The Dow Jones Industrial Average is making record highs, knocking the 2007 peak off its pedestal, but investors aren’t celebrating.

Since the Dow hit its March 2009 low, many sage market players followed the stimulative monetary and fiscal policies, ignored the noise of pundits predicting doom and gloom, and invested heavily in equities. Only in retrospect can their bold calls be recognized as wise.

I often look to social sciences and psychology to help investors understand the importance of the collective genius. In one of my favorite books, The Wisdom of Crowds, James Surowiecki points to statistics scientist Norman L. Johnson’s maze experiment as one of many illustrations of intelligent group decisions.

Johnson sent groups of people one-by-one through a maze, recorded their paths and timed the results. Do participants take a left or a right? How many steps does it take to make it through?

Then, he calculated how many total steps each individual took to reach the end of the maze. The average ended up to be 12.8 steps, but the group collectively did much better, taking only nine steps. More importantly, “there was no way to get through the maze in fewer than nine steps, so the group had discovered the optimal solution,” wrote Surowiecki.

Time and time again, Surowiecki found evidence of collective decisions to be superior to individual results, whether researchers asked people how many jelly beans are in a jar or how much an ox weighs. The “collective guess was very accurate, and was better than the vast majority of individual guesses.”

This collective wisdom theory was also used to predict the winner of elections. Nate Silver of The New York Times’ FiveThirtyEight blog analyzes data on state and national polls along with economic information, including GDP, jobs and inflation. His interests in playing poker and writing about baseball made him adept at studying statistical means, odds and probabilities, and his prediction model results are phenomenal. During the 2008 presidential election, Silver correctly predicted 49 out of 50 states correctly. And in last fall’s election, he correctly forecasted the electoral outcome in all 50 states.

Surowiecki notes that the wisdom of crowds is not a natural idea to many of his readers. Rather, it is counterintuitive because people are wrongly led to believe that “well-informed will be outweighed by the poorly informed, and the group’s decision will be worse than that of even the average individual.”

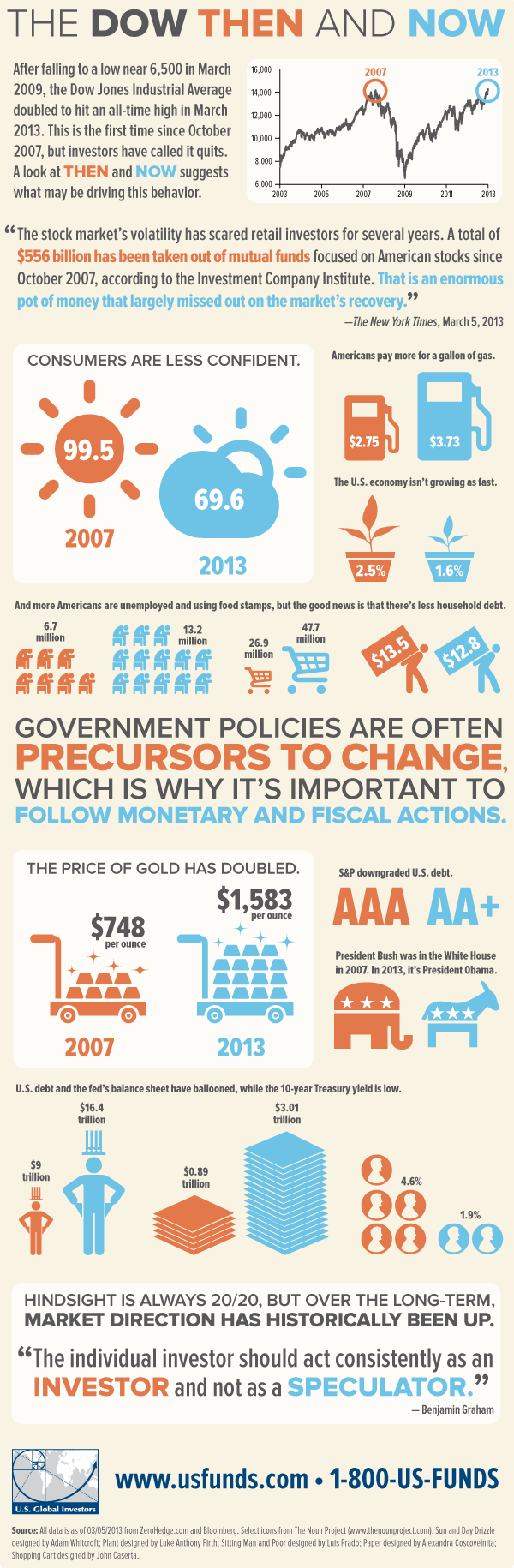

I believe Americans feel that investing in the stock market today is counterintuitive because of unemployment statistics, dysfunction in Washington and ongoing negative news about the U.S. economy. When discussing the Dow’s all-time high, The New York Times indicated that investors aren’t pouring Champagne like they would have in past years. “The stock market’s volatility has scared retail investors for several years. A total of $556 billion has been taken out of mutual funds focused on American stocks since October 2007, according to the Investment Company Institute. That is an enormous pot of money that largely missed out on the market’s recovery,” says The Times.

Take a visual look at what investors may be feeling. On our new infographic below, using data collected by zerohedge.com, you can see some of the reasons investors have thrown in the towel. It costs about a dollar more for each gallon of gas. Over six million more Americans are unemployed, fewer people are in the labor force and almost 50 million are using food stamps. Consumer confidence is vastly different today than it was back then.

The U.S. financial situation is also vastly different. The economy is growing much slower, the size of the balance sheet is ballooning and debt has skyrocketed. It’s no wonder that gold was about $750 per ounce back in 2007; now, it’s double that.

But it cannot be disputed that the Dow doubled from its 2009 low.

The market noise of today will not be going away. However, investors can gain confidence in the following wisdom of the crowd. As famous investor Benjamin Graham said, “The individual investor should act consistently as an investor and not as a speculator.” Keep calm and invest on.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply