A desirable property of a monetary instrument is that it holds its value over short periods of time. Most assets do not have this property: their purchasing power fluctuates greatly at very high frequency. Imagine having gone to work for gold a few weeks ago, only to see the purchasing power of your wages drop by 10% in one day. Imagine having purchased something using Bitcoin, only to watch the purchasing power of your spent Bitcoin rise by 100% the next day. It would be frustrating.

Is it important for a monetary instrument to hold its value over long periods of time? I used to think so. But now I’m not so sure. While I do not necessarily like the idea of inflation eating away at the value of fiat money, I don’t think that a low and stable inflation rate is such a big deal. Money is not meant to be a long-term store of value, after all. Once you receive your wages, you are free to purchase gold, bitcoin, or any other asset you wish. (Inflation does hurt those on fixed nominal payments, but the remedy for that is simply to index those payments to inflation. No big deal.)

I find it interesting to compare the huge price movements in gold and Bitcoin recently, especially since the physical properties of the two objects are so different. That is, gold is a solid metal, while Bitcoin is just an abstract accounting unit (like fiat money).

But despite these physical differences, the two objects do share two important characteristics:

[1] They are (or are perceived to be) in relatively fixed supply; and[2] The demand for these objects can fluctuate violently.

The implication of [1] and [2] is that the purchasing power (or price) of these objects can fluctuate violently and at high frequency. Given [2], the property [1], which is the property that gold standard advocates like to emphasize, results in price-level instability. In principle, these wild fluctuations in purchasing power can be mitigated by having an “elastic” money supply, managed by some (private or public) monetary institution. This latter belief is what underlies the establishment of a central bank managing a fiat money system (though there are other ways to achieve the same result).

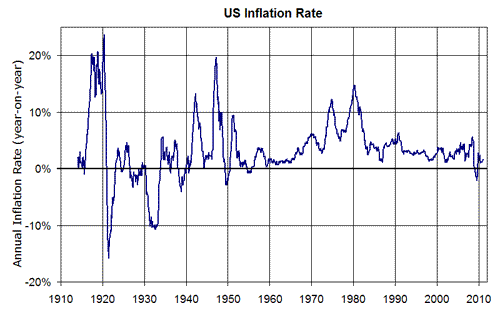

The following graph depicts the rate of return on US money over the past century (the rate of return is actually the inverse of the inflation rate). The US was on and off the gold standard many times in its history. Early on in this sample, the gold standard was abandoned during times of war and re-instituted afterward. While inflation averaged around zero in the long-run, it was very volatile early in the sample. The U.S. last went off the gold standard in 1971. Later on in the sample, we see the great “peacetime inflation,” followed by a period of low and stable inflation.

Gold standard advocates are quick to point out the benefits of long-term price-level stability. The volatile nature of inflation early on in the sample is attributed to governments abandoning the gold standard. If only they would have kept the gold standard in place…

Of course, that is the whole point. A gold standard is not a guarantee of anything: it is a promise made “out of thin air” by a government to fix the value of its paper money to a specific quantity of gold. It is possible to create inflation under a gold standard simply by redefining the meaning of a “dollar.” For example, in 1933, FDR redefined a dollar to be 1/35th of an ounce of gold (down from the previous 1/20th of an ounce). This simple act devalued the purchasing power of “gold backed money” by almost 60%.

If the existence of a gold reserve does not prevent a government from reneging on its promises, then why bother with a gold standard at all? The key issue for any monetary system is credibility of the agencies responsible for managing the economy’s money supply in a socially responsible manner. A popular design in many countries is a politically independent central bank, mandated to achieve some measure of price-level stability. And whatever faults one might ascribe to the U.S. Federal Reserve Bank, as the data above shows, since the early 1980s, the Fed has at least managed to keep inflation relatively low and relatively stable.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

” I don’t think that a low and stable inflation rate is such a big deal. Money is not meant to be a long-term store of value, after all. ”

Your career is a *long term* effort. Your wages are systematically reduced by “low and stable inflation”. Thus it comes as no surprise that up to 1971 the income gap was falling, with the federal reserve only slightly constrained by the last tie to the Gold Standard. From 1971 forward, the Income gap has risen without break.

CPI systematically underestimates inflation. It does not take into account the fact that the “basket of goods” on which it is based has seen significant reductions in production costs. Thus if we are intending to “correct” prices to the same value, yet fail to consider reductions in costs of production, then we are correcting prices to meet a shrinking unit of measure.

See Baumol’s cost disease. This was predicted. Medicine and Healthcare are not “soaring in costs”. In fact, our wages and savings are plunging in value.