How about Fannie’s stock of late? The low-high for May saw a 660%% swing. There were several days of +200Mn shares crossing hands. The stock fell off a cliff at $5.40 and 36-hours later it was back down to $1.75. Some guys made a killing, others lost their shirts. I think 99% of what happened to Federal National Mortgage Association (OTCBB:FNMA) was due momentum chasers and day traders.

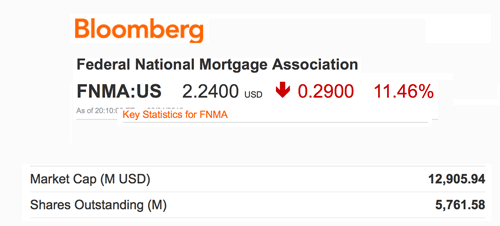

Clearly the market is having a difficult time trying to figure out what Fannie is worth these days. The news services are also struggling. The normal sources have some big discrepancies. Bloomberg measures the market cap of FNMA at $12.9Bn (5.8Mn shares outstanding):

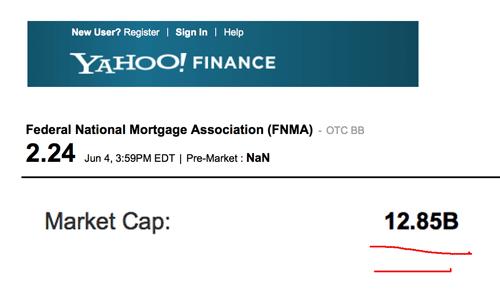

Yahoo Finance agrees with Bloomberg:

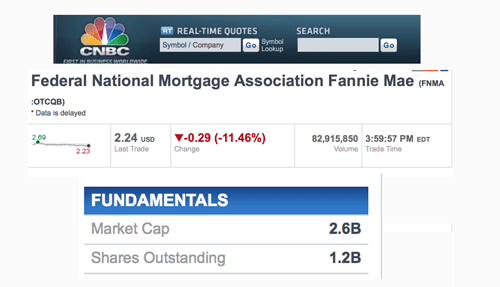

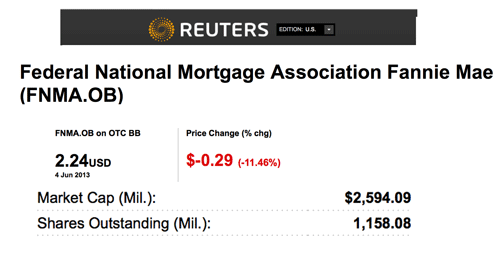

CNBC and Reuters have a different number for the market cap. They think that FNMA is only worth about $2.6Bn, about 1/4 of what Bloomberg is saying:

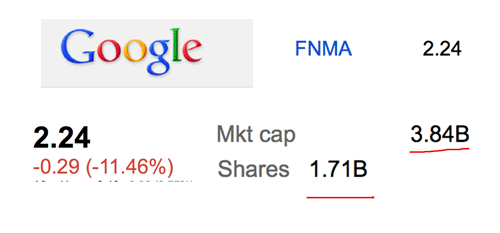

Google has yet a different number. It thinks FNMA is worth about $3.8Bn, based on 1.71Bn shares outstanding:

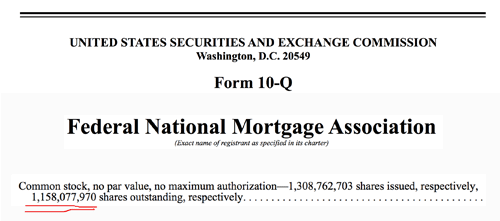

In the March 2013 10-Q Fannie confirmed that the number of shares outstanding is 1.158Bn.

So the market cap of FNMA (as of the close) is about $2.5BN. Bloomberg, Yahoo and Google have bad data. No wonder traders are so confused.

The deep thinkers in D.C. are also confused about the government’s investment in the mortgage industry. Senator Bob Corker (R-Tn) thinks that Fannie and Freddie should be shut down and a brand new government owned mortgage entity should take over. Corker has a fancy new name for his mortgage lender, Federal Mortgage Insurance Corp.

The problem with Corker’s plan is that the US already has a federally owned mortgage insurer. FHA (separate from Fan and Fred) has been booking new mortgages like crazy the last four years. FHA is under-capitalized, and will probably need a bailout in the not too distant future. Yesterday the FHA leaked an internal review that stressed tested the FHA business plan. That “plan” looks like it could be another disaster for taxpayers:

I think Corker is nuts to consider a new government owned mortgage lender. The government will screw it up just like they have with Fannie, Freddie and FHA. How many times do these guys have to get hit over the head before they realize that mortgage lending is risky stuff?

I don’t know what will happen with Fannie and Freddie (OTCBB:FMCC). If you believe in the FHFA (the administrator for F/F) then you would have to conclude that F/F have no value at all. The flip side is that if left alone, F/F would be able to pay back all of the money borrowed from the Treasury PLUS a very big return to the taxpayers. This “miracle” could be accomplished in less than 36-months.

GM/Chrysler, AIG and all of the TARP banks have done pretty much what F/F are capable of. They went into the crapper in 2009, the Feds bailed them out and after a few years all the money was paid back with a gain. Given that as a precedent, then a good case could be made to let F/F go down the same road.

If F/F were allowed to payback the taxpayers, and then emerge as new private sector companies, the Preferred stock of the Agencies would be money good, and the common stock would be worth many multiples of the current price.

Most investment opportunities have three possible outcomes. (1) A significant gain, (2) a complete loss , and (3) something in the middle. That’s not the case with F/F. There is no “middle”. Either the the common/Pref could be a huge home run, or it is going to zero. No wonder the market is having a difficult time trying to figure out how to value the equity.

- Bulenox: Get 45% to 91% OFF ... Use Discount Code: UNO

- Risk Our Money Not Yours | Get 50% to 90% OFF ... Use Discount Code: MMBVBKSM

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply