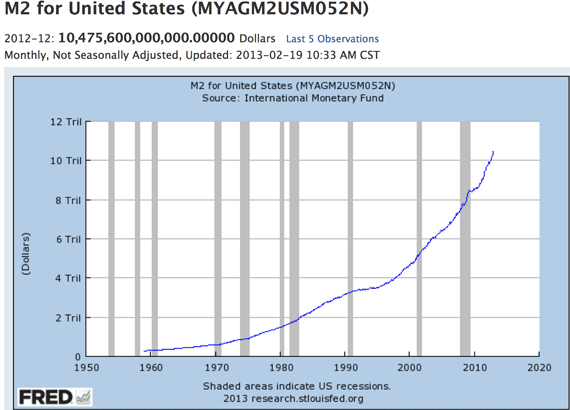

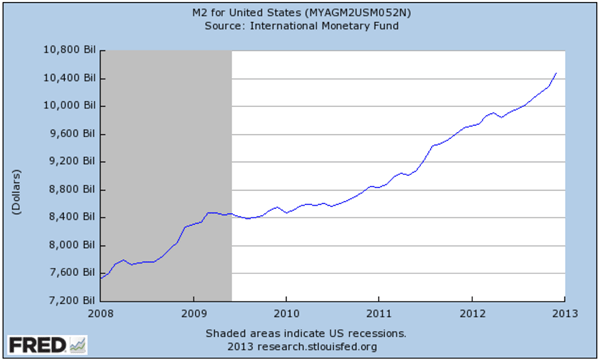

With the DOW blowing by milestones I went looking for other things that were at record levels. The first one that I looked at was M2. No surprise at all, M2 is bigger than ever. Charts of the long and short term trajectory of money supply:

The money supply is $3T higher than it was at the start of the 2008 recession. GDP is up $2T.

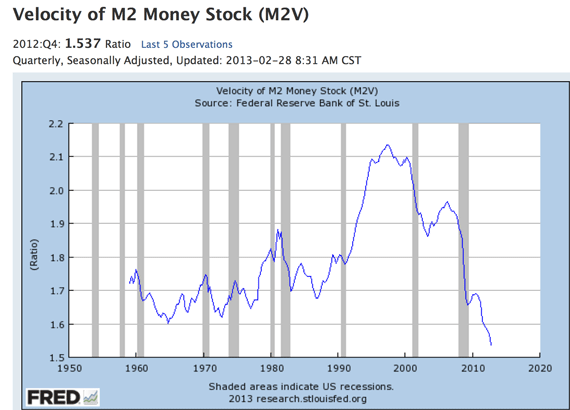

There is another component of M2. It has me baffled. It too is at a record. In this case it’s a record low. I’m sure this important. I don’t know why it’s happening. I don’t know what the consequences of this will be. This chart is screaming something:

My thoughts on the chart:

– It’s fairly clear that sharp declines in the velocity of money is consistent with periods of recession. But..

– If recessions are the cause of the decline in velocity, what the heck is going on today? We are now three years out of recessions, and velocity keeps dropping.

– Behind each of the recessions is the Federal Reserve. To offset a slowdown in the economy, it drops interest rates. When interest rates fall, velocity declines.

– As interest rates have been forced to zero for years past the last recession, the velocity of money has continued to decline.

– There are no periods in history where sustained economic expansion has occurred while money velocity is declining.

If you buy into my (admittedly un-scholarly) assessment of money velocity, then you might conclude:

* The Fed’s ZIRP policy has outlived its usefulness as a policy tool.

* The Fed’s policy on Forward Guidance for short-term interest rates (another two years of ZIRP) is accelerating the decline in money velocity, and therefore counter productive.

Clearly, Bernanke and the other Fed Doves don’t think there is a connection between record low money velocity and ZIRP. In fact, they must believe precisely the opposite. These folks are aware of the collapse in velocity, they know that this drop is a drag on the economy (particularly inflation), yet they have committed themselves to a policy that (IMHO) insures that money velocity stays historically low. Go figure.

One final thought on money velocity – it will return to a more normal level at some point. This may not happen until years into the future when monetary policy goes off “Fast Forward”. But it will happen.

When it does, the high octane gas that is now M2 and not moving; will become the bloated M2 that is moving. Another dumb question comes to mind.:

The Fed has said that it will not back off until inflation gets to 3%. But when the Fed does back off, money velocity should accelerate very quickly – and this should give inflation another big boost. So when the Fed finally does respond to rising inflation, its actions will light a fuse on more inflation.

The Fed Doves are not thinking of that scenario. If they did, they would be not so confident in their ability to control the outcome. That, or they’re bluffing.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply