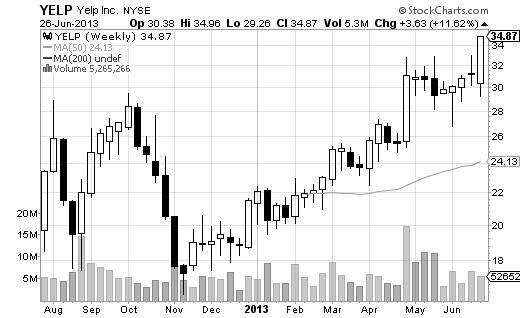

Well, there’s some good news and bad news for Yelp, Inc (YELP). The good news is that shares of the San Francisco-based online ratings service jumped as much as 12% Thursday to close at a new 52 week high of $34.87. The bad news for investors, besides that of YELP trading at more than 217x 2014 earnings estimates, which is insanely high, is there really is no reported company news to justify the stock’s recent spike.

Yelp had no comment.

Over the last 52 weeks, YELP has gained over 54%, trading above its 50 day moving average of $29.38 and the 200 day moving average of $24.12. While technically momentum traders could take that as a bullish signal to establish a short-term long position, it is prudent to note that from a key ratio perspective it’s not easy to find favorable trends occurring in the company’s numbers. For instance, YELP’s profit and operating margins are currently in the red at (-9.03%) and (-6.81%), respectively. Return on assets and equity are negative as well, standing at (-3.91%), and (-9.22%), respectively.

Technically speaking, YELP has entered into the overbought territory. The RSI with a reading value of over 69 signifies that overbought position.

Short the name for a $2 scalp if it breaks below major support located at the $33 level.

Disclosure: No Position

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply