The idea that policy uncertainty is the main reason why advanced economies and Europe in particular are not recovering fast will not go away. Marco Buti and Pier Carlo Padoan in Vox bring back this argument in their attempt to figure out why the recovery in Europe is so weak.

They explore the differences between the Eurozone and US recoveries to understand what are the factors that explain the divergence in performance (“the growth shortfall of the Eurozone compared to the US is striking”). So what are the differences between the two economic regions? Three according to the authors: policy uncertainty, weak financial system and lack of investment opportunities.

The evidence?

1. Measures of uncertainty are correlated with growth. But as many others have argued, measures of uncertainty are (in most cases) endogenous to growth.

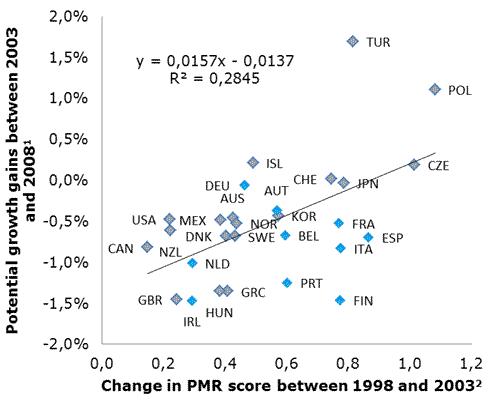

2. Reform in the years 1998-2003 is a good predictor of the potential growth gains in the five years that followed (2003-2008). I am not sure how relevant this is to explain the post-2008 growth performance but let me argue that the chart presented in the blog post is not too convincing either. Here it is:

First, notice that their measure of growth is potential (not actual). Second, while the estimated regression suggests a positive correlation, when one looks at the Euro countries, there is no obvious correlation between the two variables. And if we compare some of them to the US (this was the comparison that the authors wanted to understand), the evidence runs contrary to their argument. Spain or Italy or France or even Greece improved their (product markets) regulation much more than the USA or Canada but their (potential) growth performance was significantly weaker.

So while talking about uncertainty and reform always sounds right, the evidence is either weak or inexistent.

But what about alternative explanations? Could it be that policy, in particular fiscal policy, can explain differences in growth performance since 2008? It must be that the evidence is not that strong, otherwise how could it be that is nor mentioned in their article?

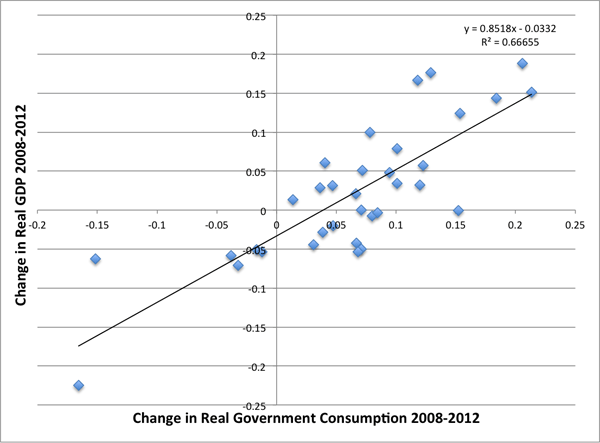

Here is my attempt to provide an alternative explanation to the cross-variation in GDP growth rates.

I compare the change in real GDP in the 2008-2012 period with the change in real government consumption during the same years. This variable is an indication of the fiscal policy stance during those years. I include all OECD countries in the sample (removing some, including only the Euro countries makes no difference to the slope or fit of the regression). The correlation is very strong with a a coefficient that is not far from 1.

But isn’t government consumption a component of GDP? Isn’t the correlation always there? Yes and No. Yes, there is plenty of endogeneity in my chart and if you want to get the numbers right you need to read all the literature on fiscal policy multipliers (which will tell you that the effects are in fact stronger than what the casual analysis above shows). But, No, we also know that many of these countries implemented explicit cuts in government spending in response to changes in their interest rate and the financial markets reaction to sovereign debt crisis. So there is a significant exogenous component to government spending in that picture, enough to be used as an explanatory variable. And remember that there are those who believe that this correlation should be zero or even negative — those who believe in zero or negative fiscal policy multipliers. So when Greece (bottom left dot) cut government consumption by 17%, they expected private spending to increase by at least the same amount. But it did not happen, private spending also fell and GDP has fallen by almost 25% during that period.

The chart above is just a reminder of how strong the evidence is in favor of the hypothesis that fiscal policy can explain most of the relative underperformance of some economies in the post 2008 period. The evidence is certainly much stronger than any of the factors that Buti and Padoan present. But somehow fiscal policy did not make it to their list of top three factors.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply