Five years into the crisis and the Fed still has not adopted a nominal GDP level target. At least we can take solace in the fact that the Fed now has an explicit inflation target, right? After all, the Fed stated it was serious about its new 2% inflation target when announced in January, 2012:

The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. Communicating this inflation goal clearly to the public helps keep longer-term inflation expectations firmly anchored, thereby fostering price stability and enhancing the Committee’s ability to promote maximum employment in the face of significant economic disturbances.

Now an inflation target can be problematic if there are large and frequent supply shocks, but if we are in a slump that is largely the result of demand shocks this target should be good news. It should hold the Fed’s feet to the fire–more so than when it was implicitly targeting inflation–and force it to do all the wonderful things promised in the paragraph above.

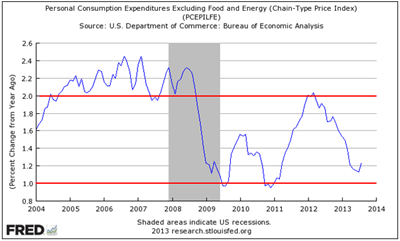

So let’s see how the Fed has done by its own standard of targeting 2% PCE core inflation:

(click to enlarge)

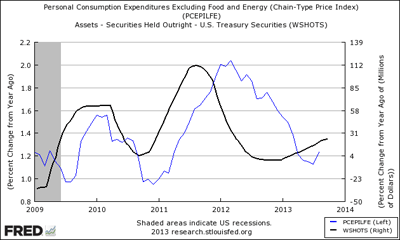

This is not what the Fed promised with its new inflation target. Instead of gravitating around an average 2% inflation target, the Fed seems to have made 2% an upper bound. And the lower bound appears to be around 1%. This band seems to have been operational since the crisis began. It also appears that the Fed’s purchases of treasury securities are closely tied to subsequent changes in the inflation rate as seen below. Maybe the apparent make-it-up-as-we-go-along nature of the QE programs was not so ad-hoc after all. Maybe they always have been tied to keeping PCE core inflation in this band.

(click to enlarge)

Just this week Justin Wolfers noted that the PCE deflator declined this past quarter. He wondered how the Fed could allow this to happen if it had a 2% inflation target. The answer, it seems, is the Fed is targeting an inflation band with 2% as the upper bound.This is a point Ryan Avent has been making for some time. Here he is back in April, 2012:

The Fed’s second failure is to treat the 2% figure as a ceiling rather than a target…The Fed’s preferred inflation measure—core PCE inflation—remains below 2%; core PCE was 1.9% year-on-year in February, in which month it increased at a 1.6% annual rate. Inflation expectations have been stable to falling since then.

Perhaps more telling, the Fed gives a range for projected inflation over the next three years with 2% as the upper extent. If the Fed does indeed have a symmetric approach to the target, as Mr Bernanke asserted yesterday, one would expect 2% to be at the middle of the range, not the top. This is particularly damning as the Fed’s estimate of the natural rate of unemployment doesn’t appear at all in the projected unemployment-rate range over the next three years; the closest the Fed comes to meeting that side of the mandate is in 2014, when the bottom end of the projected unemployment-rate range gets within 0.7 percentage points of the top end of the natural-rate range.

The Fed isn’t just failing on the guideposts set by economists like Paul Krugman, Kenneth Rogoff, Greg Mankiw and, yes, Ben Bernanke. It’s failing on the terms it sets for itself. Consistently.

So exactly what has changed with the Fed’s new inflation target? Other than creating more confusion, nothing. And the Fed seems to be getting really good at creating confusion as evidenced by the no taper fiasco. This has to stop. We need monetary policy that will respond in a predictable, systematic way conditional on the state of the economy. Right now the Fed is not doing that.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply