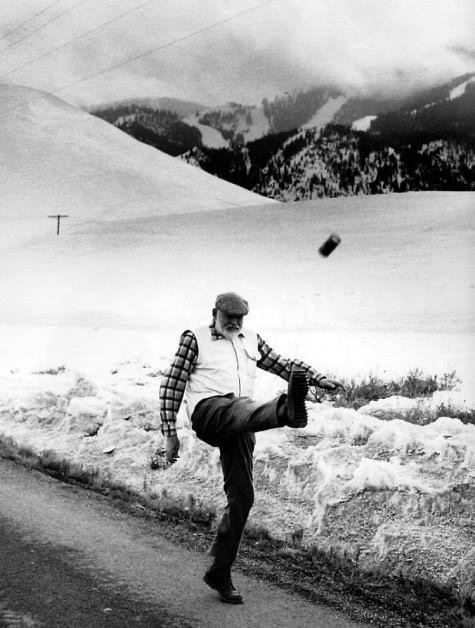

If there is one picture we’ve posted, and we’ve posted it several times, that encapsulates 2012, it is this one. Think Ernie as the allegory for the fiscal and monetary policymakers across almost all developed countries.

Let’s give them credit for stabilizing the financial and economic crisis — which they helped cause, by the way – but in terms of fixing the problems and implementing the necessary structural reforms? A big FAIL!

In our days at the World Bank, when working with troubled economies that had been been cut off by the financial markets we followed a two step process. First, the IMF would move in and try to stabilize an imbalanced economy through fiscal and monetary reform. Then the World Bank would come in and help the country implement structural reforms, such as fixing their pension system and labor markets. These SALs, or structural adjustment loans, were an aside from the Bank’s normal infrastructure lending.

Chile was our baby in the mid-1980′s and is now a economic superstar. They took the painful and necessary steps to reform their economy and pension system. We were also privileged to work with Poland as an economic and financial adviser in the early-1990′s when they were coming out of communism and restructuring their external debt. Poland is now a economic superstar.

The U.S., Japan, France, the U.K. could learn from Chile and Poland.

We expect more absurd policies, motivated by political pain aversion, to be floated, tested, and implemented over the next few years that will increase systemic risk and geopolitical tensions.

Massive monetization? Central banks canceling debt? Currency wars?

Japan may be the first test. Think collapse of money demand and potential hyperinflation. Imagine the contagion when the “printing money fixes all” meme collapses.

Yeah, yeah, yeah… look at excess capacity. That’s not the issue. Japan has structural issues that won’t be fixed by more money printing and stability of the money demand function will be the real issue. We rarely hear the point even raised, much less discussed. Well, maybe once or twice.

Only when markets revolt will the policymakers in these countries get serious about structural reform, in our opinion. The political systems lack leadership and seem to be corrupted by special interests to deal with the real issues and long-term fixes.

Were glad it looks they averted the cold turkey or crash adjustment shock, which surely would have caused a recession, but we’re disheartened Washington doesn’t have it within them to implement a glide path to structural adjustment. They just won’t learn or heed the words of Alan Greenspan during the Asian crisis in the late 1990′s,

Reality eventually replaces hope, and the cost of the delay is a more abrupt and disruptive adjustment than would have been required if action had been more pre-emptive.

Have a great, safe and sober New Year, happy compotations tonight, and we will see you back here in the Year of the Rat!

Ernest Hemingway “kicking the can down the road.”

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply