“Peak oil is dead,” Rob Wile declared last week. Colin Sullivan says it has “gone the way of the Flat Earth Society”, writing

Those behind the theory appear to have been dead wrong, at least in terms of when the peak would hit, having not anticipated the rapid shift in technology that led to exploding oil and natural gas production in new plays and areas long since dismissed as dried up.

These comments inspired me to revisit some of the predictions made in 2005 that received a lot of attention at the time, and take a look at what’s actually happened since then.

Here’s how Boone Pickens saw the world in a speech given May 3, 2005:

“Let me tell you some facts the way I see it,” he began. “Global oil (production) is 84 million barrels (a day). I don’t believe you can get it any more than 84 million barrels. I don’t care what (Saudi Crown Prince) Abdullah, (Russian Premier Vladimir) Putin or anybody else says about oil reserves or production. I think they are on decline in the biggest oil fields in the world today and I know what’s it like once you turn the corner and start declining, it’s a tread mill that you just can’t keep up with….

“Don’t let the day-to-day NYMEX (New York Mercantile Exchange) fool you, because it can turn and go the other direction. I may be wrong. Some of the experts say we’ll be down to $35 oil by the end of the year. I think it’ll be $60 oil by the end of the year. You’re going to see $3 gasoline twelve months from today, or some time during that period.”

But others, like Daniel Yergin, chairman of Cambridge Energy Research Associates, were not as concerned. Yergin wrote on July 31, 2005:

Prices around $60 a barrel, driven by high demand growth, are fueling the fear of imminent shortage– that the world is going to begin running out of oil in five or 10 years. This shortage, it is argued, will be amplified by the substantial and growing demand from two giants: China and India.

Yet this fear is not borne out by the fundamentals of supply. Our new, field-by-field analysis of production capacity, led by my colleagues Peter Jackson and Robert Esser, is quite at odds with the current view and leads to a strikingly different conclusion: There will be a large, unprecedented buildup of oil supply in the next few years. Between 2004 and 2010, capacity to produce oil (not actual production) could grow by 16 million barrels a day– from 85 million barrels per day to 101 million barrels a day– a 20 percent increase. Such growth over the next few years would relieve the current pressure on supply and demand.

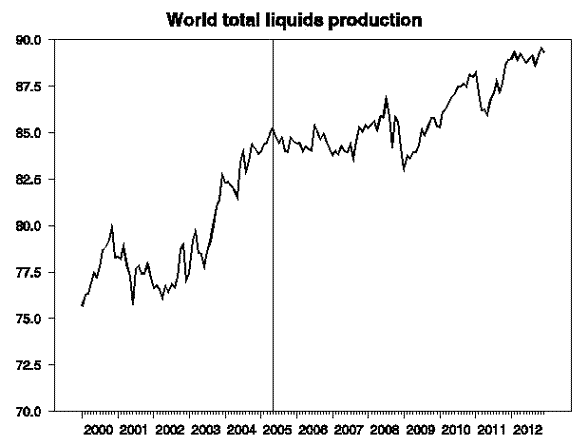

Let’s start by taking a look at what happened to global oil production in the years since those two very different views were offered. Total world liquids production as reported by the EIA had reached 85.2 million barrels a day at the time Pickens issued his pronouncement. It briefly passed that level again in June 2006 and June 2008, though mostly was flat or down over 2005-2009 before resuming a modest and erratic climb since then. The most recent number (December 2012) was 89.3 million barrels a day, 4 mb/d higher than where it had been in May 2005, and 12 mb/d below the levels that Yergin had expected we’d be capable of by 2010.

Figure 1. Global liquids production, monthly, Jan 2000 – Dec 2012, in millions of barrels per day. Includes field production of crude oil, crude condensate, natural gas plant liquids, refinery process gain, and other liquids such as biofuels. Vertical line marks May 2005. Data source: EIA

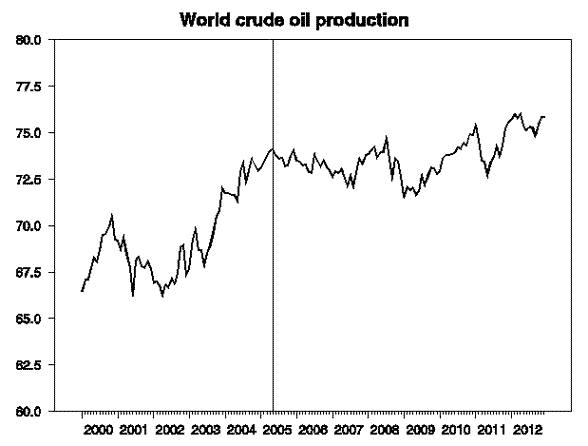

But more than half of that 4 mb/d increase has come in the form of natural gas liquids— which can’t be used to make gasoline for your car– and biofuels– which require a significant energy input themselves to produce. If you look at just field production and lease condensate, the increase since May 2005 has only been 1.7 mb/d.

Figure 2. Global production of crude oil (including lease condensate), monthly, Jan 2000 – Dec 2012, in millions of barrels per day. Excludes natural gas plant liquids, refinery process gain, and other liquids such as biofuels. Vertical line marks May 2005. Data source: EIA

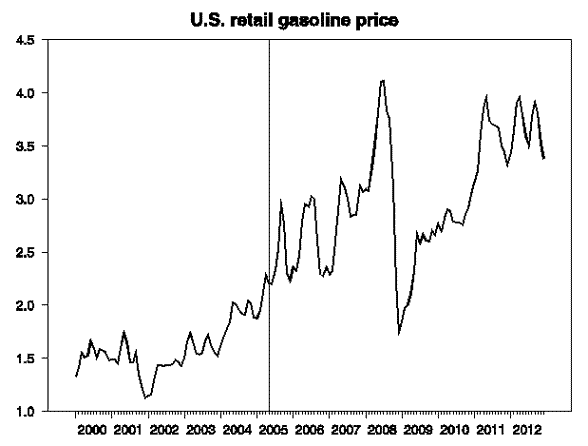

Gasoline in the United States reached $3.00 a gallon in July 2006, just as Pickens had predicted it would. Today we’d consider that cheap.

Figure 3. Average U.S. retail gasoline price, all grades and formulations, Jan 2000 – Dec 2012, in dollars per gallon. Vertical line marks May 2005. Data source: EIA

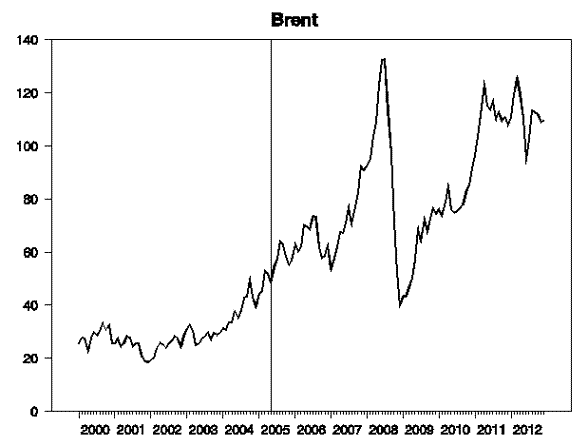

Crude oil only took two months after Pickens’ prediction to reach $60/barrel. Brent is almost twice that today.

Figure 4. Price of Brent crude oil, Jan 2000 – Dec 2012, in dollars per barrel. Vertical line marks May 2005. Data source: EIA

Knowing all the facts today, of the assessments offered in 2005 by Pickens and Yergin, which one would an objective observer characterize as having been closer to the truth? How could anyone come away with the conclusion that those who saw the world as Pickens did were “dead wrong”?

The rush to judgment seems to be based on the remarkable recent success from using horizontal fracturing to extract oil from tighter rock formations. Here for example is a graph of production from the state of Texas, one of the areas experiencing the most dramatic growth in tight oil production. In 2012, Texas produced almost 2 million barrels each day, up 800,000 barrels a day from 2010.

Figure 5. Top panel: Texas field production of crude oil, annual, 1946-2012, in millions of barrels per day, from Hamilton (2012) and EIA. Bottom panel: Price of West Texas Intermediate crude oil in 2012 dollars, calculated as average nominal price over year (from FRED) divided by ratio of end-of-year seasonally unadjusted CPI to Dec 2012 CPI (from FRED).

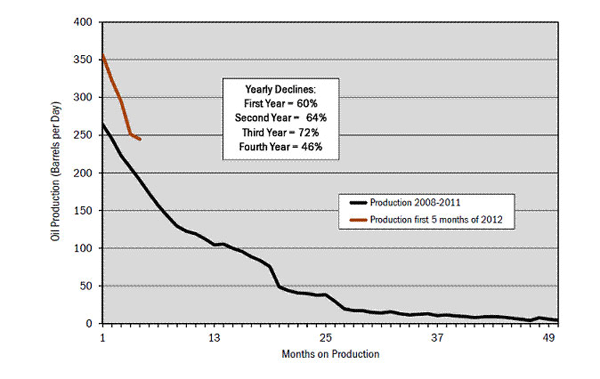

But Texas production in 2012 was still 1.4 mb/d below the state’s peak production in 1970, and I haven’t heard anyone suggest that Texas is ever going to get close again to 1970 levels. Production from any individual tight-formation well in Texas has been observed to fall very rapidly over time, as has also been the experience everywhere else.

Figure 6. Type decline curve for Eagle Ford liquids production. Source: Hughes (2013).

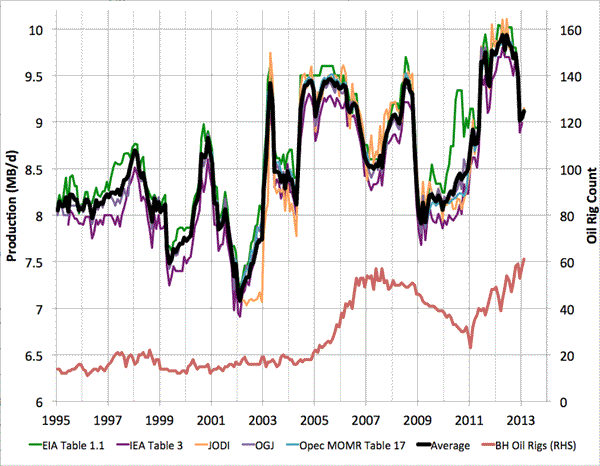

Total U.S. production– including Texas, offshore, and every other state– is up 1 mb/d since 2012. But interestingly, that’s almost the magnitude by which Saudi production (which accounted for 13% of the 2012 total in Figure 2 above) has recently declined.

Figure 7. Alternative estimates of Saudi daily oil production (mb/d, left scale) and Saudi oil rig count (right scale). Source: Stuart Staniford.

Stuart Staniford speculates that the recent Saudi cutback may have been a deliberate response to U.S. production gains in an effort to prevent oil prices from declining. On the other hand, his graph shows that Saudi effort (as measured by active drilling rigs) has ramped up significantly in the last two years.

Perhaps it’s the case that Saudi Arabia isn’t willing to maintain its previous production levels, or perhaps it’s the case that Saudi Arabia isn’t able to maintain its previous production levels. But whatever the explanation, this much I’m sure about: those who assured us that Saudi production was going to continue to increase from its levels in 2005 are the ones who so far have proved to be dead wrong.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply