Game on? Game on indeed.

The party (for the bears, at least) started in Europe, where some very large (50,000 +), fairly high-delta bearish option strategies printed, sending futures tumbling as the market-maker hedges went through. The size and structure of the trades suggest institutional hedging rather than directional punting. Either way, however, they represented a concern about further upside in the market that has been largely absent over the past several months.

In the US, meanwhile, equity weakness was particularly telling in light of a pretty solid ISM report, which comfortably beat the published consensus (though fell short of the hotly-whispered 55 level.) Failure to rally on good news is clearly a change in tone, and there was a poetic symmetry to yesterday’s price action. Futures volume was the highest since March 10, the day after the SPX printed its low close. ‘Twill be interesting to see if the follow-through is as pronounced over the coming months….

In any event, the composition of the sell-off was gratifying, as (and there’s really no other way to phrase this) the turds got flushed. Low-quality and impaired financials, which as noted yesterday had dominated exchange volume in recent weeks, got their comeuppance, falling very sharply in tandem. Chalk that up as a small victory for rationality.

While it’s tempting to go all-in from the short side, the last six months of aborted reversals and repeated bear hunts have left Macro Man remaining cautious. Perhaps that very caution, if broadly shared, will provide the fuel for a deeper down-move. We’ll see. At the very least, Macro Man prefers to wait until the August lows are breached before placing all of his chips on “red.” As tautologically-inclined technical analysts will tell you, the SPX needs to break those lows around 980 before it can go even lower.

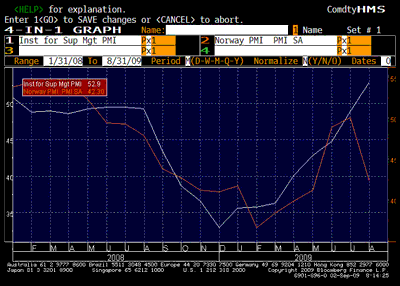

Weakness has carried over this morning, despite Asia not selling off as much as might be feared. While it’s tertiary (at best) data, we saw the first dose of Roundup applied to the green shoots this morning as Norway’s PMI turned sharply lower.

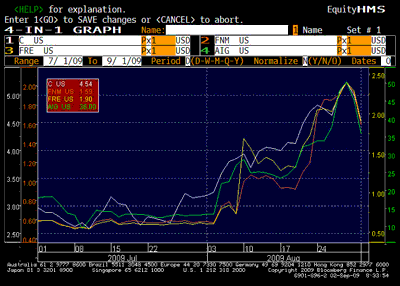

The NOK has been a darling amongst those punters not totally anesthetized to trading FX and now looks to be putting in a reversal against the EUR and USD. This reminds Macro Man of the rarely-cited Fifth Law of Thermodynamics: the amount of pain in AUD/NZD and the Scandi FX markets is always constant.

Given that the ostensibly positive Aussie GDP number put a bid under AUD/NZD, thereby gratifying a widely-held view, it was inevitable for the smooth functioning of the universe that the wheels come off of the Nokky trade.

Now, if you see them both get flushed at the same time, be afraid. Be very, very afraid.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply