a life cycle too and they DIE (or are supposed to naturally). Nowhere do they mention the underlying currency and what is occurring with the INSOLVENT central banks. Nor do they mention the fact that the politicians have been bought and paid for by those same central bankers who also control the military industrial complex and the media.

No, this report shows clearly that most economists are focused clearly one little FICTITIOUS tree. Then they try to describe the tree with math, yet they fail to ever take out their calculator add up all the debts – personal, corporate, and government on all levels – and THEN SIMPLY COMPARE ALL THAT DEBT TO INCOME.

But Mr. Stark will ask, “How many years did you spend studying economics?” And, “What graduate school did you attend?”

No where did this report talk about the purpose of markets, the advent and the role of high frequency trading or “dark pools,” the rule of law, the flow of capital, the velocity of money, DEBT saturation… and yet they believe they are going to find “perfect foresight” in regards to the market.

It would be really funny if it weren’t so sad. But that paper, and nearly every one like it, should answer the question for you of why so many economists simply get it all wrong – garbage in = garbage out.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply