Annie’s (NYSE:BNNY): The California-based natural and organic food company based topped Wall Street consensus EPS and revenue estimates by $0.01 and $1.47M, respectively for the Q4 2013. However share prices are down $2.64 midday after the earnings announcement.

EPS Results

Actual $0.29 vs. Expected $0.28

Grew 20.83% year-over-year

Revenue Results

Actual $52.2 vs. Expected $50.73M

Grew 21.5% year-over-year

9% growth in total distribution points

Guidance

EPS Full Year 2014: Raised to $0.97-$1.01

Key Takeaways from Conference Call

Annie’s CEO John Foraker: “Our strong fourth quarter results capped off a successful year for our company. Our sales for both the quarter and full year exceeded our expectations and were driven by a continuation of strong consumption trends. Our sharp focus on execution enabled us to overcome the challenge presented by the voluntary pizza recall announced on January 22nd and deliver robust sales and EPS growth.”

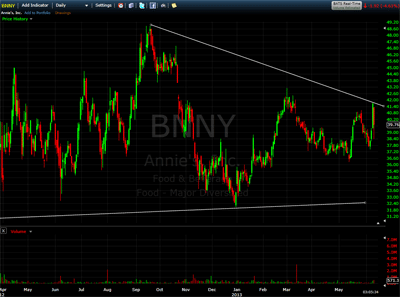

Taking a Look at the Chart

Pattern: Sideways Trend/Wedge Pattern

BNNY rallied strongly on Monday, perhaps in anticipation of a strong report, but the small top- and bottom-line beats were not enough to sustain higher prices. The stock is down nearly 5% midday following last night’s report. Annie’s IPOed on March 28, 2012, opening for trading at $31.11 and closing its first day at $35.92. Since then, the stock has been trading in a sideways range between the all-time low of $32.06 and all-time high of $48.87. Long-term, it is healthy to see Annie’s consolidate in a range above its IPO price, so keep the stock on your radar for a potential future break out of this wedge pattern.

(click to enlarge)

Potential Sympathy Trades – Stocks in the Same Sector

General Mills, Inc. (NYSE:GIS)

John B. Sanfilippo & Son, Inc. (NASDAQ:JBSS)

The Hain Celestial Group, Inc (NASDAQ:HAIN)

Campbell Soup Company (NYSE:CPB)

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply