Here I briefly survey some recent developments.

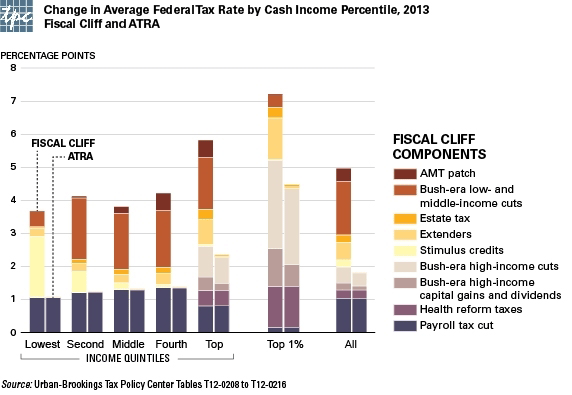

Forbes had this graphic of the consequences of the recent fiscal-cliff deal (named by its Congressional sponsors the American Taxpayer Relief Act, or ATRA) for various income quintiles. The left bars show how much your after-tax cash income would have gone down in percentage points as a result of the tax increases had there been no deal, broken down by specific contributing factors. The right bars show how much your after-tax income actually fell as a result of the deal.

Megan McArdle has some concerns about the outcome:

Consider the fiscal cliff deal that we just passed. Virtually every economist agreed on what needed to happen: Congress should extend all the tax cuts and spending hikes temporarily, because any fiscal tightening would also reduce economic growth and raise unemployment. But because our current trillion dollar deficits are entirely unsustainable, Congress should also set a deadline to have all or most of these temporary measures expire….

In a month-long round of backroom bargaining interspersed with public name calling, our politicians essentially managed to craft the opposite of this deal. We raised taxes immediately, which will put pressure on a still-weak economy. On the other hand, we also made the overwhelming majority of the Bush tax cuts permanent, at a cost of trillions over the next ten years.

Next political cliff-hanger to gawk at: negotiations over raising the debt ceiling. We learned this weekend that this won’t be side-stepped with the trillion dollar platinum coin trick. Ezra Klein quotes Treasury Department spokesman Anthony Coley as stating:

Neither the Treasury Department nor the Federal Reserve believes that the law can or should be used to facilitate the production of platinum coins for the purpose of avoiding an increase in the debt limit.

So what will happen? Here is Bill McBride’s assessment:

The House will raise the debt ceiling before the deadline, and the U.S. will pay the bills. The House majority has no leverage on the “debt ceiling”; as I’ve noted before, the House majority holds a losing hand and everyone knows it. The sooner they fold (and raise the debt ceiling) the better for everyone.

Also from the indispensible McBride, a couple of favorable developments on the longer-term outlook. Goldman Sachs Chief Economist Jan Hatzius is predicting that the U.S. federal deficit will be down to 3% of GDP by 2015. And the state of California is now projecting a budget surplus for the current year.

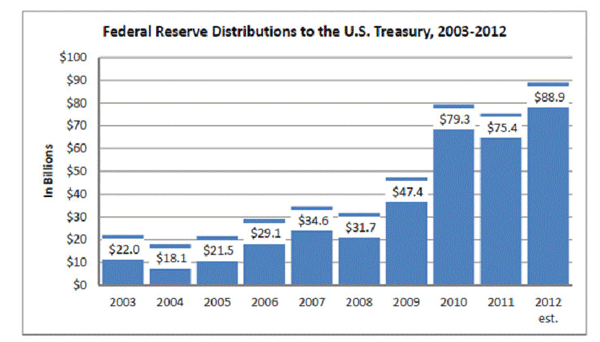

Another small bit of good news for the budget– the extraordinary measures that the Federal Reserve has been adopting the last three years have generated extraordinary windfalls for the federal budget. The Fed announced on Thursday that it earned a record $89 B in profits returned to the U.S. Treasury in 2012.

Source: Federal Reserve.

Now somebody else just needs to find another $900 B or so and we’re all set.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply