Here we go again, right?

If you’re cynical, you’re not alone.

Our reaction? Caution flag!

Anyone remember Facebook (FB)?

When the stock went public on May 18, 2012, it opened at $42.05. Giddy investors who piled in then saw shares slump to under $20 just three months later. Only in the past couple of weeks has the stock returned to its IPO level.

Lesson learned? No chance.

Expect to see the same stampede with Twitter. Why?

Because investing directly in an IPO is your classic “get rich quick” scenario. Like moths to a flame, investors are drawn to a big IPO’s appeal… only to inevitably get burned.

The truth is, investing in an IPO stock can prove dangerous if you don’t know what to look for, or haven’t done enough research (which is at least double the usual amount required).

But guess what? There’s a simple way to get involved in Twitter’s IPO action without enduring the usual volatility and single-stock “lose your shirt” risk that comes with a Wall Street launch. Here’s how…

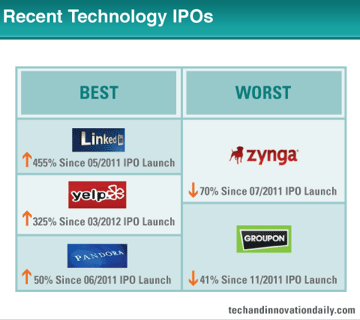

In recent years, we’ve seen varying degrees of success for tech IPOs in the social media field.

On the one hand, stocks like LinkedIn (LNKD), Yelp (YELP) and Pandora (P) have surged since their IPOs. But heavily hyped stocks like Groupon (GRPN) and Zynga (ZNGA) have flopped.

The question is: How do you position yourself for any upside while at the same time guarding against another potential social media massacre?

Well, when it comes to playing the Twitter IPO, just like apps, there’s an ETF for that. And there are a few that give you various degrees of exposure.

In this case, one fund has already confirmed its stake in Twitter — the Global X Social Media ETF (SOCL).

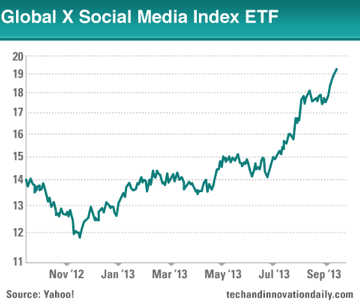

When the ETF started in 2011, some analysts scoffed and labeled it a gimmick. But they’re eating their words now…

As you can see, SOCL has enjoyed some solid momentum this year, with investors warming to social media stocks. It’s seen a bounce in the wake of Twitter’s IPO announcement and is now trading just shy of its 52-week-high.

In fact, while SOCL is still a relatively small fund, with only $25 million in assets, it’s attracted $10 million over the last few months.

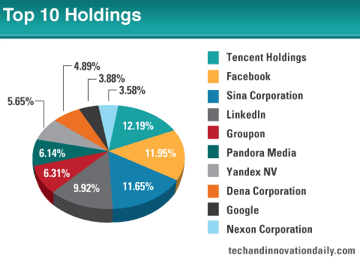

The fund allocates all its assets to stocks, but diversifies between U.S. and foreign companies. For example, 12% of the fund is invested in Facebook, which is a virtually identical holding to leading Chinese social media companies like Tencent Holdings (TCEHY) and Sina Corp. (SINA).

Given the breakdown of SOCL’s current holdings, it’s reasonable to assume that Twitter would hold a high single-digit weighting in the fund. That would be enough to move the needle on this ETF.

However, if you’re not keen on owning that much of the social media sub-sector, there are other options…

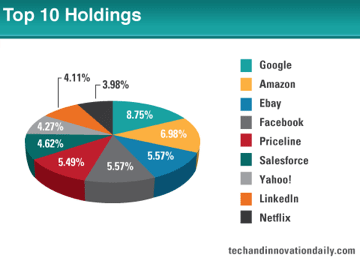

For example, if you want broader exposure to the Internet area, check out the First Trust DJ Internet Index Fund (FDN).

It’s the heavyweight champ of Internet stocks, with its assets well distributed between several major Internet companies.

While nothing is confirmed yet, FDN will probably make Twitter a top-10 position in its portfolio, too, with a weighting between 4% and 8%.

Consider FDN if you’re looking for an ETF that be influenced by a volatile Twitter IPO, but also gives you more downside protection from the broader Internet sector.

There’s a similar sense of anticipation and speculation over the Twitter IPO as there was with Facebook, Groupon, Zynga and others. And it will continue all the way through to the company’s eventual IPO.

That means if you want to play the potential upside, it’s imperative that you build in some downside protection, too. Consider these two ETFs as a way of avoiding the IPO madness and single-stock risk.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply