Score another one for the tort lawyers.

Toyota Motor Corp. (TM) agreed to pay about $1.1 billion to settle a class-action lawsuit stemming from complaints of unintended acceleration in its vehicles that soured its reputation for quality and undermined its sales globally.

If you’re unfamiliar with the circumstances that led to this payout, here is a brief recap.

Around 2009 people started experiencing episodes of sudden uncontrollable acceleration of various Toyota cars. They were crashing into all sorts of things and tragically a few people were killed in accidents attributed to this problem. The media latched onto the issue and Congress obligingly followed. The farce reached its crescendo during committee hearings when Department of Transportation Secretary Ray LaHood in response to a question from a congressman opined that those Toyota models suspected of being faulty were not safe to drive and needed to go back to the dealer. He was shortly after the committee hearing obviously counseled by some cooler heads in his department and retracted his statement. The damage to Toyota was extensive as its sales and market share nose dived. The DOT not content to let the market extract its toll fined the company a total of $83 million for failing to tell it about the problems.

Mr. LaHood’s comments, the media circus and general public paranoia they inspired were based on, well, nothing, no scientific evidence. Never let a good story get in the way of the facts. Naturally, some actual scientific examination ensued and, as has been the case in all other incidents of unexplained acceleration of motor vehicles, the cause was attributed to drivers pressing on the accelerator though they mistakenly thought they were applying the break pedal. It was determined that in some cases the drivers side floor mats were removed for by car wash attendants and then not properly secured when placed back in the vehicle. The mats then slid forward and pushed against the accelerator pedal.

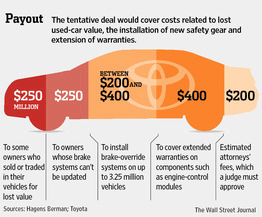

So Toyota was more or less not at fault, paid a heavy price in fines, corporate reputation, recall expenses and sales. But any trial lawyer worth his salt not to mention sleazy reputation could see a payday in this one and boy did they get one. The little graph below shows how the loot is to be divied up.

Note that aside from the lawyers who naturally are collecting an absurd amount of money the actual litigants, those members of the class that sued, are being monetarily rewarded because they allegedly lost money when they traded in their vehicles. Point of Law.com does a fine job of pointing out the absurdity.

The class action that was settled mostly involved people who had never had an incident of unintended acceleration, but who were suing because the resale value of their vehicles was allegedly diminished by the (false) belief in the market that Toyotas could accelerate all by themselves. That ground of suit is nowhere legally accredited, and is baseless on several grounds: Toyota does not guarantee nor is there any legal right to any given resale value; the mistaken market belief about Toyotas, if it existed, was caused by misleading press reports and not by Toyota; etc.

So Toyota cave. It’s often said of the corporate income tax that it isn’t in fact paid by corporations, that they just act as the tax collector for the government as they pass the cost on to their customers. I suppose the corollary to that might be that in this day and age those who choose to settle these humongous class actions are merely the conduit for funds flowing from the public to the lawyers. Unfortunately, in choosing to act the agent Toyota abets the growth of this shakedown racket.

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Leave a Reply