The last few days have been filled with reminders for me of both the destructive and the redemptive powers of life. The weekend started with a family outing to a Yankee game. As a fan, it was wrenching to see Mariano Rivera and Andy Petite, two players who I have watched for almost two decades, pitch for the final time in Yankee stadium, but it was redeemed at least partially by a young Yankee pitcher, Ivan Nova, pitching a complete game on Saturday. Yesterday was my birthday, a joyous day marred only by the realization that putting as many candles on the cake as my age merited would likely set off fire alarms. Before I could feel sorry for myself, though, my eighteen-year old daughter, a freshman in college, called, exhilarated about getting a hundred on her first college exam. Towards the end of the day, the story that Blackberry (BBRY) had an offer to be taken private by Fairfax Financial for $4.7 billion crossed the newswires, an occasion for mourning not just by longtime Blackberry users but for anyone who appreciates life changing technologies, but that story was accompanied by one from Apple (AAPL), announcing that the company had sold nine million iPhones over the weekend.

A Life Cycle view of Business

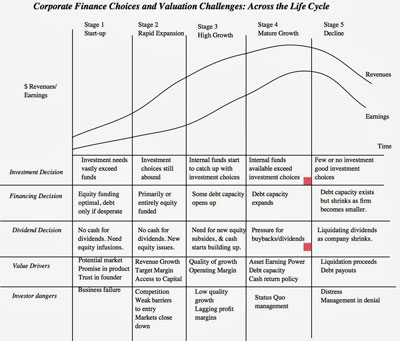

A Chinese saying, that we are all born, grow old, get sick and the die (生, 老, 病, 死 ), which provides an unvarnished assessment of the cycle of human life, can be extended to businesses as well. Businesses too are born, grow with vigor, mature, decline and die; some, of course, die early and never see growth and some live longer, more productive lives. If the fundamentals of corporate finance can be boiled down to a investment choices of a business (the investment decision), how those choices are financed (the financing decision) and how and when cash is returned to the owners of businesses (the dividend decision), those decisions can be framed in terms of the business life cycle:

(click to enlarge)

The business life cycle also shapes how we approach valuation, with the principles not changing, but the focus shifting at each stage of the cycle. When valuing young, growth companies, the drivers of value are almost invariably in the investment choices that the company makes and the effects of those choices on both growth and profitability. Thus, with Tesla (TSLA) and Facebook (FB), it is the revenue growth and target operating margins that determine value and not how much debt they have in their capital structure or how much they pay in dividends. When valuing mature companies, the focus in valuation changes to valuing existing assets (and their earning power) and to the effects on value of better financing and dividend choices. Thus, for Apple, as much of the discussion of value is focused on whether the company will gain from its use of debt and buying back stock as it is on the future growth of the company. When valuing declining companies, the focus is on winding down portions of existing businesses, while repaying debt due and returning as much cash as possible, in a timely fashion, to stockholders. In my December 2011 post on Blackberry, I estimated a value of about $ 9 billion for the company, on the assumption that the best course for the firm was to narrow its focus to a niche product (I called it the Blackberry Boring, a phone for security-conscious corporates that would prevent games, apps or other distractions from getting in the way of employees checking their email) and liquidate itself over time (five years) in an orderly fashion. I followed up by looking at Blackberry and Nokia (NOK) as potential contrarian plays in June 2012, but luckily, I went with Nokia as my pick. That option play paid off partially because Nokia recovered from its lows but the big payoff came, ironically, when Microsoft bought them early this month.

Reactions to Decline: Anger, Denial and Acceptance

If aging is part of being human, it is just as human to fight aging and businesses seem to follow the same script. Rather than accept maturation and decline as inevitable parts of the business life cycle, businesses seem to go through their version of the stages of grief, starting with anger (at markets), denial (about being mature or in decline) and final acceptance.

Stage 1: Anger

When growth companies transition to becoming mature companies, the market responds by lowering the multiples that they are willing to pay for earnings and some investors demand that the company behave like a mature company, borrowing more and returning more cash to its stockholders (in dividends and buybacks). In many of these companies, managers respond first by accusing markets (and by extension, their own investors) of being short term and ignorant of the facts. While that characterization may fit some (or even many) investors, it still remains true that markets are often more perceptive than managers are.

Stage 2: Denial

Managers, angry at investors for treating their companies as mature or declining, make it their mission to prove the world wrong by going for more growth, and in the process, often do further damage to themselves and their investors. The impetus to fight maturation and decline is fed by four factors:

- The emotional connection: In the midst of the Second World War, when it was clear that Britain could no longer hold on to its far flung colonies, Winston Churchill was quoted as saying that “I have not become the King’s First Minister in order to preside over the liquidation of the British Empire.” Many managers at iconic companies that have fallen into decline tend to go along with this sentiment, especially if (like Churchill) they were involved in building up the companies in the first place. That explains why a Michael Dell would leave a comfortable retirement in 2007 to return to his namesake company as CEO, in a futile attempt to turn the company around.

- Fountain of youth ecosystem: Just as there is a lucrative ecosystem that makes money of the desire to stay young (cosmetic surgery, magic supplements, hair transplants etc.), there is an even more lucrative ecosystem of bankers, consultants and turnaround experts who promise mature and declining companies that they will lead them back to everlasting growth. They play to management egos and offer them hope, while eating through billions of dollars of stockholder money, with little to show for it.

- Analyst Growth Obsession: Many equity research analysts are obsessed with earnings growth, judging companies on how much they grow rather than on how much value that growth adds. Thus, a declining company that invests badly to grow at a low rate is viewed as better than a declining company that shrinks, while paying out large dividends. Not surprisingly, managers feel the need to feed this obsession for growth.

- The PR problem: If your business is declining and your growth prospects don’t look good, the right thing for you to do as a top management is to accept that reality, convey it to your employees and start shrinking the business. However, that is not painless and people will lose jobs, employees will see their paychecks shrink and customers will lose their favorite products. If you are in the public eye, you (as the CEO) will be labeled a Scrooge or worse. It is no wonder, therefore, that companies that are serious about facing up to decline prefer to do so as private businesses rather than as public companies.

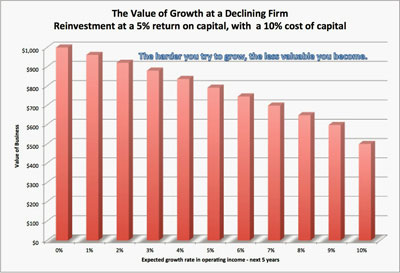

While denial is understandable, it is also costly to investors. As I have noted in a prior post, growth can be value destructive, if it is expensive. In fact, to illustrate the effects of “value destroying” growth, I have taken a base case of a mature company, with no growth prospects and $100 million in after-tax earnings that pays out its entire earnings as cash flows. If you attach a cost of capital of 10% for this company, its value is $ 1 billion (=$100 million/.10). Now assume that the managers of this company decide to push for growth, though that growth requires them to invest immense amounts of capital (in acquisitions, R&D and new projects) with a return on capital of 5%. In the figure below, I have the value of the company at different growth rates.

(click to enlarge)

You can consider the difference between $1 billion and the estimated value of a company at any given growth rate to be the cost of denial to investors in the company. Thus, at a 5% expected growth rate, the value of the company is $792.47 million and the cost of denial by managers (and for stockholders) is $207.53 million. (You can play with the spreadsheet by clicking here).

This analysis should open investors eyes to a clear and an ever-present danger when investing in mature and declining companies that look cheap (on a value basis or even based on a PE or PBV ratio). Those companies are cheap, only if their managers don’t try too hard. In fact, the more activity there is on the part of management to “fix” the growth problem, the less cheap the companies become. To me, this is the key to understanding “value traps”, companies that look cheap on every metric but stay cheap forever. To offer you three examples, consider Cisco, Microsoft and Merck’s stock prices over the last decade:

(click to enlarge)

These are companies that I have seen tagged as cheap companies repeatedly over the last ten years, but none of them would have delivered much in terms of returns. These three companies had management teams that have tried hard to return them to growth status, spending billions of dollars in that venture: Merck in R&D, Cisco on acquisitions and Microsoft on “new” products. I know that I have the benefit of hindsight here, but I would wager that investors in these companies would have been better served, if they had lowered their sights on growth and focused on delivering the most earnings from existing investments and returning the cash back to stockholders.

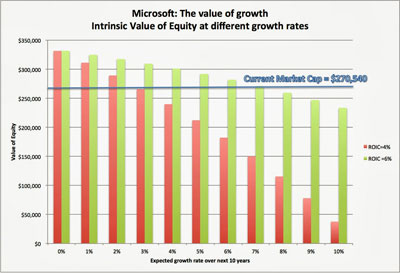

I decided to take a shot at valuing Microsoft by breaking it down into the value of assets in place (Microsoft Office and Windows, for the most part) and expected value of growth. In the fiscal year ended June 30, 2013, Microsoft reported $26,764 million in pre-tax operating income on revenues of $77,849 million; revenues increased by 5.60% over the previous year but operating income was down 4.26%. Using the company’s effective tax rate of 19.2% for the year and attaching a cost of capital of 8% to the company (in the 60th percentile of US companies), you can value Microsoft (MSFT) assuming no growth in the future:

Value of assets in place (with no growth, no reinvestment) = $26,764 (1-.192)/ .08 = $270,316 million

Adding their cash balance of $ $77,022 million on June 30 to this value and subtracting out the debt outstanding of $15,600 million yields an estimated value of equity of $331,738 million, about $61,198 million higher than the market cap of $270,540 million. Put briefly, assuming no growth in earnings, Microsoft is worth about 22% more than its market capitalization. You can take give the spreadsheet a try, if you are so inclined. (I know that I may be overstating the value of assets in place by assuming that Office and Windows will generate earnings in perpetuity, but using a fifteen-year annuity yields a value close to the market price.)

It is no wonder then that Microsoft keeps looking cheap using all the standard metrics (PE, EV/EBITDA etc,) but there may be a core problem that we are ignoring. For most of the last twenty years, Microsoft has spent billions on new technologies and products and has little to show for it. While it is difficult to isolate the return on capital on just these new investments, it is quite clear that it has been less than the cost of capital. I think I am being generous to Microsoft in assuming that its’ new ventures have earned an average return on capital of 6%, but with that assumption, it is quite clear that if Microsoft continues to keep trying for growth, it will be value destructive, as shown in the figure below:

(click to enlarge)

The intrinsic value of Microsoft drops with every increment in growth and at a growth rate of 7% for the next decade, the intrinsic value converges on the actual market price. This may explain the horrific reaction that the market had to Microsoft’s announcement that it would acquire Nokia for $7.2 billion, and Microsoft’s market capitalization dropped by more than $15 billion. It may not have been the acquisition per se that triggered the drop off but the signal that it sent to investors that Microsoft with its new CEO (from Nokia) would keep trying to grow. The best news, if you buy int this analysis and you are a Microsoft investor, would be an announcement by the firm that they are disbanding their R&D department, stopping all new product development and appointing Larry the Liquidator as their new CEO.

Stage 3: Acceptance

Ultimately, no matter how hard you fight aging, reality sets in. For individuals fighting middle age, the moment of awakening may be a torn muscle from trying to run a fast break on a basketball court, but for businesses, it may take a longer time. In some cases, it may require pressure from activist investors and in some, a new top management who has no emotional connection to the company’s history. In some, though, it will be forced upon the business by external factors, difficulty making a debt payment or an inability to retain employees.

What form will acceptance take? If the business is mature, it will start behaving like a mature firm, tilting its capital structure towards more debt and increasing cash returned to investors. For many followers of Apple, that capitulation seemed to happen in their March earnings report, where the company ratcheted down its forecasted growth, announced its first debt issue and increased its stock buybacks.

If the business is in decline, it may be the acceptance that the future will not only be less rosy than the past but also a plan for gradual or partial liquidation. That, to me, seems to be the message in the proposed Blackberry deal. Fairfax Financial is the largest stockholder in Blackberry and its chief executive, Prem Watsa, has been labeled the “Canadian Buffet”. His plans seem to be to focus on Blackberry’s business services and to throw in the towel on the smartphone and tablet businesses. Will he succeed? I hope so but I think he has his work cut out for him. The company has done significant damage to its orderly liquidation prospects in the two years since my last valuation and it may be too late to turn this ship around.

It’s really not too bad

On a personal note, I am older today than I was yesterday but given the alternative, I am okay with that. I really don’t want to be eighteen, twenty three or twenty five again, not because those were not great years, but so was my most recent year. I could tell you that I know more today than I did three decades ago, but that is really not true, but I do know more about what I don’t know today than I did three decades ago (if that makes any sense). Keeping with the theme of this post, I know that my Tesla/Facebook days are way in my past (I am not sure that I had them), that my Google days are in my rearview mirror, that I am probably in the Apple days of my existence (which is really not too bad) and that I will one day be in my Blackberry/Microsoft phase of life. I can only pray that when that phase arrives, I will have the grace to do an orderly winding down of my activities and not keep reaching back in time for the glory of bygone days. In the meantime, I will get my revenge on time by using it as productively as I can.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply