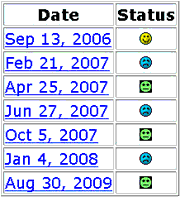

If you’ve only been following Econbrowser since 2008, you may have thought that the crabby countenance in the upper-right corner of our main page was a permanent fixture, conveying our general grumpiness about the state of the economy or perhaps life in general. Despite having been stuck in the pessimistic mode for quite some time now, the emoticon was in fact always intended to be a dynamic feature, adjusted from time to time to provide readers with our overall impression of incoming data. The table on the left provides links to each occasion that our Little Econ Watcher’s countenance has changed in the past.

If you’ve only been following Econbrowser since 2008, you may have thought that the crabby countenance in the upper-right corner of our main page was a permanent fixture, conveying our general grumpiness about the state of the economy or perhaps life in general. Despite having been stuck in the pessimistic mode for quite some time now, the emoticon was in fact always intended to be a dynamic feature, adjusted from time to time to provide readers with our overall impression of incoming data. The table on the left provides links to each occasion that our Little Econ Watcher’s countenance has changed in the past.

Last week’s data persuaded me to move the Econbrowser Emoticon back into neutral, signifying that I now judge overall output to be growing slowly rather than declining. Here are details on the evidence that prompted this change in assessment, and what it signifies.

What’s changed? For starters, we saw a surge in automobile sales and production in July, and preliminary indications are that August will be even stronger. Granted, there are real concerns that this was a temporary kick from the cash for clunkers program, meaning that September sales could fall sharply. But remember that the revised data reported by BEA on Thursday showed U.S. real GDP growth of -1.0% at an annual rate for the second quarter, to which motor vehicles and parts contributed -0.13%. Even if auto sales in Q3 were at the same low level they had been in Q2, a 0% rather than -0.13% contribution would mean a higher GDP growth rate for Q3 than Q2, other things equal. And even with a very bad September, Q3 auto sales should handily exceed Q2.

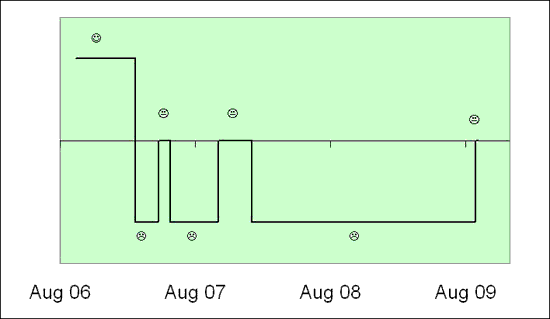

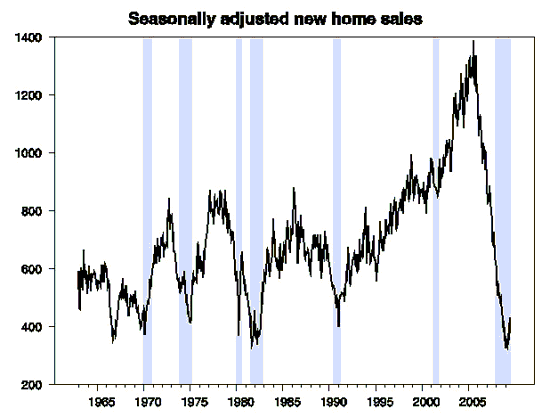

An even stronger case holds for housing, which contributed -0.66% to that -1.0% 2009:Q2 GDP growth. The Census Bureau reported on Wednesday that seasonally adjusted new home sales in July were 9.6% higher than in June. Granted, they remain at historically very low levels. But again, even if these are only modest improvements over the dismal Q2 numbers, that -0.66% becomes a positive number for Q3. And although there’s lots of potential measurement error in the new home sales data, a 9.6% gain within a month isn’t a modest number.

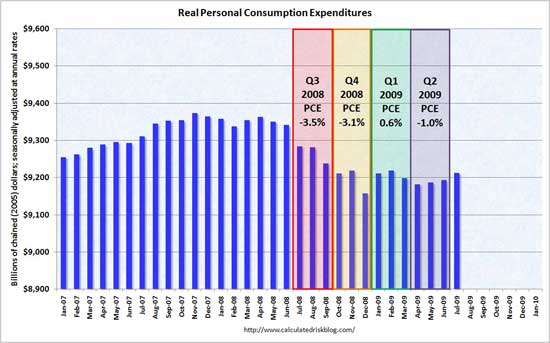

Many analysts were troubled by the BEA report on Friday that personal income was flat in July, and I agree that this is not what you’d expect in a surging economy. But it’s worth noting that real personal consumption expenditures were up 0.2% in July, consistent with the conclusion that we’re unlikely to see a further decline in overall GDP this quarter.

Source: Calculated Risk

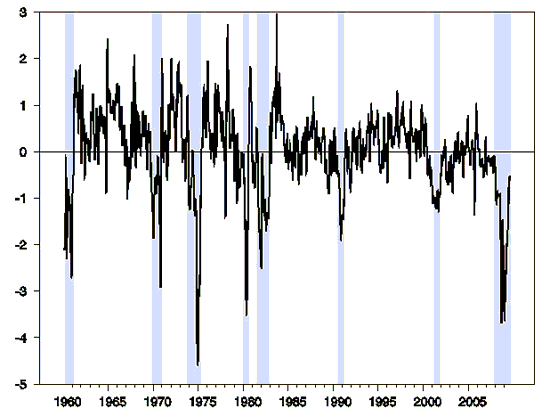

There are other indicators that encourage me as well. The Census Bureau released on Wednesday a very favorable report on new orders for durable and capital goods. Semiconductor chip maker Intel (NASDAQ:INTC) announced Friday that it expects much higher revenue for the third quarter than it saw in the first half, suggesting sales of computers and a variety of electronic products are picking up. The Aruoba-Diebold-Scotti Business Conditions Index, although still negative, has climbed back up considerably from its earlier lows. All of this leads me to form the opinion that U.S. real GDP has stopped falling and is starting to grow again.

Aruoba-Diebold-Scotti Business Conditions Index as reported on Aug 28, 2009, with NBER-dated recessions as shaded regions. Data source: FRB Philadelphia

Let me now clarify what this change in our little friend’s countenance does not signify. First, it is not an Econbrowser Declaration that the recession is over– that will have to wait until our GDP-based recession indicator index falls below 33%.

Nor is this a less formal “all-clear” signal. Far from it. I still don’t see the evidence that employment has started to pick back up, and as long as the number of people with jobs is falling, there is plenty of potential for destabilizing feedback. Lower employment can aggravate mortgage defaults and put further stress on key financial institutions. As long as employment continues to fall, things could rapidly deteriorate.

But the situation definitely looks better than it did.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply