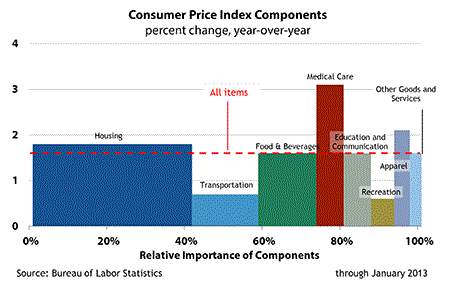

As we’ve said before, we’re suckers for cool charts. The latest that caught our eye is the following one, originally created by the U.S. Bureau of Labor Statistics (BLS). It highlights the relative importance assigned to the various components of the consumer price index (CPI) and shows where increases in the index have come from over the past 12 months.

It probably won’t surprise anyone that the drop in gasoline prices (found in the transportation component) exerted downward pressure on the CPI last year, while the cost of medical care pushed the price index higher. What might surprise you is the size of that big, blue square labeled “housing.” Housing accounts for a little more than 40 percent of the CPI market basket and, given its weight, any change in this component significantly affects the overall index.

This begs the question: In light of the recent strength seen in the housing market—and notably the nearly 10 percent rise in home prices over the past 12 months—are housing costs likely to exert more upward pressure on the CPI?

Before we dive into this question, it’s important to understand that home prices do not directly enter into the computation of the CPI (or the personal consumption expenditures [PCE] price index, for that matter). This is because a home is an asset, and an increase in its value does not impose a “cost” on the homeowner. But there is a cost that homeowners face in addition to home maintenance and utilities, and that’s the implied rent they incur by living in their home rather than renting it out. In effect, every homeowner is his or her own tenant, and the rent they forgo each month is called the “owners’ equivalent rent” (or OER) in the CPI. OER represents about 24 percent of the CPI (and about 11 percent of the PCE price index). The CPI captures this OER cost (sensibly, in our view) by measuring the cost of home rentals (details here). So whether the robust rise in home prices will influence the behavior of the CPI this year depends on whether rising home prices influence home rents.

So what is likely to happen to OER given the continued increase in home prices? Well, higher home prices, in time, ought to cause home rents to rise, putting upward pressure on the CPI. Homes are assets to landlords, after all, and landlords (like all investors) require an adequate return on their investments. Let’s call this the “asset market influence” of home prices on home rents. But the rents that landlords charge also compete with homeownership. If renters decide to become homeowners, the rental market loses customers, which should push home rents in the opposite direction of home prices for a time. Let’s call this the “substitution influence” on rent prices.

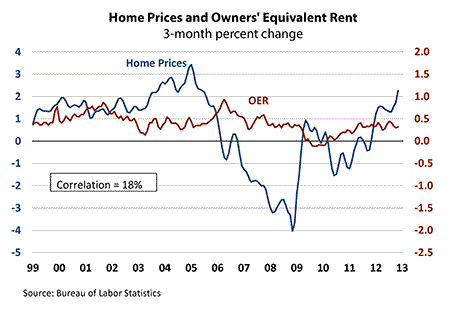

Consider the following charts, which show three-month home prices and home rents (measured by the CPI’s OER measure). It’s a little hard to see a clear correlation between these two measures.

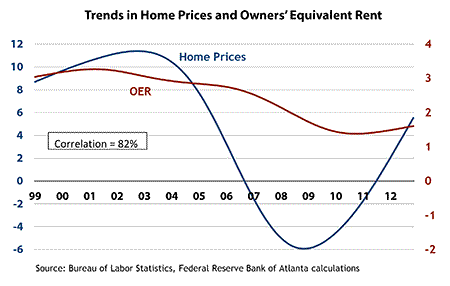

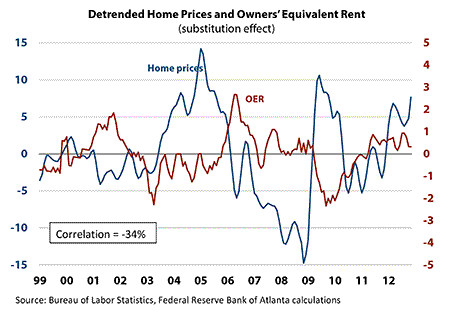

So we’ve separated these data into their trend and cycle components (using Hodrick-Prescott procedures, if you must know) shown in the following two charts. Now, if one takes the trend view, there is a clear positive relationship between home prices and home rents. This is consistent with the asset market influence described above. But also consider the detrended perspective. Here, home prices and home rents are pretty clearly negatively correlated. This, to us, looks like the substitution influence described above.

So let’s get back to the question at hand. What do rising home prices mean for OER and, ultimately, the behavior of the CPI? Well, it’s rather hard to say because the link between home prices and OER isn’t particularly strong.

Not definitive enough for you? OK, how about this: We think the recent rise in home prices will more likely lean against the rise in OER for the near term as the growing demand for home ownership provides some competition to the rental market. But, in time, these influences will give way to the asset market fundamentals, and rents are likely to accelerate as returns on real estate investments are reaffirmed.

Nick Parker contributed to this commentary

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply